Empresas CMPC - LATAM Stock Investment Analysis #6

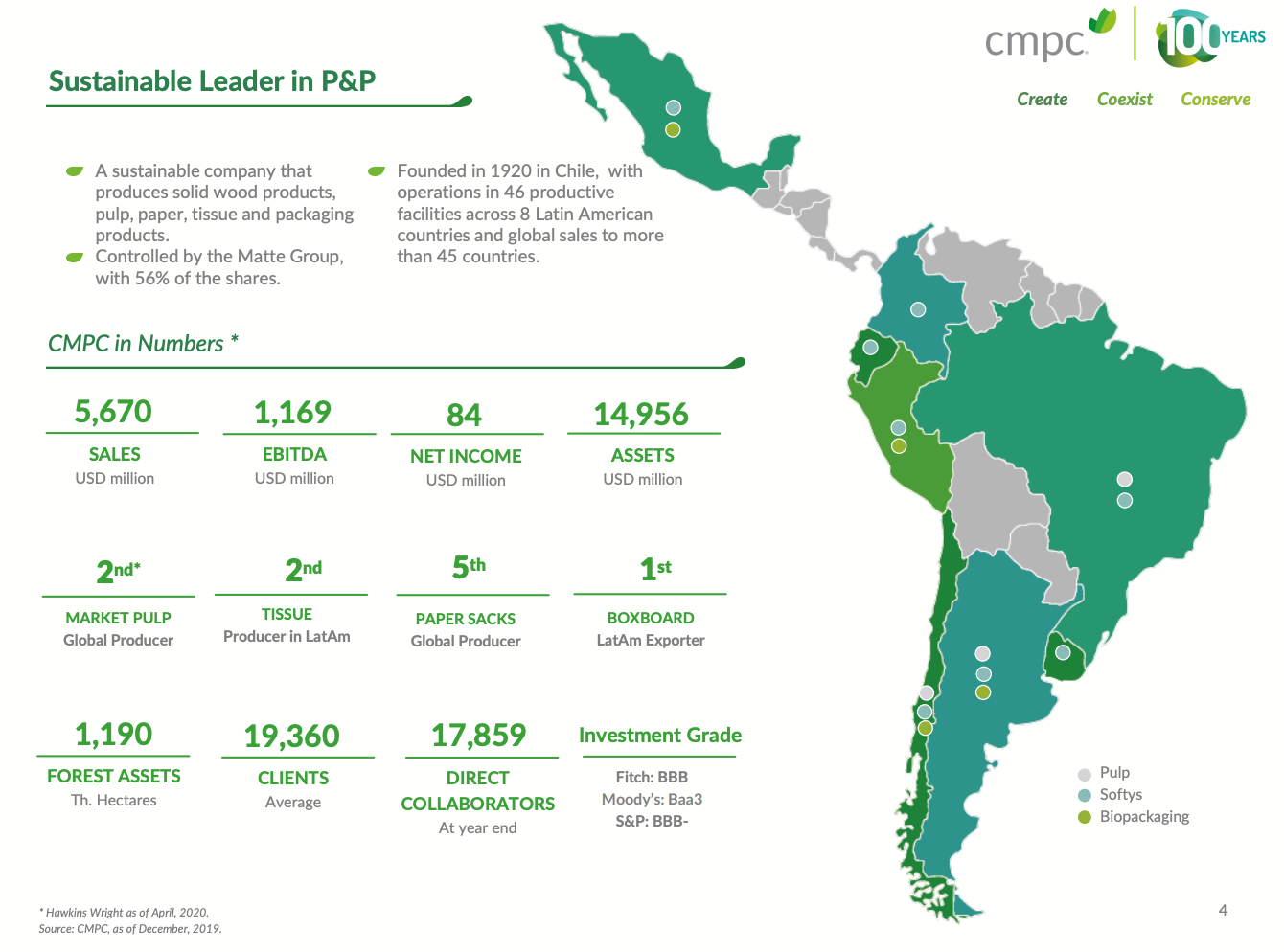

This is an analysis of the Chilean company Empresas CMPC, one of the largest pulp and paper manufacturers in the world.

Dear LATAM Stocks Readers,

Thanks for reading another edition! This edition will cover the Chilean company Empresas CMPC, one of the largest pulp and paper companies in the world. In addition to their pulp and paper businesses, they have a consumer products segment (toilet paper, diapers, etc…) and a packaging segment. The company manages a huge portfolio of forestry plantations in Chile, Brazil, and Argentina.

I find the forestry business fascinating from an investment perspective, so I really enjoyed analyzing this company. With all the money printing going on globally, it’s no surprise commodity prices are rising. CMPC stock presents an interesting opportunity for short term investors looking for leverage to rising pulp, paper, and lumber prices. It’s also a solid opportunity for long term investors looking for slow and steady compounding in a lower risk industry.

If you have any questions, doubts, or criticisms of this analysis, leave a comment at the end of the article!

If you haven’t subscribed yet and would like to receive more free research about LATAM investment opportunities, subscribe to this newsletter here:

You can also connect on LinkedIn or follow me on Twitter.

Common Stock: Empresas CMPC

Current Market Price: $2,320 CLP ($3.24 USD)

Market Capitalization: $5.8 Trillion CLP ($8.1 Billion USD)

*All values in this article are expressed in United States Dollars (USD) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

Summary of the Company

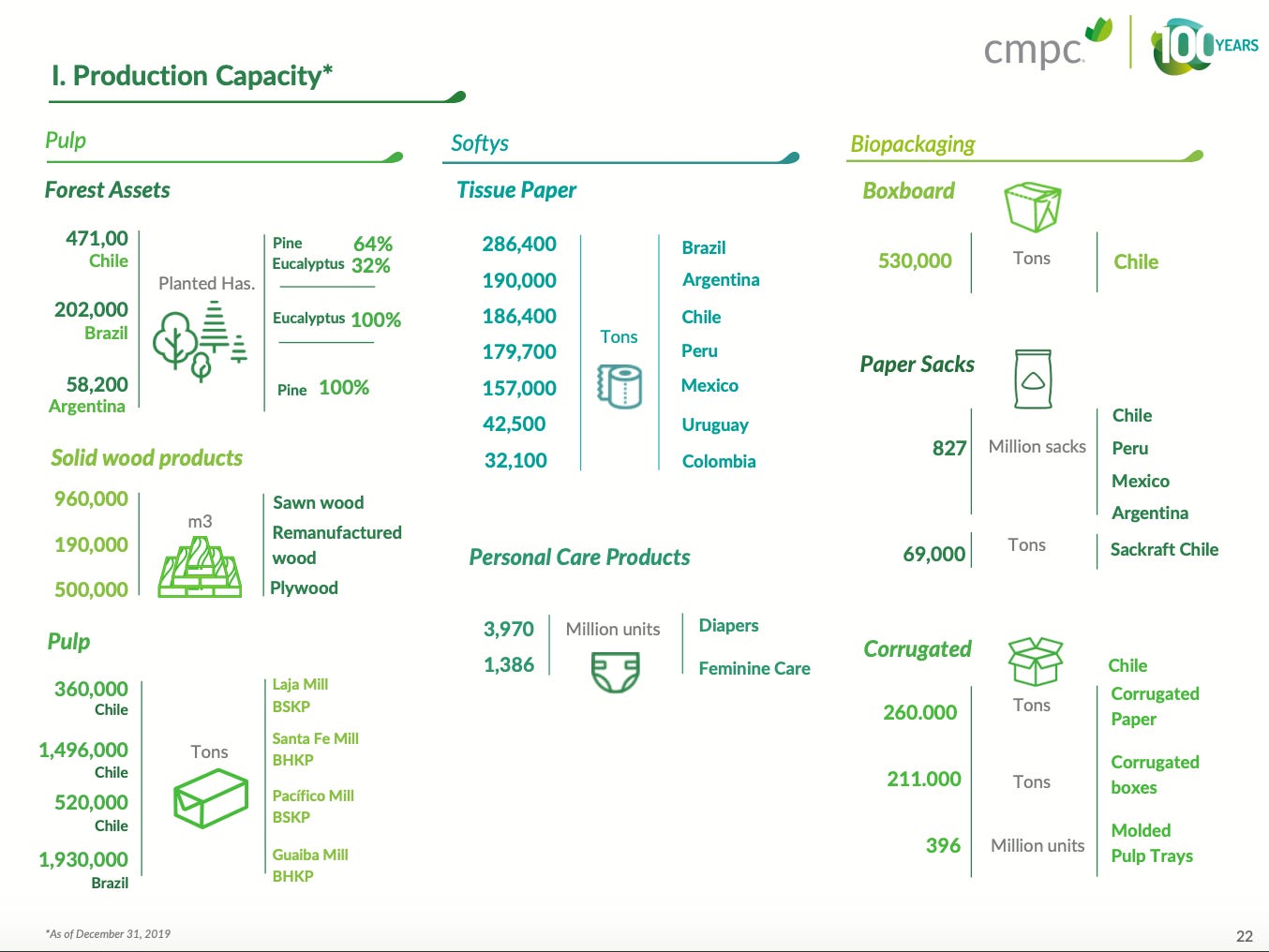

CMPC is a Chilean forestry company. Their products include wood pulp, grain wood, packaging, paper, and tissue. The company manages over 719,000 hectares of forest plantations with 654,000 hectares planted and an additional 65,000 to plant. Their plantations consist of mostly pine and eucalyptus. The majority of these plantations are located in Chile, Brazil, and Argentina.

Planted Hectares:

Chile – 459,000

Brazil – 141,000

Argentina – 54,000

CMPC is the 2nd largest market pulp producer in the world, the 2nd largest tissue producer in LATAM, the 5th largest paper sack producer in the world, and the largest boxboard exporter in LATAM.

CMPC has 3 distinct business segments;

Pulp - This business segment operates 4 production lines in Chile and 2 in Brazil, with total annual production capacity of approximately 4.1 million metric tons of pulp (plus 121,000 tons of paper of different kinds and weights). Pulp installed production capacity is 800,000 tons of bleached softwood kraft, including 32,000 tons of non-bleached pulp and 3.2 million tons of bleached hardwood kraft pulp. These products are sold globally through subsidiaries to over 220 customers. The pulp segment is also responsible for the management of CMPC’s forestry and lumber businesses.

Biopackaging - This business segment consists of ten subsidiaries with commercial operations and a holding that groups them. One of them participates in the production and marketing of cardboard and another produces paper for corrugation. There are six subsidiaries whose line of business is manufacturing and marketing elaborated paper products, such as corrugated cardboard boxes, bags or industrial sacks and molded pulp trays. Finally, this business area also has a subsidiary specializing in the distribution of paper and another dedicated to paper recycling.

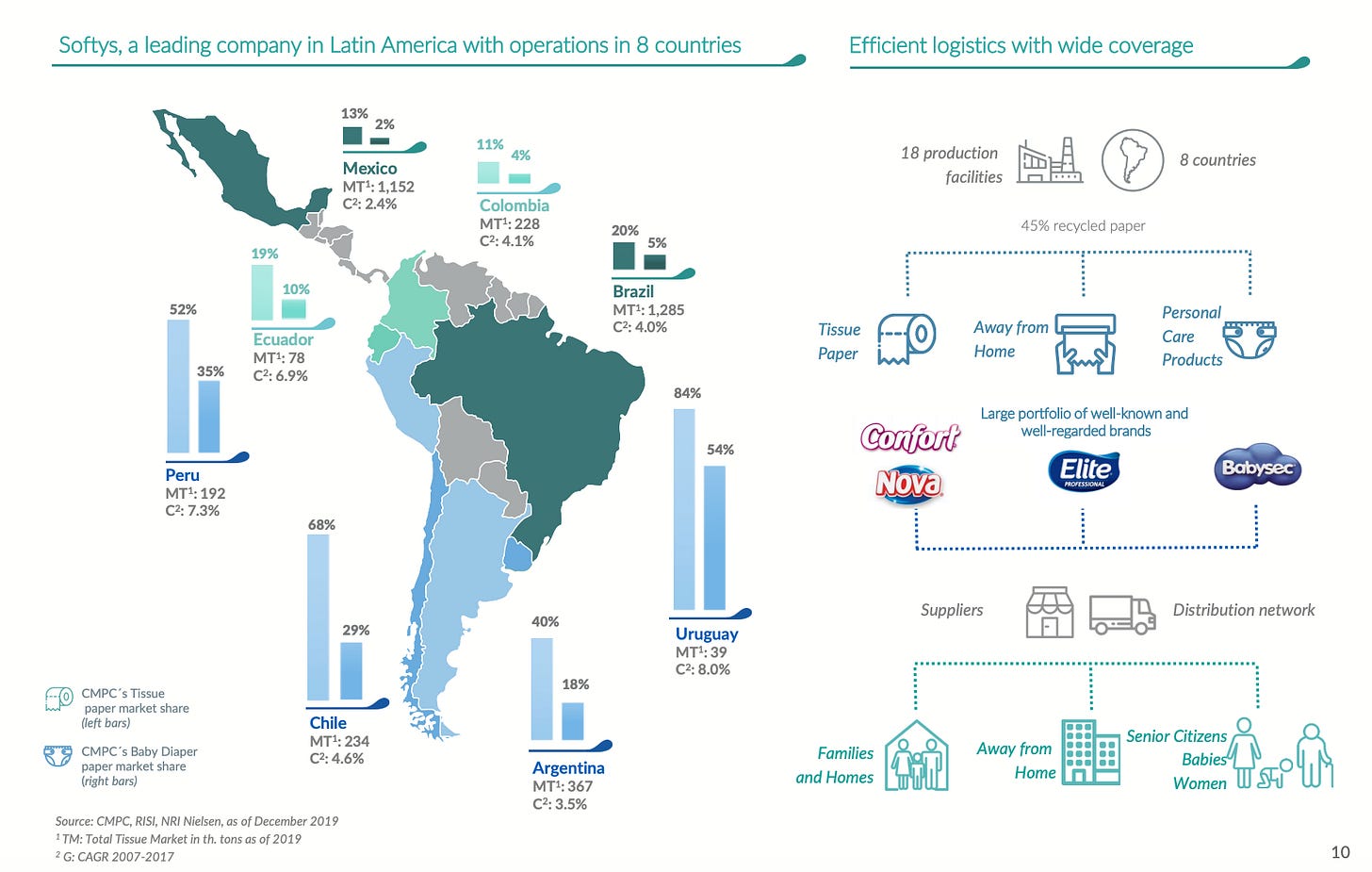

Softys - This business segment is engaged in the production and selling of tissue products (toilet paper, paper towels, paper napkins and facial tissues), sanitary products (baby diapers, wipes, adult diapers and sanitary napkins) and specialized hygiene products for consumption in institutions and public places. Softys reaches its consumers through a wide distribution network, mainly supermarkets, pharmacies and distributors.

CMPC sells its products in over 45 countries and has 46 industrial plants located in Chile, Brazil, Ecuador, Argentina, Peru, Colombia, Mexico, and Uruguay. Around 80% of the company’s revenue is from exports, with the remaining 20% coming domestically in Chile. They employ over 19,000 people. CMPC was founded in 1920 and is headquartered in Santiago, Chile.

The Global Pulp Market

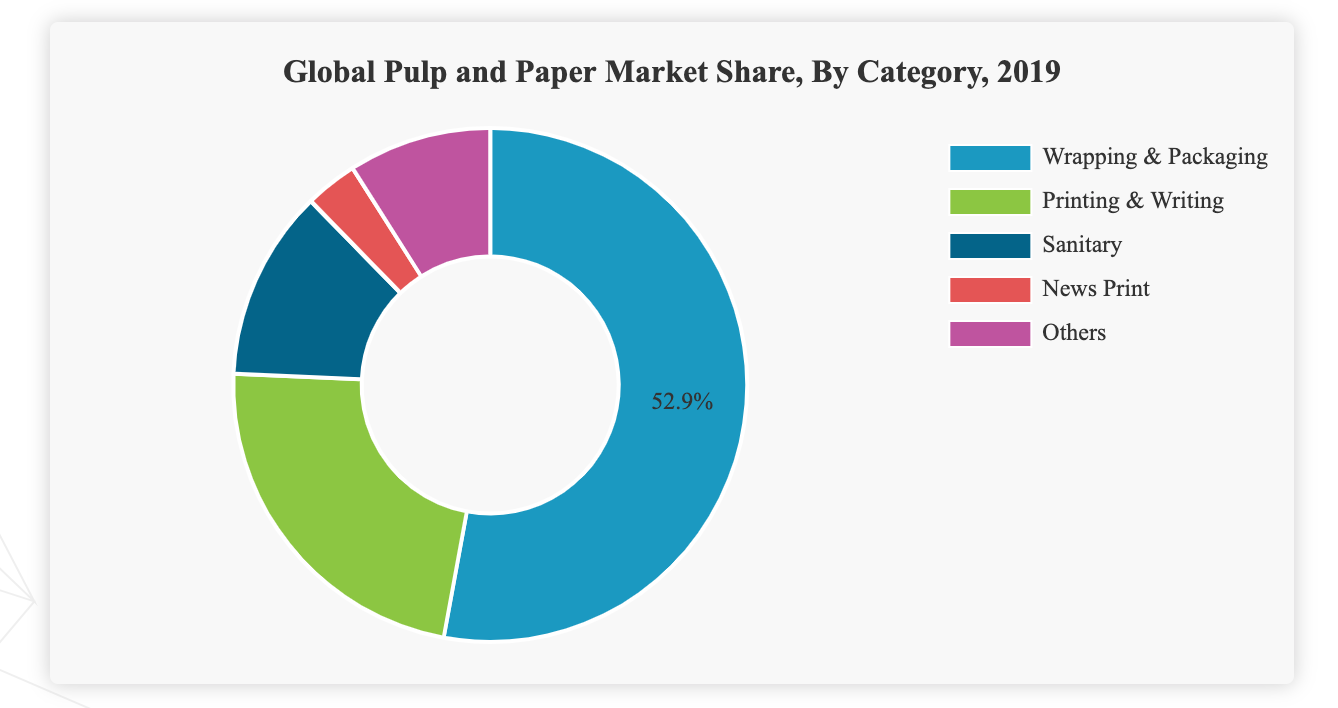

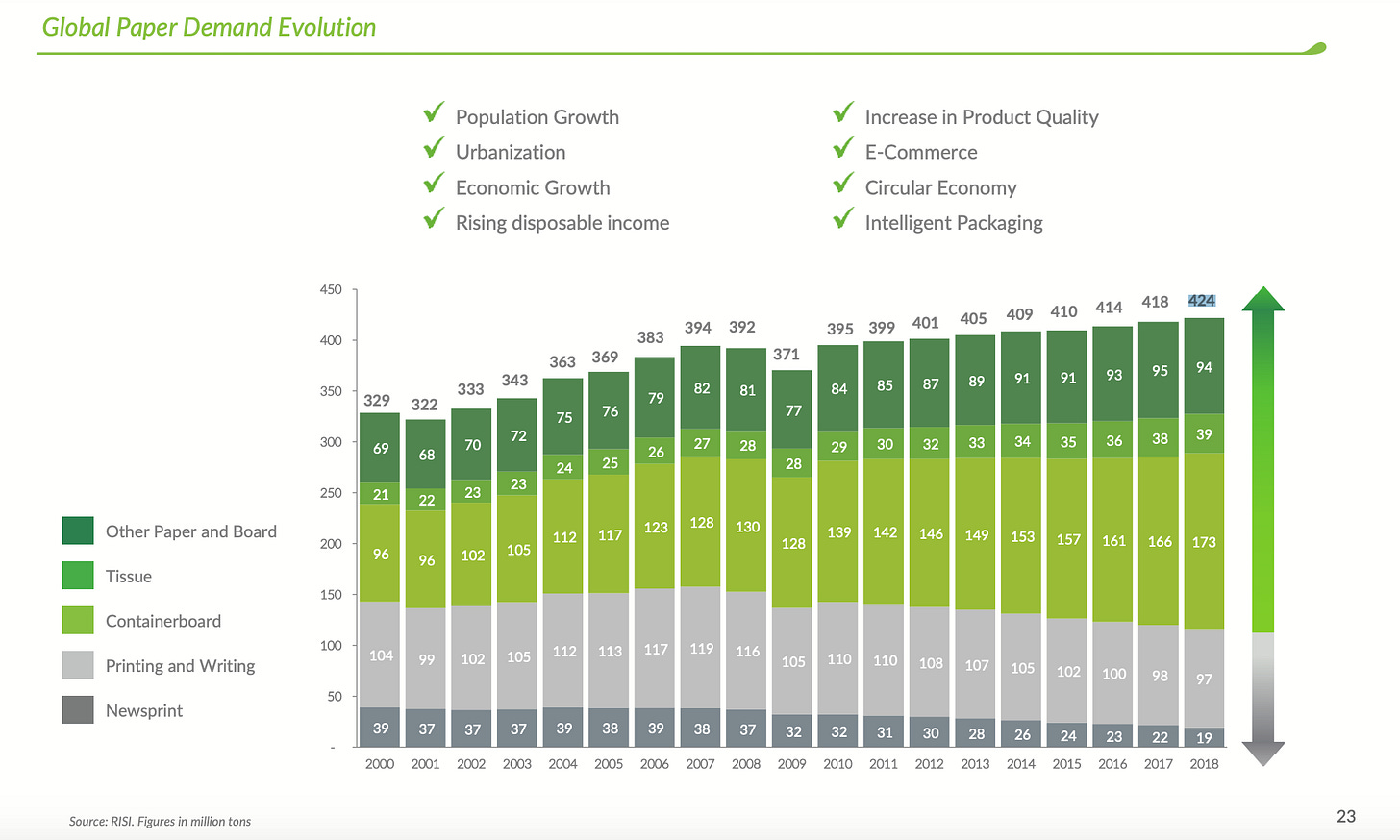

The global pulp and paper industry had an estimated market value of $518.8 billion in 2019. Over the next 7 years the industry is expected to have a compound annual growth rate (CAGR) of 3.45%, reaching a value of $679.7 billion by 2027.

The largest segment in the pulp and paper industry is wrapping and packaging, with a 52.9% market share in 2019, followed by printing and writing, and then sanitary. CMPC is relevant in all 3 of the largest market segments.

The global trend towards increased use of e-commerce is expected to greatly impact the pulp and paper industry moving forward. The writing and printing segment is expected to lose market share. However increased deliveries of products from online sales is expected to increase demand for cardboard and packaging. A growing global population will also increase long term demand for the sanitary segment.

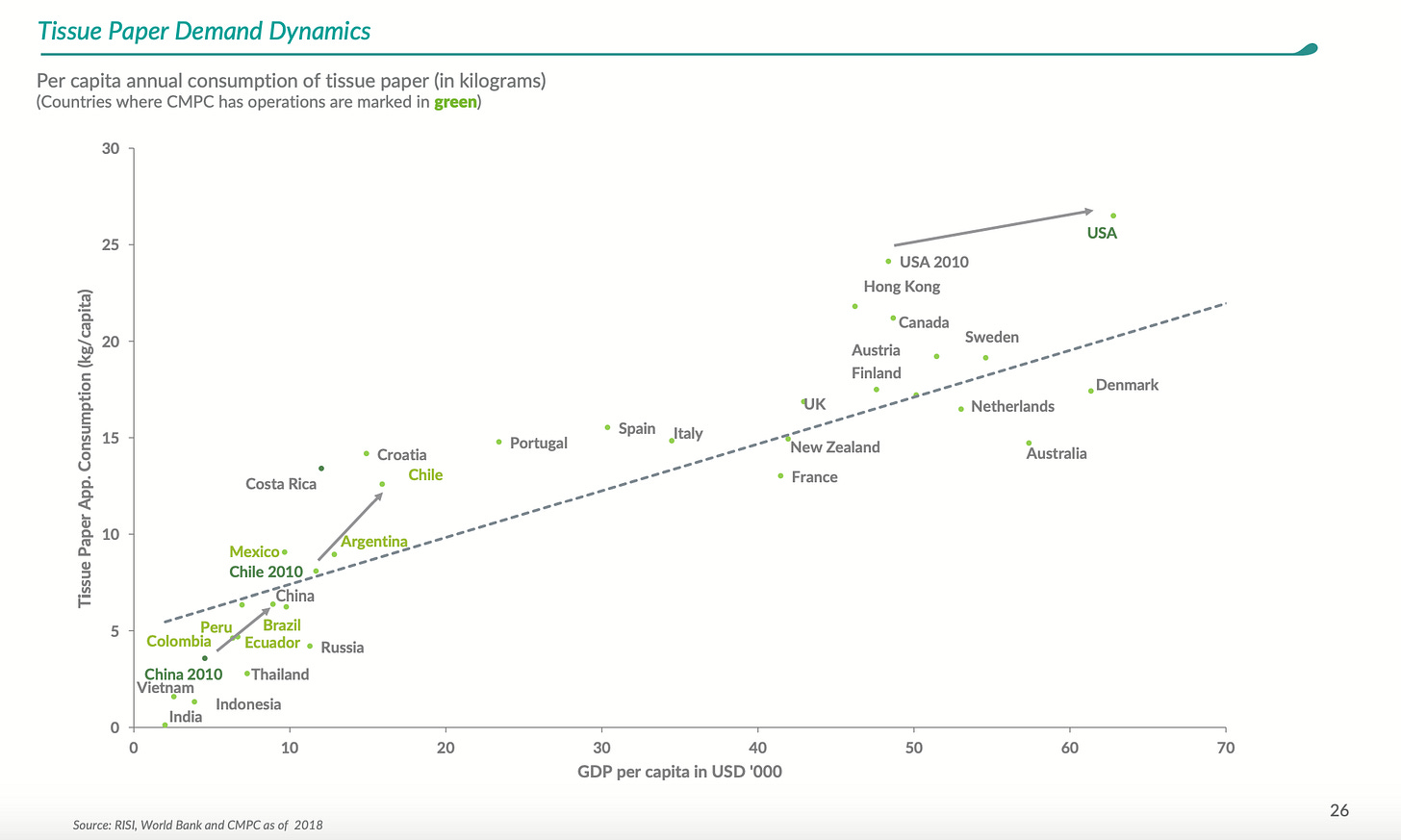

Per capita tissue paper consumption in emerging markets is still well below developed market consumption. If emerging market consumption converges toward developed market levels, then per capita consumption in many of CMPC’s markets will increase significantly.

Financial Analysis

Revenue and Cost Analysis

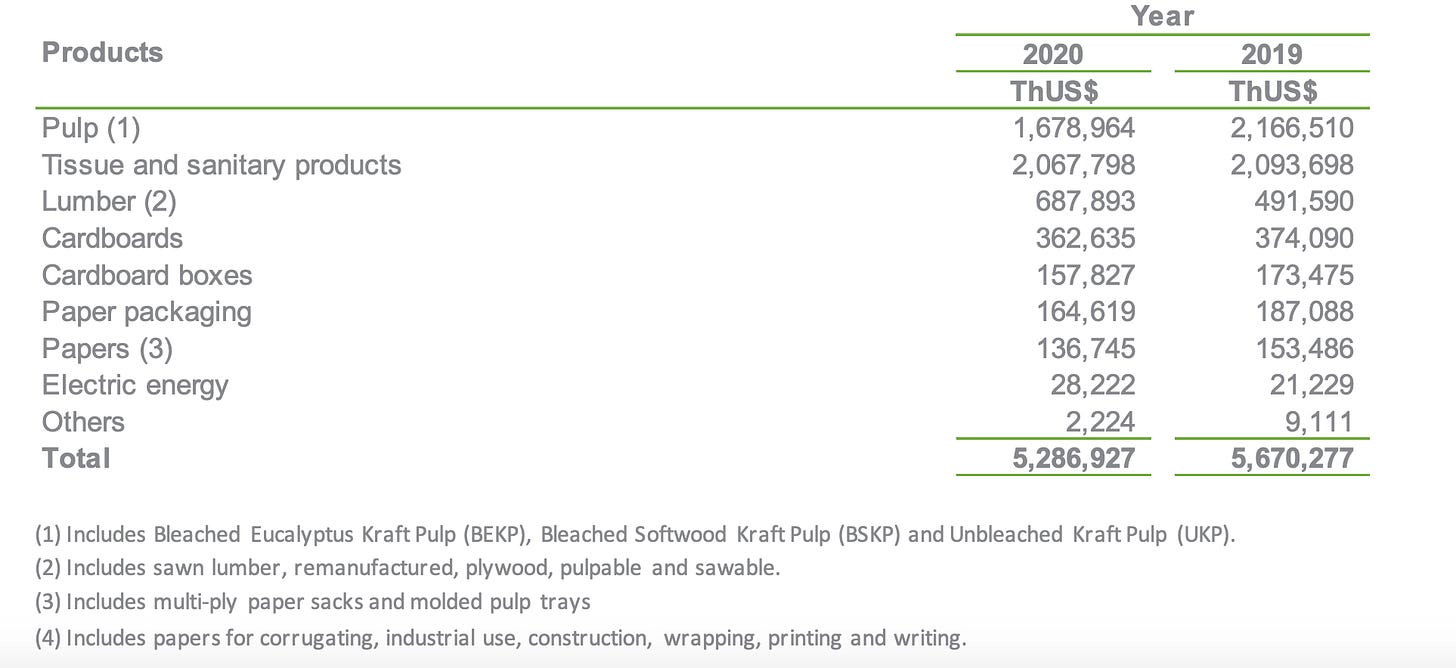

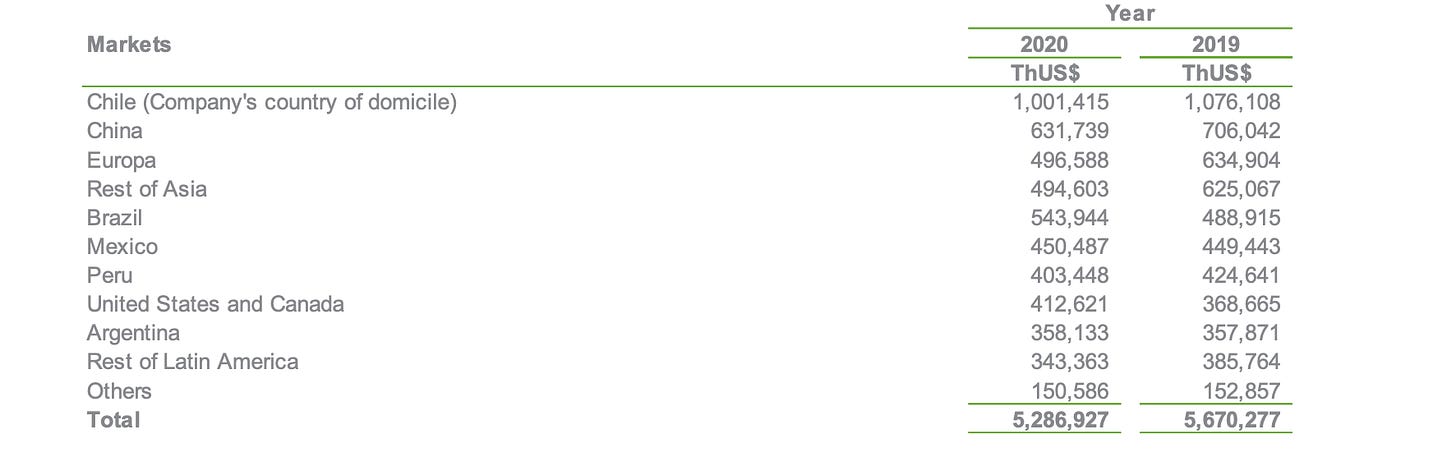

CMPC had revenue of $5.3 billion in 2020, a decrease from $5.7 billion in 2019. Their COGS in 2020 was $4.4 billion, representing a gross margin of 16.3%, also a decrease compared to 19.5% the previous year.

Due to this decrease in gross margins, increased losses from currency translation, and lower financing income, CMPC had a net loss of $27.6 million in 2020. This represents a significant deterioration compared to a profit of $84.4 million in 2019. Administrative expenses declined significantly year over year.

Acquisitions and Divestures

In 2019 the Softy’s business segment acquired Brazilian tissue manufacturer Sepac. Sepac has annual production capacity of 135,000 tons of tissue and 175 million diapers. CMPC paid around $200 million for the company.

In 2020 the company acquired Mexican paper bag manufacturer Grupo Calidra. Grupo Calidra has annual production capacity of 60 million bags. CMPC paid $13 million for the company.

Balance Sheet Analysis

CMPC has a decent balance sheet. They have a sound short term liquidity position and a good base of long term assets. The company is not leveraged and liability levels are reasonable. However they do have a significant amount of long term debt outstanding.

I don’t see any red flags related to the company’s accounts receivables, inventory, or accounts payable management.

It is worth noting the company uses complex derivative instruments, mainly currency and interest rate swaps, to hedge its currency, interest rate, and commodity price exposures. Investors should analyze this derivatives book in detail before investing.

Debt Analysis

As of year-end 2020 the company has $4 billion in total debt outstanding, $252.8 million of which is classified as current. $1.8 billion of this debt has more than 5 years until maturity. Their effective interest rate as of December 2020 was 4.53%.

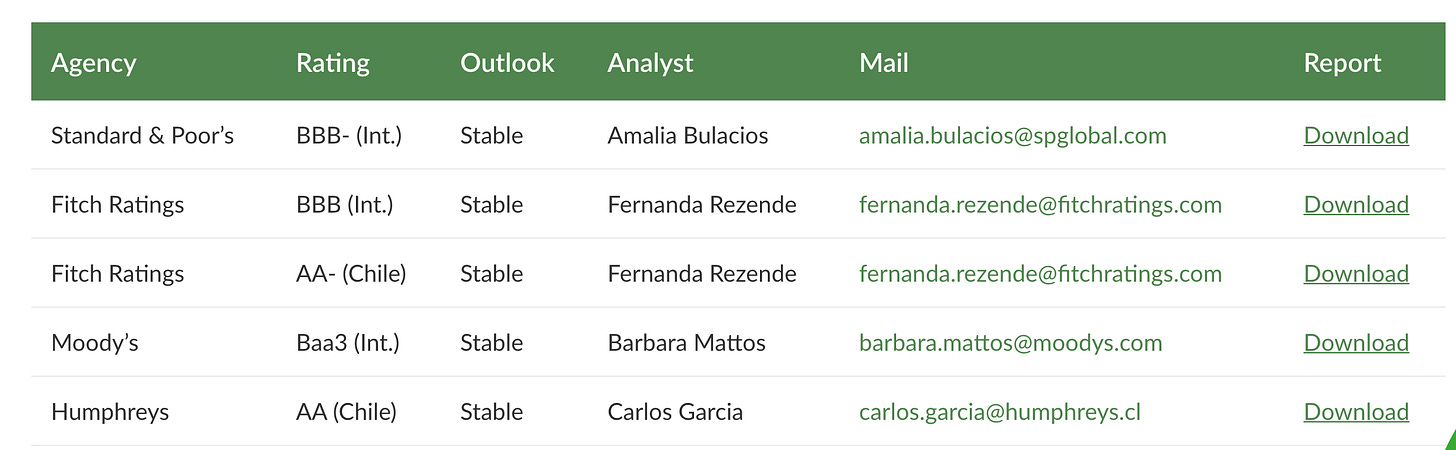

Fitch, Standard & Poor’s, and Moody’s all rate CMPC debt as investment grade.

Share Dynamics and Capital Structure

As of year-end 2020 the company has 2.5 billion common shares outstanding. The are controlled by The Matte Group, who through their interests in various companies, own 55.8% of CMPC.

Dividends

The company paid a dividend of $0.0014 cents per share in 2020, a significant decrease compared to $0.0226 cents per share in 2019. At the current market price this implies a dividend yield of 0.04%.

CMPC has paid a dividend every year since 2009. The dividend has been volatile due to the volatile nature of the company’s earnings. Their current policy is to pay out 30% of net profits, which is the legal minimum under Chilean securities law.

4 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

$6.8 billion / $7.8 billion = .87

A debt to equity ratio of .87 indicates that CMPC uses a mix of debt and equity in its capital structure, but is not leveraged, and relies more heavily on equity financing for funding.

Working Capital Ratio

Current Assets/Current Liabilities

$3.6 billion / $1.2 billion = 3

A working capital ratio of 3 indicates a sound liquidity position. CMPC should not have problems meeting its near term obligations.

Price to Book Ratio

Current Share Price/Book Value per Share.

$3.24 / $3.14 = 1.03

CMPC has a book value per share of $3.14. At the current market price this implies a price to book ratio of 1.03, meaning CMPC stock currently trades at a slight premium to the book value of the company.

Price to Cash Flow Ratio

Current Share price / Operating Cash Flow per Share

$3.24 / $0.30 = 10.76

In 2020 CMPC had operating cash flow per share of $0.30. At the current market price this implies a price to cash flow ratio of 10.7, meaning for every $1 in operating cash flow generated by the company, investors are currently paying $10.76 by investing in the stock.

Summary and Conclusions

Positives

Global player with diversified business segments and a globally diversified client base.

Latin America has a growing population. The company’s sanitary business segment, Softy’s, is well positioned to benefit from the regions favorable demographics long term.

Large and growing land package. The company is expanding its already large forestry plantations, positioning itself for long term growth.

Leveraged to global commodity prices for pulp, paper, and lumber. Given the current levels of global money printing this is a positive.

Balance sheet is healthy. The company is not over leveraged and has a sound liquidity position.

Negatives

Results are dependent on the global price of pulp and paper, making the company’s earnings volatile. The company’s performance can fluctuate significantly in the short to medium term.

2020 dividend declined significantly. Although it is a positive that the company was able to maintain its dividend through the coronavirus lockdowns, their dividend yield is now negligible.

Decreased gross and net margins in 2020. The company’s operating results deteriorated significantly in 2020. 2020 was an exceptional year with the coronavirus crisis, but if these margins don’t rebound in 2021, I would view this as a major red flag.

Conclusion

CMPC is a solid company. They are a one of the largest forestry companies in the world, with industrial plants in 8 countries throughout Latin America. Both their revenue and production are well diversified. The company is in good financial health, with sufficient near term liquidity and reasonable leverage levels. However a decreased gross margin in 2020 caused the company to have a net loss. Investors need to monitor the company’s gross margin and debt/derivatives positions closely.

I think CMPC stock is a sound investment opportunity for both short and long term investors. The company’s stock is an interesting way for shorter term investors to gain exposure to global pulp, paper, and lumber prices. Longer term investors have the opportunity to invest in a global player with a solid track record and favorable long term growth prospects.

If you liked this analysis and would like to learn more about LATAM investment opportunities, subscribe to this newsletter, its free!

You can also connect with me on LinkedIn or follow me on Twitter.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.