Coca-Cola Andina - LATAM Stocks Investment Analysis #9

This is an analysis of Chilean Coca-Cola bottler Andina, the 7th largest Coca-Cola bottler in the world.

Dear LATAM Stocks Readers,

This edition will cover Embotelladora Andina, a Chilean Coca-Cola bottler and distributor. Andina is the 3rd largest Coca-Cola bottler in LATAM in terms of volume and the 7th largest globally. They operate in Chile, Argentina, Brazil, and Paraguay, dominating the NARTD (Non-Alcoholic-Ready-to-Drink) market in all four countries.

The company has a long history of successful operations and creating shareholder value. They are well positioned to continue dominating the soft drink markets where the operate and have significant growth potential in other beverage segments such as juices and alcoholic beverages.

The company is sound financially and consistently returns capital to shareholders via a dividend. Andina stock may not be the most attractive for shorter term investors, as macroeconomic factors such as local currency devaluations and rising input costs could create short term headwinds. But long term the company has the potential create significant value for shareholder by capitalizing on its market leading position and extensive production and distribution network.

Given what appears to be a reasonable valuation at current levels, if Andina can continue to effectively serve its nearly 55 million consumers, I believe the company’s stock is a sound investment opportunity for long term buy and hold investors.

If you have any questions, doubts, or criticisms of this analysis, leave a comment at the end of the article!

If you would like to receive more free research about investments in Latin America, subscribe here:

You can also connect with me on LinkedIn or follow me on Twitter.

Common Stock: Embotelladora Andina (SSE - Andina-B; NYSE - AKO.B)

Current Market Price: $1,619 CLP ($2.21 USD)

Market Capitalization: $1.5 Trillion CLP ($2 Billion USD)

*All values in this article are expressed in Chilean Pesos (CLP) unless otherwise noted. All conversions are based on the current USD/CLP exchange rate of 732/1.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

Summary of the Company

Andina is a Chilean Coca-Cola bottling and distribution company. They operate in four markets; Chile, Argentina, Paraguay, and Brazil. They are the largest Coca-Cola bottler in Chile and Argentina, the third largest in Brazil, and the only Coca-Cola bottler in Paraguay. Andina was founded in 1946 and is headquartered in Santiago, Chile. They employ over 17,300 people. Their stock has been traded on the New York Stock Exchange since 1994.

The company is a market leader in almost all of the countries and market segments in which it operates. Andina is the largest soft drinks company in Chile, the largest soft drinks and juices company in both Argentina and Brazil, and the largest soft drinks, juices, and water company in Paraguay. The company has a market share of the NARTD (Non-Alcoholic-Ready-to-Drink) market of well over 50% in Brazil, Chile, and Argentina.

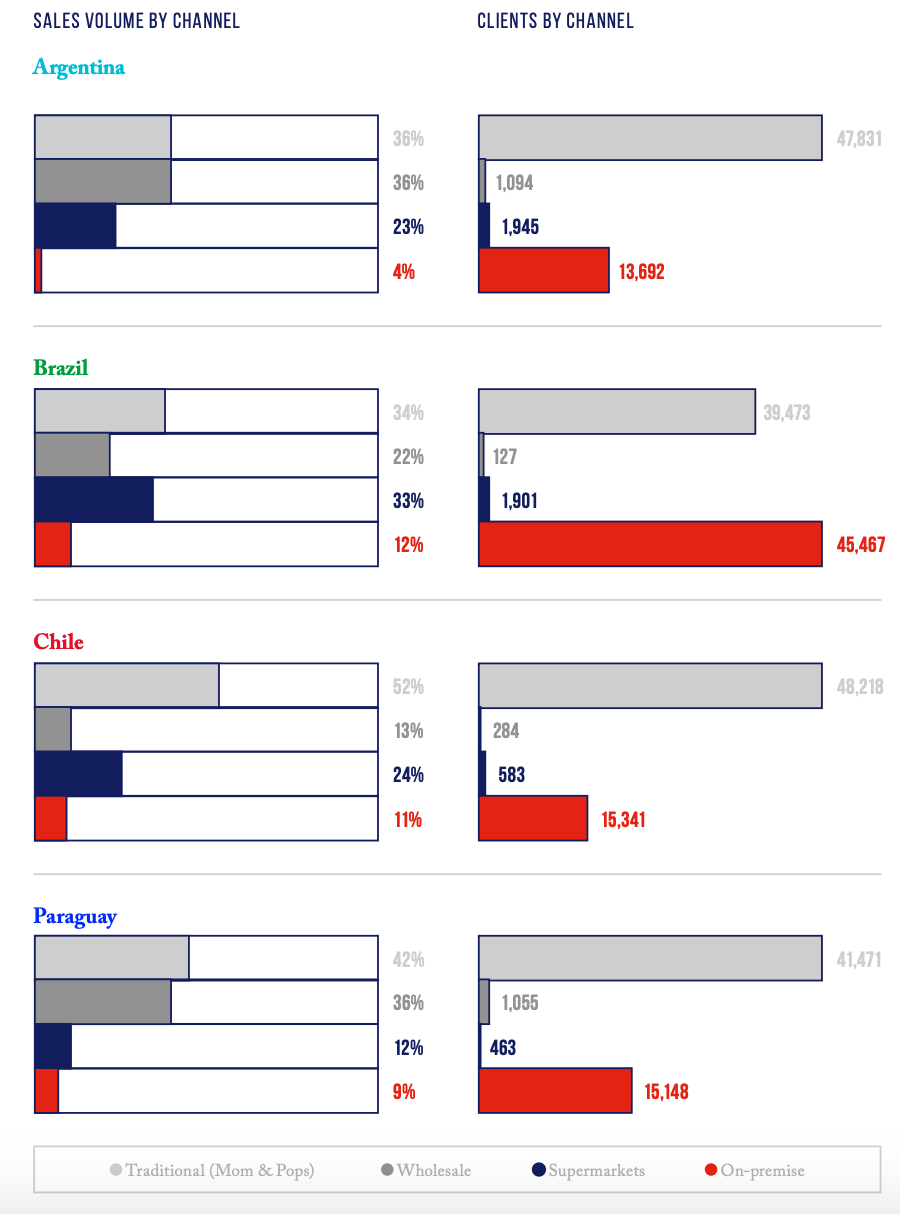

They sell their products to over 273,000 clients, reaching nearly 55 million customers. This reach makes them one of the largest Coca-Cola distributors in Latin America. The company operates 4 distinct sales channels in all of its markets;

Traditional Mom & Pops

Wholesale

Supermarkets

On-Premise

Traditional Mom & Pops are still the company’s leading channel in all of its markets. The remaining segments vary in importance, depending on the country. The company uses a mix of its own transportation companies and third parties for distribution. They use over 2,800 tucks in total.

The company has 10 production plants and 91 distribution centers. Total installed production capacity is nearly 1.6 billion unit cases. This implies significant room for growth without additional CAPEX to expand capacity, as 2020 sales were less than half of installed capacity.

Diversification Strategy

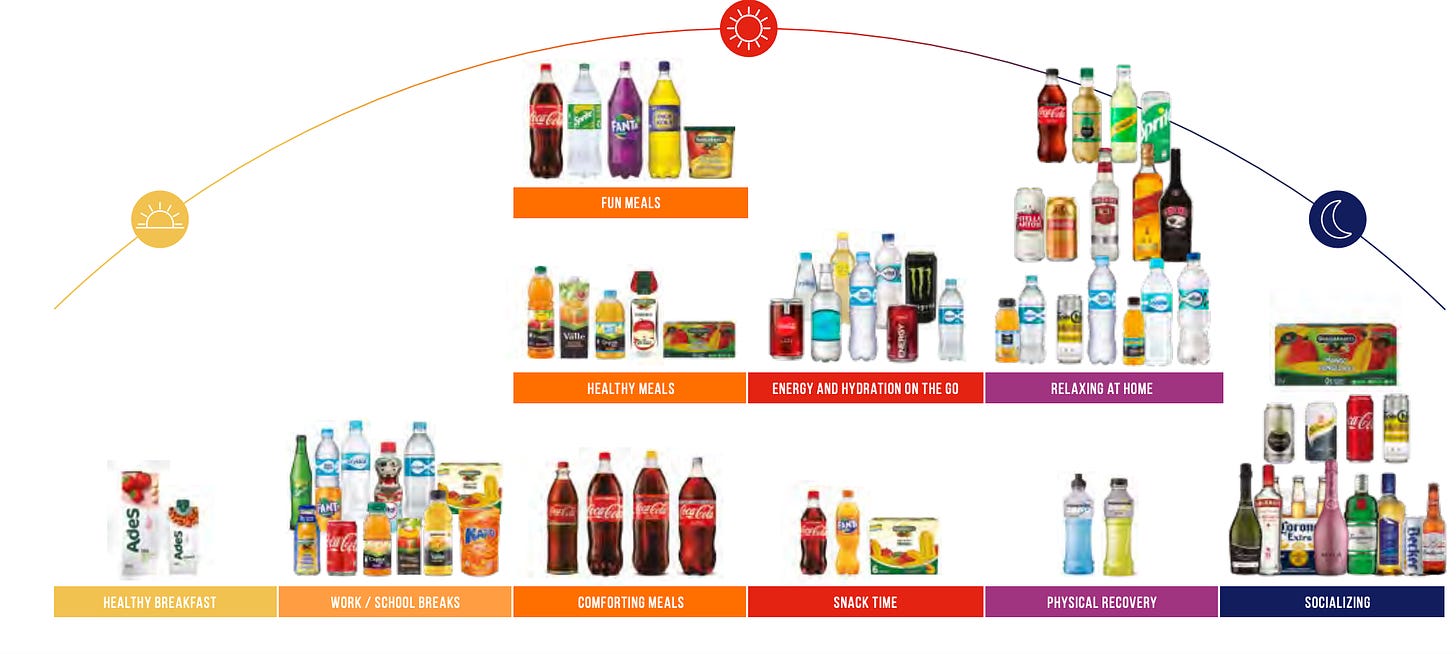

In 2020 Andina signed a distribution agreement with AB InBev to commercialize their beers in Chile. This is part of the company’s diversification strategy which also included an agreement with Diageo in 2018 to distribute alcoholic beverages and an agreement in 2019 to distribute Pisco Capel in Chile.

The alcoholic beverage segment is an interesting potential growth avenue for the company moving forward, but is not yet relevant to Andina’s business. In 2020, 96% of the company’s sales were Coca-Cola products.

Andina’s Consumer

Annual per capita soft drink consumption has been declining since 2018 in all four of Andina’s markets. This helps explain the company’s diversification strategy into juices and alcoholic beverages.

Within the soft drink market, all of the company’s markets show a strong preference for the family sized format compared to single serve beverages.

Financial Analysis

Revenue and Cost Analysis

Andina had total revenue of $1.69 trillion ($2.3 billion USD) in 2020, a decrease compared to $1.77 trillion ($2.4 billion USD) in 2019. Their COGS was $1.02 trillion in 2020, representing a gross margin of 39.8%, on par with their gross margin of 41% in 2019.

Total beverages sold in 2020 declined year over year. The company sold 734.6 million cases in 2020, a significant decrease compared to 746.4 million cases in 2019. The company’s largest market in terms of volume in 2020 was Brazil, followed by Chile. However Chile had slightly higher sales than Brazil in 2020.

Soft drinks are by far the company’s most important segment, accounting for 76% of sales volume in 2020. Water accounted for 11%, followed by juices at 9%, and alcoholic beverages at 4%.

The company was profitable in each of the past two years. In 2020 Andina had net income of $123.1 billion ($168.2 million USD), representing a profit margin of 7.2%, a decrease compared to 9.9% in 2019.

Balance Sheet Analysis

Andina has a decent balance sheet. They have a sound base of long term assets and sufficient liquidity in the near term. However they are leveraged and have significant liabilities, including debt.

I don’t see any red flags related to the company’s inventory, accounts payable, or accounts receivable management.

Debt Analysis

As of year-end 2020 Andina has $1.03 trillion ($1.4 billion USD) in total debt outstanding, $38.6 billion of which is classified as current.

In January 2020 the company issued $300 million USD in bonds on the international market. The bonds have a 30 year maturity and a bullet structure. They carry an annual interest rate of 3.95%.

Debt Ratings

S&P has rated the company as BBB and Fitch has a rating of BBB+, meaning both rating agencies consider Adina’s debt to be investment grade.

Share Dynamics and Capital Structure

The company has 473.3 million preferred shares outstanding and 473.3 million common shares outstanding. Total shares outstanding is around 946.6 million shares. 38.1% of the company is owned by a controlling group made up of various investment firms. 9.1% of the company is owned by Chilean pension funds and Coca-Cola owns 7.3% of Andina.

Dividends

Andina’s stated policy is to pay out “at least 30% of net earnings for the fiscal year” as dividends. The company has consistently paid annual dividends since at least 2013 (length of data set shown in report).

In 2020, Andina paid total dividends of $57.20 CLP per common share. At the current market price this implies a dividend yield on the common shares of 3.5%.

4 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

$1.6 trillion / $831.5 billion = 1.94

A debt to equity ratio of 1.94 indicates that Andina is leveraged and relies heavily on debt financing for funding.

Working Capital Ratio

Current Assets/Current Liabilities

$797.2 billion / $378 billion = 2.1

A working capital ratio of 2.1 indicates that Andina has a sound liquidity position. The company should not have problems meeting its near term obligations.

Price to Book Ratio

Current Share Price/Book Value per Share.

$1,619 / $878.5 = 1.84

Based on total shares outstanding Andina has a book value per share of $878.5. At the current common share price, this implies a price to book ratio of 1.84, meaning Andina stock currently trades at a premium to the book value of the company.

Price to Cash Flow

Current Share price / Operating Cash Flow per Share

$1,619 / $294.5 = 5.5

In 2020 Andina had total cash flows from operations of $278.7 billion, implying operating cash flow per share of $294.5. At the current price this implies a price to cash flow ratio of 5.5, meaning investors are currently willing to pay $5.5 per $1 of operating cash flow generated by the company.

Summary and Conclusions

Positives

Stable business in a low risk industry. Management clearly has a long term perspective and does not manage the business based on quarterly results.

Diversified geographies and sales channels. No single country accounted for more than 38% of sales in 2020. Within each market Andina has diversified sales channels and is not overly reliant on any single channel or client.

Dominant market position.

Potential growth from diversification into alcoholic beverages.

Significant excess production capacity. 2020 sales were less than half of installed production capacity, implying plenty of room for growth before additional investments in production are needed.

Reasonable valuation based on price to book, price to cash flow, and dividend yield.

Negatives

Covid lockdowns caused rapid changes to the company’s operations, for example significant changes in their sales mix. Sales also declined significantly in 2020. Although these changes aren’t necessarily negative in the long term, their impacts are still not well understood, causing uncertainty in the shorter term.

The company is highly reliant on the Coca-Cola brand and its products. Any changes in Coca-Cola’s public image or the terms of their distributor relationship could have significant negative impacts on Andina’s business.

Currency risk - All of the company’s revenue is denominated in local currency, while many of the company’s inputs are dollar denominated, meaning the company’s results suffer when the local currencies in their operating markets depreciate. This has been a drag on results for the past several years and may continue to impact earnings in the future.

Conclusion

Andina is an impressive company. They have a large Coca-Cola franchise market, spanning four countries, making them one of the largest Coca-Cola bottlers in Latin America. They operate in this market effectively, evidenced by their dominant market share, profitability and ability to consistently pay dividends to shareholders. Overall the company is currently in decent financial health.

However Andina is leveraged, with relevant amounts of debt outstanding. In addition the company’s financial results have suffered due to weakening local currencies in all of their operating markets. Rising input costs have also been a drag on earnings.

Andina stock looks like a relatively low risk way for long term buy and hold investors to gain exposure to the Chilean, Brazilian, Argentinian, and Paraguayan consumer market.

The company’s dominant market position in soft drinks and juices should protect investors on the downside. While favorable demographics, rising incomes, and growth from the alcoholic beverage segment could create long term upside from increasing revenues.

If you liked this analysis and would like to receive all of our future LATAM investments newsletters, you can subscribe for free here:

You can also connect with me on LinkedIn or follow me on Twitter.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.