Fibra Danhos - LATAM Real Estate Analysis #1

This is an analysis of Fibra Danhos, a real estate investment trust based in Mexico City

Dear LATAM Stocks reader,

Thanks for reading another edition of the newsletter. My name is Matt and I’ll be covering public LATAM real estate investments. This is the first edition of the LATAM Real Estate thread which will cover the most attractive real estate companies in Latin America. I’ve spent my entire career in the real estate industry focused on Latin American markets, from strategic advisory and asset management for global institutional clients to independent consulting and investment advisory for local businesses and HNWIs. If you’re interested in reading more about my background, please follow this link for my detailed bio.

Today’s edition covers Fibra Danhos, a Mexican real estate investment trust that develops, leases, operates, and manages premier quality real estate assets in Mexico City and Puebla – two of the most attractive real estate markets in Mexico and in all of Latin America. The trust has a fascinating portfolio of diversified assets that attract an annual visitor flow of over 125 million. This is an opportunity to gain exposure to a real estate market that is in the early stages of its growth in terms of sophistication, quality, and foreign institutional interest. In addition, with the recent introduction of the FIBRA model, it’s an opportunity to enter the early stages of the anticipated Mexican REIT surge, similar to the US REIT mania in the early 1990s.

If you haven’t subscribed yet and would like to receive more free research about LATAM investment opportunities, subscribe to this newsletter here:

You can also connect with me on LinkedIn or follow me on Twitter for more real estate insights.

Common stock: DANHOS13

Current Market Price: MXN$23.80 / US$1.18

Market Capitalization: $1.7 billion

*All figures in the analysis are listed in USD. The USD to MXN exchange used for 2019 to 2017 figures are: $18.87, $19.65, and $19.74 respectively. The 2020 rate is $21.93.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

Summary of Fibra Danhos

Danhos is a Mexican-based real estate investment trust, known as a FIBRA in Mexico, founded in 1976. The trust’s main activity consists of the development, leasing, operation, and management of institutional quality commercial real estate within Mexico City and Puebla. The trust’s portfolio includes retail, office, hospitality, and mixed-use assets.

Retail: Currently, Danhos controls seven premier quality shopping centers totaling 390,580 square meters which represents 44% of the current operating portfolio. Retail occupancy rates average 93.9% with a low of 78.5% and a high of 99.8%. All of the properties in the portfolio are located along the main communication routes with access to public and private transportation. The annual flow of visitors to the company’s retail properties exceeds 100 million.

Office: The Danhos portfolio includes four office buildings, totaling 122,724 square meters of gross leasable area (GLA). All of the office properties are classified as Class A and located in the most attractive office submarkets in Mexico City and represent 14% of the current operating portfolio. Pre-coronavirus office occupancy averaged 88.7%. The tenants consist of nationally and internationally recognized businesses.

Mixed-Use: The mixed-use projects in the portfolio combine retail, office, and hotel space. Currently, there are four mixed-use properties in the portfolio totaling approximately 378,436 square meters of gross leasable area which represents 42% of the total existing portfolio. The occupancy for these projects averages around 87%.

Pipeline: The current pipeline consists of a 70,000 square meter retail development that’s currently under construction, representing 4% of the current portfolio. Construction of the Parque Tepeyac project is expected to be completed during the first quarter of 2022. The project is a 50% joint venture located in the Gustavo A. Madero borough.

*Amounts in table are listed in Mexican pesos.

Mexico economic snapshot

Mexico’s economy is steadily recovering from the effects of the coronavirus pandemic. The country has a population of 127.6 million people, making it the second most populous country in North America, and third most populous in the Americas. The country has a GDP of over $2.6 trillion with a 2.1% CAGR during the past five years. Pre-coronavirus, the country registered historically low unemployment and inflation, at 3.4% and 3.6% respectively.

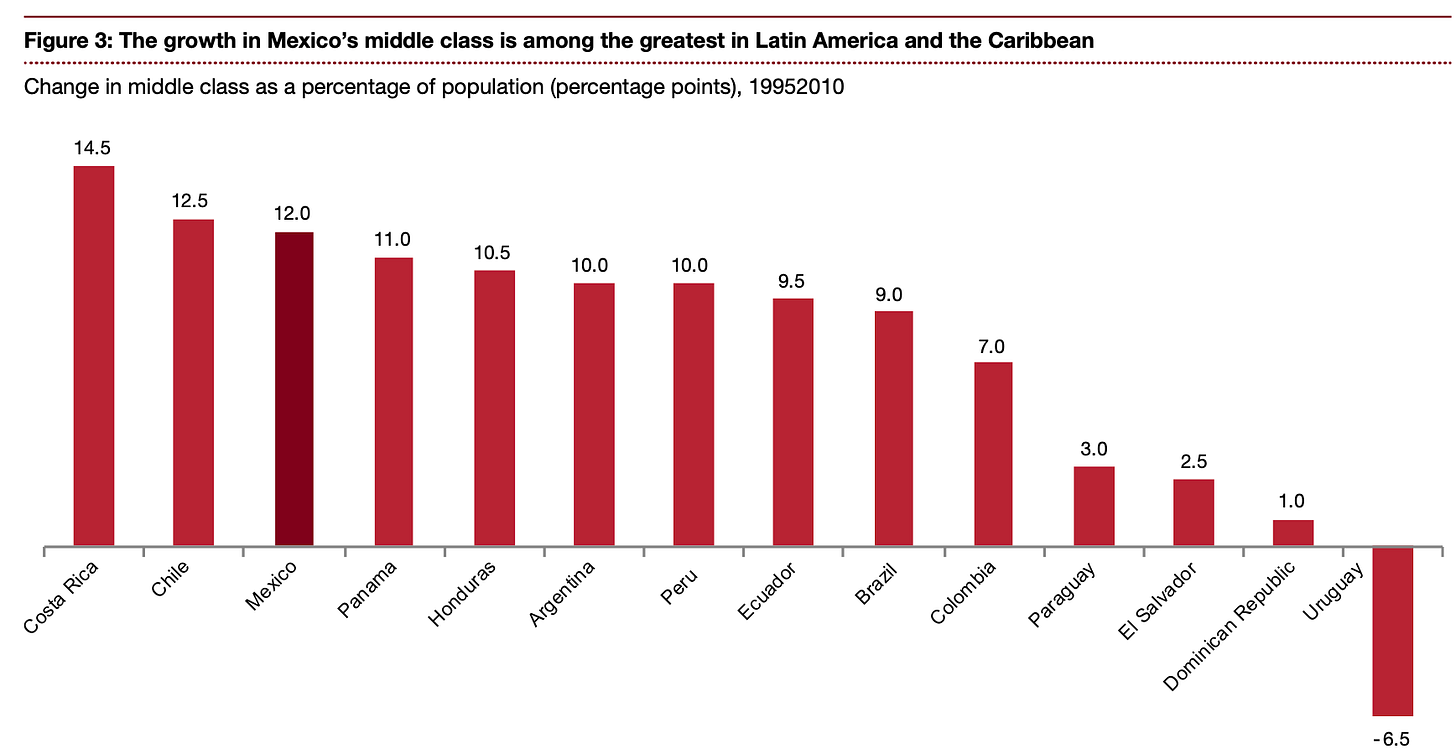

As of 2019, Mexico’s middle class represented nearly half of the total households in the country. The middle class is expected to continue growing, bringing an additional 3.8 million households into the middle class by 2030. Several factors have contributed to this growth trend: precipitous decline in inflation, trade openness, prudent fiscal management by the government, and easier access to financial capabilities by the general population.

Mexico has a favorable political climate for developing and establishing a mature real estate market. The current president, Andres Manuel Lopez Obrador (AMLO) has a history of supporting and implementing policies that directly benefited the real estate sector during his political career. During his time as Mayor of Mexico City he introduced policies and incentives, such as making property tax deductible for the first 10 years, to boost construction and real estate growth. These policies laid the foundation for the construction of the city’s first skyscraper. During his first two years as president, his administration has supported the development of organized real estate growth across the country.

The number of developers in Mexico has swelled over the past decade, capitalizing on these economic and demographic trends. There is a clear strategy of prioritizing key markets, such as Mexico City, and an emphasis on constructing mixed-use projects. In addition to the rapid growth in development firms, Mexico has experienced significant fund raising, both foreign and domestic capital, for FIBRAs and Certificates of Capital Development.

An overview of the Mexican FIBRA structure:

The recently introduced FIBRA investment vehicle is modeled after the US REIT structure, providing an efficient way for domestic and international investors to tap into the growing Mexican real estate industry. The overhaul of Mexican tax rules means that FIBRAs now offer substantial tax benefits, which include:

Deferral of income tax and entrepreneurial fixed rate tax payments on contributions of real estate into the FIBRA;

Exemption from making provisional monthly payments of income tax and entrepreneurial fixed rate tax with the obligation by the FIBRA to distribute profits at least once per annum. Profits will not cause an entrepreneurial fixed rate tax;

Perform sale and leaseback transaction with the FIBRA, without paying income tax;

Exemption on payment of entrepreneurial fixed rate tax on any income generated by the CPIs (Certificados de Participacion Inmobiliarios), if acquired by foreign pension and retirement funds;

The possibility to defer payment of the local real estate acquisition tax.

Furthermore, the National Commission for the Pension System (CONSAR) amended provisions to their laws and now allow pension fund administrators to make investments in structured instruments like FIBRAs.

Mexico City office sector snapshot

The office sector in Mexico City has been on a strong growth trajectory during the past decade. As of September 2020, the total office stock in Mexico City totaled over 7.2 million square meters, 60% of which is concentrated in the Norte, Santa Fe, and Polanco submarkets.

Year-over-year supply grew 36%, totaling nearly 1.4 million square meters of available inventory. The gap between supply and demand widened starting in 2015, as office supply significantly outpaced demand growth.

It will take several years for the supply and demand relationship to stabilize in Mexico City. Rent prices are expected to decrease and developers will shift their focus to other asset classes in search of better returns.

Mexico City retail sector snapshot

In contrast to the prolonged decline in retail performance in the US, the retail sector in Mexico’s major cities continues to grow thanks to a growing middle class and higher disposable incomes. By 2030, Mexico’s middle-class is expected to add over 3.8 million households to total 36.8 million – around 50% of total households.

Several important economic and demographic trends support an optimistic outlook for the Mexican retail sector in the short- to mid-term. Two-thirds of Mexicans do not own a bank account, meaning that most retail purchases are made in cash at brick-and-mortar locations. Furthermore, 40% of Mexicans do not have access to a smart phone, the leading demand generator for e-commerce in the country. Combined with steep shipping fees and taxes, e-commerce loses its appeal to the majority of Mexican shoppers. With limited online options, Mexican consumers turn to retail outlets and shopping malls. It’s no surprise that economists and market participants project the Mexican commercial real estate sector to grow at a compound annual growth rate (CAGR) of 6.7% by 2024.

Financial analysis

Revenue and cost analysis

Danhos recorded total revenues of $211 million in 2020, a 20% decrease compared to 2019. Quarterly growth indicates some positive momentum, with Q4 2020 revenue showing an increase of nearly 13% over Q3. From 2017 to 2019, total revenues grew at a compound annual growth rate of 18.3%, NOI at 20.2%, and AFFO (adjusted funds from operations) at 8.1%. NOI margin remained steady over the same time frame, hovering around 80%.

Average monthly fixed rent has remained stable, growing at a CAGR of 0.8% from 2017 to 2019. Lease spread, which is a proxy for overall market health, recorded a high of 13.5% in 2017, dropping to just under 6% for 2018 and 2019. Revenue growth can be attributed to an increase of gross leasable area, which has grown at a CAGR of 7.5% over the same period. Occupancy costs have remained stable between 8-9%.

The trust invested its cash balance in fixed-income securities which generated $3.7 million in 2019. The trust also recorded a positive foreign-exchange gain of $1.18 million due to the appreciation of the US Dollar against the Mexican Peso and its impact on the trust’s collections in dollars.

Acquisitions and Divestures

In 2019, Danhos opened a new amusement park at its Parque Las Antenas property and an aquarium at its Parque Puebla property, immediately increasing the volume of visitors to the properties.

There was a payoff of the Danhos 16-2 bonds which totaled $52.9 million at maturity which helped to strengthen the overall financial structure of the trust.

Balance Sheet Analysis

Danhos has a healthy balance sheet. Low leverage, high rated bonds by Fitch Mexico and HR Ratings de Mexico, decent short-term liquidity, and a strong real estate portfolio with an audited fair market value of USD$3.3 billion.

I did not find any red flags regarding accounts receivable or payable, however, it’s worth noting that from a credit risk standpoint, the Toreo Parque Central, Parque Delta, Parque Tezontle, and Parque Las Antenas together represent nearly 40% of the trust’s lease revenue. The trust’s ten largest tenants occupied approximately 41.7% of the total leasable area in 2019.

Debt Analysis

As of 2019, the company had $297 million in total debt obligations. The trust’s debt load increased by 2.8% from 2018 and their average interest rate on debt averaged 8.16%.

Share dynamics and capital structure

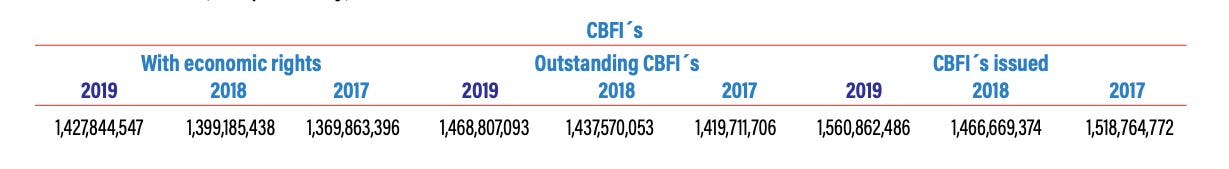

By the end of 2019 the trust had 1.56 billion total CBFIs/shares in circulation. 1.46 billion CBFIs/shares were outstanding, while 1.42 billion had economic rights.

Dividends

DANHOS paid a total dividend of $0.13 cents per share in 2019, an increase from $0.12 cents per share in 2018, implying a dividend yield of 9.1%.

5 Metrics to consider

Debt-to-Equity

(Total liabilities / Total shareholder equity)

$393 million / $2.6 billion = 0.15

Limited access to debt financing in Mexico means that FIBRAs must finance their real estate investments primarily with equity. A debt-to-equity ratio of 0.15 means that the trust utilizes a substantial amount of equity to finance its real estate investing activities.

Debt ratio

(Total liabilities / Total assets)

$393 million / $3.06 billion = 12.8%

The debt ratio is the proportion of REIT assets financed by debt. The total debt includes short- and long-term liabilities but excludes accounts payable and negative goodwill. A 3:1 debt ratio is considered acceptable.

Debt-to-EBITDA

(Total liabilities / EBITDA)

$393 million / $137 million = 2.86

The debt/EBITDA ratio is used to gauge the overall credit worthiness of a REIT and to determine the level of risk associated with a REIT’s debt. Danhos has a debt/EBITDA ratio of 2.86, up from 1.96 in 2019. This is within the parameters for a healthy real estate trust – a ratio below the 3:1 industry average is considered good.

AFFO payout ratio

(Dividend per share / AFFO per share)

$0.13 / $0.15 = 89%

The AFFO payout ratio measures a REIT’s ability to pay dividends to shareholders in the long term. A ratio over 100% means that the dividends of that REIT are higher than income projected for future operations. An AFFO payout ratio of 89% is standard for REITs.

Price/FFO

(Price per share / FFO per share)

$ 1.43 / $0.13 = 11

In 2019, Danhos FIBRA generated $188.6 million in FFO (funds from operations) or $0.13 per share, which yields a P/FFO ratio of 11. A REIT with a P/FFO ratio of, say, 15 can pay a lower dividend of 4-5% and still retain substantial cash flow to pay down debt or finance additional acquisitions for its portfolio. Generally speaking, the lower the P/FFO ratio for a trust with stable cash flowing properties, the more attractive the investment opportunity for a patient value investor.

Summary and Conclusions

Positives:

Strong, diversified portfolio of institutional quality assets located in highly desirable and affluent submarkets in Mexico City.

Steady revenue growth over the past several years with consistent dividend payments and healthy operating margins.

Robust balance sheet and adequate liquidity position.

Pipeline of new projects that will further strengthen, diversify, and mitigate some of the existing credit risk.

Favorable demographic and economic trends bode well for real estate market growth in Mexico City.

Concerns:

Credit risk is a concern for the existing portfolio as a small number of tenants and buildings represent a majority of the lease revenues and occupied GLA.

Low rent growth over the past several years.

Dependency on equity to finance growth could be problematic due to dilution.

Conclusion:

Solid diversified real estate portfolio in a high demand, growing, robust market. They have a sound balance sheet, strong revenue and NOI growth, with consistent focus on constructing high quality assets that capitalize on the evolving real estate market in Mexico. They have consistent dividend payment and are expected to continue providing healthy returns to shareholders.

The trust hasn’t published an audited 2020 financials report, which will likely show a significant impact from the coronavirus pandemic. The trust’s market price fell 36% during the onset of the coronavirus lockdowns and has recovered 87% of its pre-pandemic price as of April 2021. The assets that comprise the portfolio have undoubtedly experienced volatility in 2020, however, I’m optimistic that the trust’s portfolio will return to pre-pandemic level performance in the mid-to-long term as the Mexican economy continues its recovery. Fibra Danhos could be an attractive long-term trade for the patient value investor. It’s an opportunity to gain exposure to a one of the most robust, demographically sound, and rapidly evolving markets in Latin America that’s forecast to undergo substantial real estate growth in the mid- to long-term.

If you liked this analysis and would like to learn more about LATAM investment opportunities, subscribe to this newsletter, its free!

You can also connect with me on LinkedIn or follow me on Twitter for more real estate insights.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.