Cementos Pacasmayo - LATAM Stock Investment Analysis #5

This is an analysis of Cementos Pacasmayo, one of the largest cement manufacturers in Peru.

Dear LATAM Stocks Readers,

Thanks for reading! This edition will cover one of the leading cement manufacturers in Peru, Cementos Pacasmayo. They are the 2nd largest cement producer in the country, and the only producer in the northern region of Peru. The company is financially sound. I believe Cementos Pacasmayo stock could be of interest to both short and long term investors.

In the near term the company could benefit from pent-up demand in the construction industry, as well as improved gross and profit margins, due to excessively poor margins in 2020 resulting from the coronavirus lockdowns.

Longer term the company operates in a country with a significant housing deficit, favorable demographics, and a robust mining industry. All of these factors are favorable for the long term growth of the cement industry.

If you have any questions, doubts, or criticisms of this analysis, leave a comment at the end of the article!

If you haven’t subscribed yet and would like to receive more free research about LATAM investment opportunities, subscribe to this newsletter here:

You can also connect on LinkedIn or follow me on Twitter.

Common Stock: Cementos Pacasmayo (NYSE:CPAC) (BVL:CPACASC1)

Current Market Price: $5.90 PEN

Market Capitalization: $2.5 Billion PEN

*All values in this article are expressed in Peruvian Soles (PEN) unless otherwise noted.

** The current USD/PEN exchange rate can be found by following this link.

***The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

Summary of the Company

Cementos Pacasmayo is one of the leading cement and building materials manufacturers in Peru. Their products are mainly used in the construction and mining industries. The company is focused almost entirely on selling its products in the northern region of Peru, where they are the only cement manufacturer.

The company’s product portfolio includes:

Cement and concretes for a wide range of project types such as housing, roads, sidewalks, and mining.

Industrial Precasts for a wide range of project types such as warehouses, hangars, bridges, and parking lots.

Packaged Solutions – Pre-dosed for ready to use concrete and cement.

Quick Lime mainly for the mining industry.

Cementos Pacasmayo currently operates 3 plants, all in northern Peru, that have a combined production capacity of 4.9 million tons of cement per year and 2.7 million tons of clinker per year, making them the 2nd largest cement and clinker manufacturer in Peru.

The company has 3 distinct business segments:

Production and sale of cement, concrete and precast.

Marketing and sale of third party construction supplies such as rebar, wires, and pipes.

Production and sale of lime.

The majority of the company’s revenue, around 91% in 2020, comes from the cement and concrete segment. Construction supplies and lime are small, but relevant business lines. The lime segment is well positioned to grow along side the Peruvian mining industry.

Cementos Pacasmayo was founded in 1957 and is headquartered in Lima, Peru. They employ over 1,700 people. In addition to trading on the Peruvian stock exchange, the company has an ADR that trades on the New York Stock Exchange.

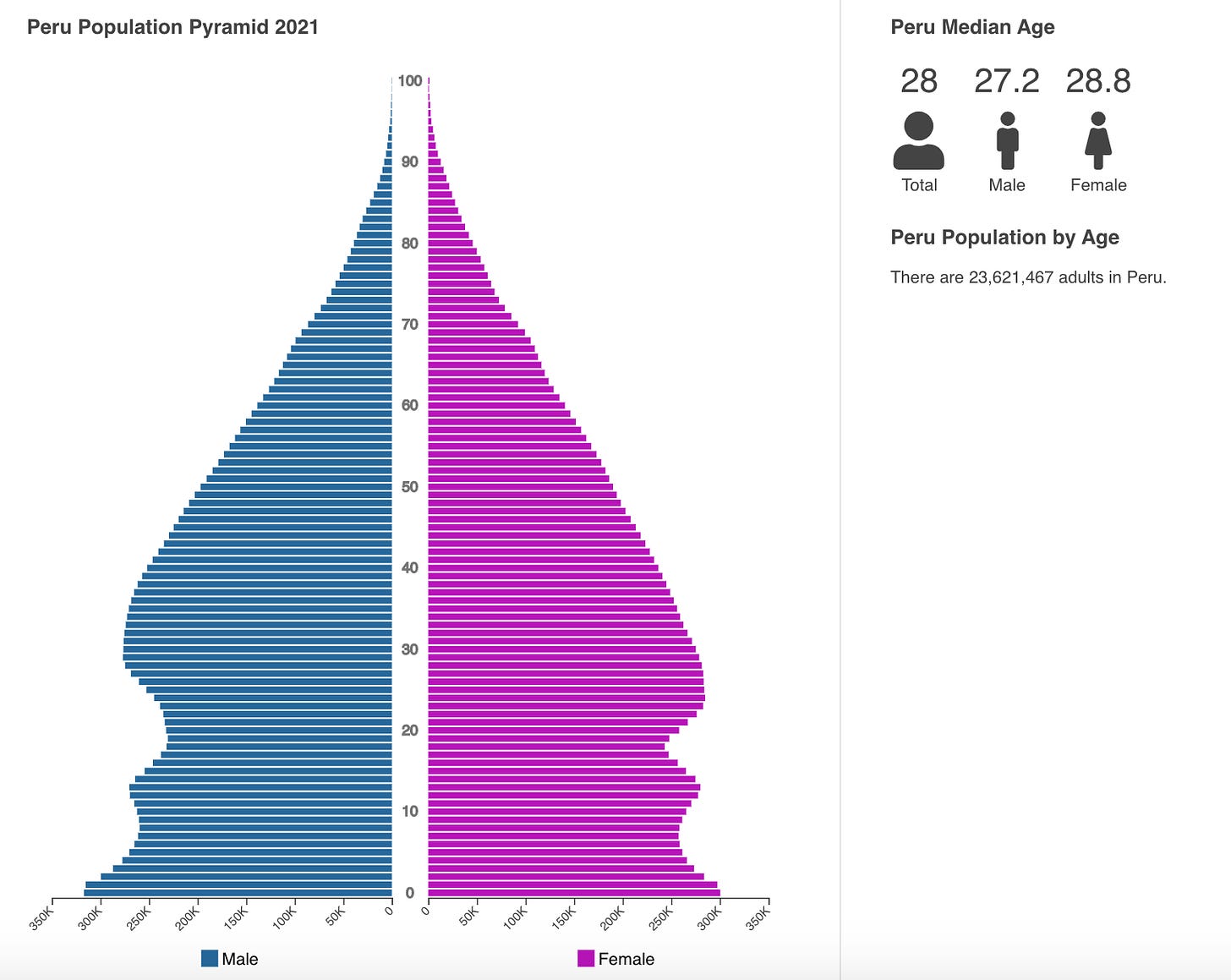

Peru’s Demographics

Peru has a young and growing population. The country has a total of 33.2 million people, making it the 44th most populous country in the world. Population growth in Peru is expected to be around 1.5%. The median age is only 28.

A large portion of Peru’s population is in or will soon be entering its peak economic years in terms of productivity and spending. This is generally viewed as bullish for housing and construction.

The Peruvian Housing and Construction Market

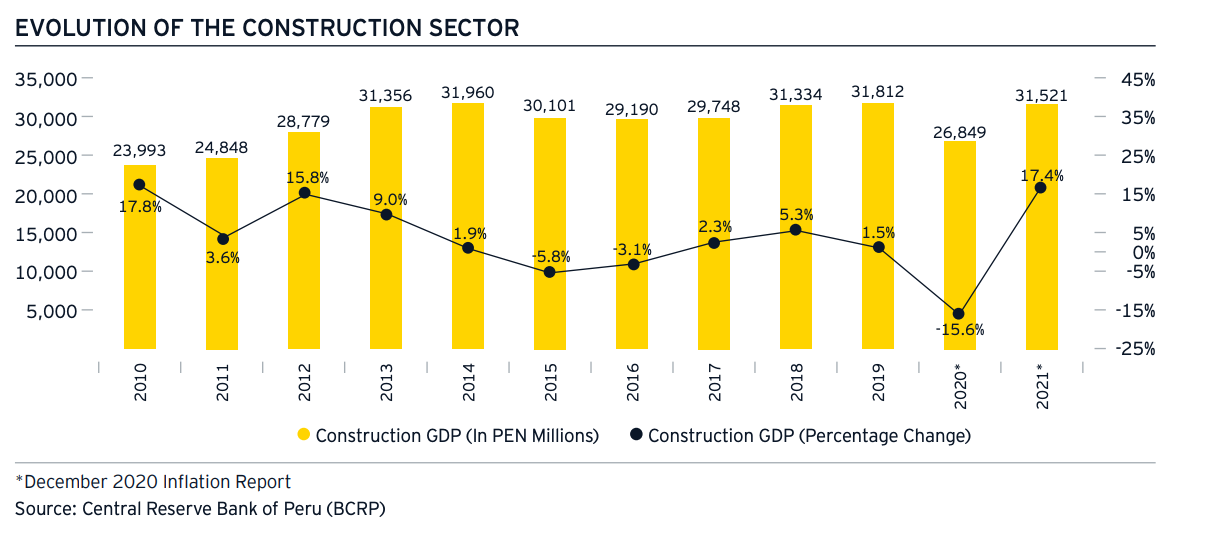

The Peruvian construction market took a serious hit in 2020 due to the coronavirus shutdowns. Some estimates are that the construction industry contracted by as much as 15%, and housing sales in 2020 may have been down by 25%.

However long term the industry is expected to grow significantly due to the countries growing population and current housing deficit. The Peruvian central bank estimates the construction sector will grow 17.4% in 2021 (off its 2020 coronavirus lows) and account for over 35% of GDP.

Cementos Pacasmayo’s management had this to say about the Peruvian housing and construction market:

“Peru continues to have a significant housing deficit, estimated by the INEI at 1.9 million homes nationwide. In Peru, cement is mainly sold to a highly fragmented consumer base, consisting primarily of households that buy cement in bags to gradually build or improve their own homes without professional technical assistance, a segment known in our industry as auto-construcción. We estimate that in 2019 sales to the auto-construcción segment accounted for approximately 60.3% of our total sales of cement, private construction projects accounted for 19.9%, and public construction projects accounted for the remaining 19.8%. Approximately 89.0% of our total cement sales in 2019 were in the form of bagged cement, substantially all of which was sold through retailers.”

Peruvian Mining Sector

Mining is already a relevant industry in Peru, accounting for around 23.5% of all foreign direct investment, more than any other industry. The Frazier institute mining survey ranks Peru as the 24th most attractive mining jurisdiction in the world for investment.

Peru is the 2nd largest silver, zinc, and copper producer in the world. They are the largest gold, lead, tin, and zinc producer in Latin America.

The mining industry in Peru is expected to continue growing, providing growth opportunities for Cementos Pacasmayo. According to the Ministry of Energy and Mines (MINEM), investment in mining during the 2020-2022 period is estimated to be equivalent to USD 56.16 billion. 67.7% will be invested in copper projects and the majority of the remaining percentage will be invested in gold and iron projects.

Financial Analysis

Revenue and Cost Analysis

In 2020 Cementos Pacasmayo had revenue of $1.29 billion, a decrease compared to $1.39 billion in 2020, but an increase when compared to compared to $1.26 billion in 2018. Their COGS in 2020 was $921 million, representing a gross margin of 28.9%, a significant deterioration compared to 34.9% in 2019 and 36.9% in 2018.

The company has been profitable in each of the past three years. In 2020 Cementos Pacasmayo had net income of $57.9 million, representing a profit margin of 4.5%, a decrease compared to 9.4% in 2019 and 5.9% in 2018.

This decline in profitability can be attributed mostly to lower gross margins and higher financing expenses. Operating and administrative expenses have been declining over the past three years.

Acquisitions and Divestures

In 2017 Cementos Pacasmayo spun off their ownership of Fosfatos del Pacifico (FOSSAL). Fossal is a phosphate mining and exploration company that owns a significant phosphate deposit in Peru. To develop this deposit would require a very large capital expenditure. Rather than develop a mine, Cementos Pacasmayo opted to spin out the asset and focus on their core business. Cementos Pacasmayo still owns 7.76% of Fossal shares.

Balance Sheet Analysis

Cementos Pacasmayo has a decent balance sheet. They have a sound liquidity position in the near term and a solid base of long term assets. However they are leveraged with a significant amount of debt outstanding.

I do not see any red flags related to the company’s accounts receivables, inventory management, or accounts payable.

It is worth noting that the company uses derivatives to hedge its currency and interest rate exposures. This derivatives book should be analyzed in detail by investors, especially considering it has had a significant impact on the company’s financial results in the past.

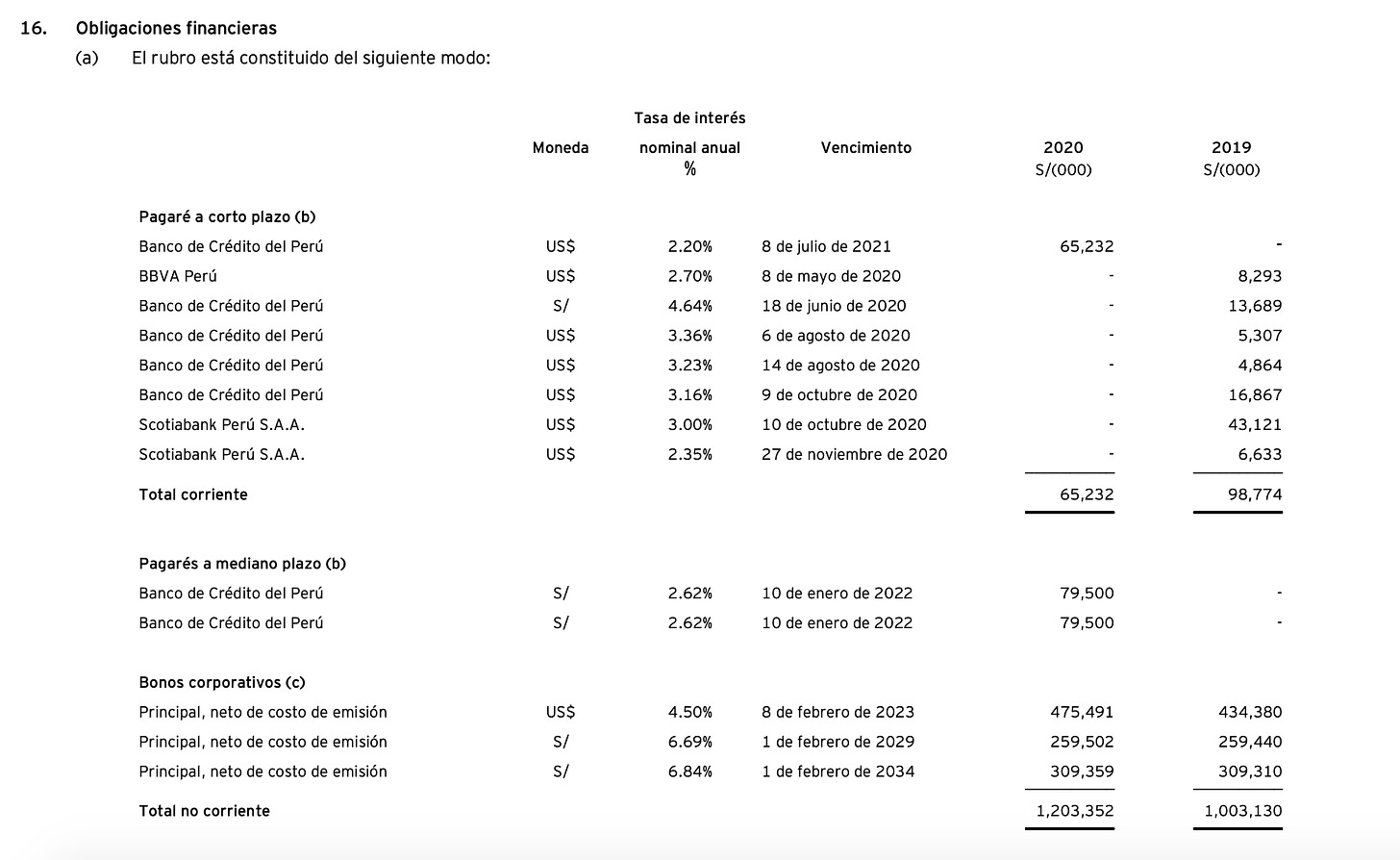

Debt Analysis

As of year-end 2020 the company has $1.26 billion in total debt outstanding, $65.2 million of which is classified as current. The company’s debt load increased slightly year over year. Total debt was $1.1 billion in 2019 and $1.08 billion in 2018. The interest rate on their debt ranges from 2.2% to 6.8%.

A significant portion of the company’s debt is denominated in US Dollars, potentially exposing the company to the negative effects of a depreciating local currency.

Share Dynamics and Capital Structure

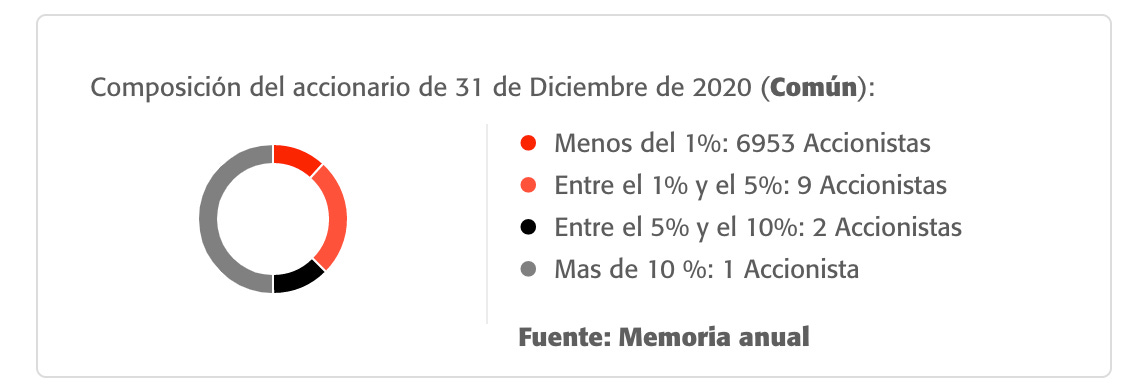

As of year-end 2020 the company has 423.9 million common shares outstanding, 31 million of which are listed and traded on the New York Stock Exchange.

The majority of the company’s shareholders have an ownership position of less than 1%. The company has one major shareholder, Eduardo Hochschild of The Hothschild Group, who owns 50.01% of the company’s outstanding shares.

Dividends

The company paid total dividends of $0.23 cents per share in 2020, a decrease from $0.36 cent per share in 2019.. At the current market price this implies a dividend yield of 3.9%.

4 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

$1.6 billion / $1.4 billion = 1.2

A debt to equity ratio of 1.2 indicates that Cementos Pacasmayo uses a mix of debt and equity in its capital structure, but is leveraged, relying more on debt financing for funding.

Working Capital Ratio

Current Assets/Current Liabilities

$877.7 million / $265 million = 3.3

A working capital ratio of 3.3 indicates a sound liquidity position. Cementos Pacasmayo should not have problems meeting its near term obligations.

Price to Book Ratio

Current Share Price / Book Value per Share.

$5.90 / $3.22 = 1.8

Cementos Pacasmayo has a book value per share of $3.22. At the current market price this implies a price to book ratio of 1.8, meaning Cementos Pacasmayo stock currently trades at a slight premium to the book value of the company.

Price to Cash Flow Ratio

Current Share Price / Operating Cash Flow per Share

$5.90 / $0.78 = 7.55

In 2020 Cementos Pacasmayo had total operating cash flow of $331.4 million, representing operating cash flow per share of $0.78. At the current market price this implies a price to cash flow ratio of 7.55, meaning for every 1 Sol in operating cash flow generated by the company, investors are willing to pay $7.55 Soles.

Summary and Conclusions

Positives

Relatively steady revenue. 2020 saw a decline, but given the coronavirus lockdown this is not surprising.

Consistently profitable and pays a dividend. Although the dividend declined in 2020, I view the fact that the company was able to maintain profitability and a dividend during the coronavirus lockdowns as a sign of strength.

Installed production capacity is still much larger than actual production. This means the company has plenty of room to grow its production without needing new capital investments into manufacturing facilities.

The company dominates northern Peru. Cementos Pacasmayo is the only cement manufacturer in northern Peru.

Peru is one of the leading mining jurisdictions in the world. If this industry continues to grow, the company should capture some of this growth.

Long term demographics are favorable for the company’s business.

Negatives

Deteriorating gross margins. The steady decline in gross margins is concerning. I would expect 2021’s gross margin to be better than 2020’s, but if it is not, this would be a major red flag.

A significant portion of the company’s debt is denominated in US Dollars, exposing the company to the risk of a depreciating Peruvian Sol. Many Latin American companies have been destroyed by the USD carry trade, investors should pay close attention to the companies USD denominated debt.

The company’s revenue is highly correlated to the Peruvian housing market. Any downturn in Peruvian housing will have a negative impact on Cementos Pacasmayo. The company does not have any relevant revenue coming from outside Peru.

Conclusion

Cementos Pacasmayo is a very intriguing investment opportunity. They are the second largest cements manufacturer in Peru and the only cement manufacturer in northern Peru. They have 3 plants and have invested heavily in modernizing their operations. These plants still have plenty of excess capacity the company can grow into. The company is financially healthy, with sufficient liquidity and reasonable liability levels. They have been consistently profitable and return capital to shareholders via a dividend.

However debt levels are concerning, particularly their US Dollar denominated debt. Also concerning is they company’s deteriorating gross margin.

I think Cementos Pacasmayo stock has the potential to perform well in the medium term (1-2) years, if gross margins and thus profitability revert towards their mean. I also think the stock is investable for long term buy and hold investors (3+ years), as a way to play the Peruvian housing and construction markets, which should perform well long term given the countries housing shortage and favorable demographics.

If you liked this analysis and would like to learn more about LATAM investment opportunities, subscribe to this newsletter, its free!

You can also connect with me on LinkedIn or follow me on Twitter.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.