Grace Kennedy - LATAM Stocks Investment Analysis #10

This is an analysis of Grace Kennedy, a Jamaican food and financial services conglomerate

Dear LATAM Stocks Readers,

Thanks for reading! This edition will cover a Jamaican food and finance conglomerate, Grace Kennedy. I decided to dig into Jamaican stocks when a reader emailed me to suggest several Jamaican companies. So far I have looked at 10 out of the ~50 companies listed on the Jamaican stock exchange and I have been pleasantly surprised by the quality of the businesses and their financial disclosures.

Grace Kennedy is a market leader in both the industries in which it operates. They have consistently grown revenues for that past 5 years and remain financially healthy. Management returns capital to shareholders via a dividend, which has also grown steadily year over year. The company’s stock is a solid investment opportunity for investors looking for long term exposure to the Caribbean consumer and financial services industries.

Also, this was the first edition where I ran into significant capacity (space) constraints, and had to limit parts of the analysis. Given the complexity of the company’s balance sheet, which includes a pension obligation, investors seriously considering investing in Grace Kennedy would be wise to dig much deeper into the company’s balance sheet.

If you have any questions, doubts, or criticisms of this analysis, leave a comment at the end of the article!

If you would like to receive more free research about investments in Latin America, subscribe here:

You can also connect with me on LinkedIn or follow me on Twitter.

Common Stock: Grace Kennedy Group

Current Market Price: $99.22 JMD

Market Capitalization: $98.7 Billion JMD ($641 Million USD)

*All values in this article are expressed in Jamaican Dollars (JMD) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

Summary of the Company

Grace Kennedy is a Jamaican conglomerate with operations in two distinct industries; food and financial services. The groups operations are separated into two distinct segments;

Food Trading: This comprises the business of food manufacturing through our own factories, as well as through external suppliers; the distribution of Grace and Grace-owned brands in Jamaica and internationally; and the operation of retail outlets through our Hi-Lo Supermarket chain in Jamaica. The Group also manufactures and distributes third party brands in Jamaica and internationally. The Food Trading segment operates in Jamaica, the Caribbean, Central America, North America, the United Kingdom (UK), and several European countries.

Financial Services: This comprises our commercial banking, general and health insurance businesses, insurance brokerage, investment banking, remittance, cambio and payment services businesses. Our Financial Services subsidiaries presently operate within the English-speaking Caribbean.

Food Trading

Within the food trading segment there are three distinct business lines:

Manufacturing – Grace Kennedy has 6 factories in Jamaica which produce over 50% of the products sold by Grace Kennedy brands. Some of the products produced at the company’s factories are canned goods, packaged soups, sauces, cereals, meats such as hams and sausages, as well as dairy products such as yogurts and cheeses.

Distribution - Grace Kennedy distributes its products in over 40 countries. In Jamaica, Canada, Belize, Ghana, The United States, and The United Kingdom, the company distributes through its own subsidiaries in those countries. For the rest of the world the company distributes its products through a network of independent distributors. In The United States you can find Grace Kennedy products in major food retails such as Walmart, Publix, and Stop & Shop.

Retail – Hi-Low Food Stores is the company’s retail brand in Jamaica. Hi-Low is the second largest food store in Jamaica, with locations throughout the country.

Financial Services

Within the financial services segment there are three distinct business lines:

Banking and Investments – Through the company’s subsidiaries GK investments, First Global Bank, Signia Globe, and GK Capital, Grace Kennedy offers commercial banking, stock brokerage, as well as corporate finance and advisory services.

Money Services -This segment offers bill payment services throughout the Caribbean through the brand Bill Express. They offer money transfer and remittance services, acting as the exclusive agent for Western Union is several Caribbean countries. They also offer foreign exchange services under the FX Trader brand, allowing clients to buy and sell 5 major foreign currencies; The US Dollar, Euro, Cayman Island Dollar, Canadian Dollar, and the Pound Sterling.

Insurance – Through its subsidiaries Grace Kennedy offers a range of insurance products, including health and commercial insurance lines.

The company was founded in 1922 and is headquartered in Kingston, Jamaica. They currently employ over 1,900 people.

Acquisitions and Divestures

M&A is part of the company’s growth strategy and the company has a history of acquisitions.

In 2020 the company acquired Key Insurance, and in 2021 they acquired Scotia Insurance Eastern Caribbean Limited.

On the food side the company acquired the 876 spring water brand in 2021.

The Jamaican Economy

Jamaica is the largest island in the English-speaking Caribbean with a population of nearly 3 million people. Their GDP was around $15 billion USD in 2019. The country has a diversified economy, but tourism and finance are by far the two most important industries.

The heritage foundation classifies Jamaica’s economy as “moderately free”, ranking it as the 45th freest economy in the world. Regulatory efficiency and fiscal health are bright spots, however Jamaica ranks poorly in financial freedom.

The Jamaican Food Industry

Euromonitor estimates that in 2016 the size of the Jamaican grocery retail food market was $987 million USD. The food services sector is also an important component of the Jamaican food industry, particularly food services for the tourism industry. In 2015 Euromonitor estimates that total food consumption by the hotel restaurant sector was $600 million USD.

The food processing sector in Jamaica is underdeveloped. The majority of the ingredients used by the food industry are imported from The United States, the country’s largest trading partner. Jamaica is the 2nd largest market for U.S. agricultural exports in the greater Caribbean after the Dominican Republic. U.S. exports of agricultural products to Jamaica totaled $371.5 million USD in 2016.

Financial Analysis

Revenue and Cost Analysis

Grace Kennedy has consistently grown its revenues for the past five years. In 2020 the company had total revenues of $115.4 billion ($749 Million USD), a significant increase from $103 billion in 2019.

The company was profitable in each of the last two years. In 2020 Grace Kennedy had net income of $6.9 billion, representing a profit margin of 5.9%, an increase compared to 4.8% in 2019.

The majority of the company’s revenue comes from the food trading segment, which accounted for 79% of revenues in both 2019 and 2020. The remaining revenue comes from the financial services segment.

Revenue growth was driven by both of the company’s operating segments. Standout businesses in terms of growth were the international food business, GraceKennedy Foods (USA) and within the financial services segment, insurance and money services drove growth.

The majority of the company’s revenue is derived in Jamaica, however the company does have a large and relevant international presence throughout the Caribbean, as well as in North America and Europe.

Balance Sheet Analysis

The company has a complex balance sheet due to their financial services segment. Also it was hard to analyze the company’s liquidity position, as they do not separate current vs non-current accounts on their balance sheet.

It is worth noting that the company has a defined benefit pension obligation that investors should consider before investing. The plan appears to be in decent financial health.

I don’t have enough space via this medium to do an adequate analysis of the company’s balance sheet. So I will draw your attention to the issues above and recommend that investors seriously considering investing in Grace Kennedy dig deeper into the company’s balance sheet before investing.

Debt Analysis

As of year-end 2020 the company has $25.2 billion in total debt outstanding, an increase from $24 billion the previous year. Interest rates on the debt range from 1.6% to 7.2%.

Share Dynamics and Capital Structure

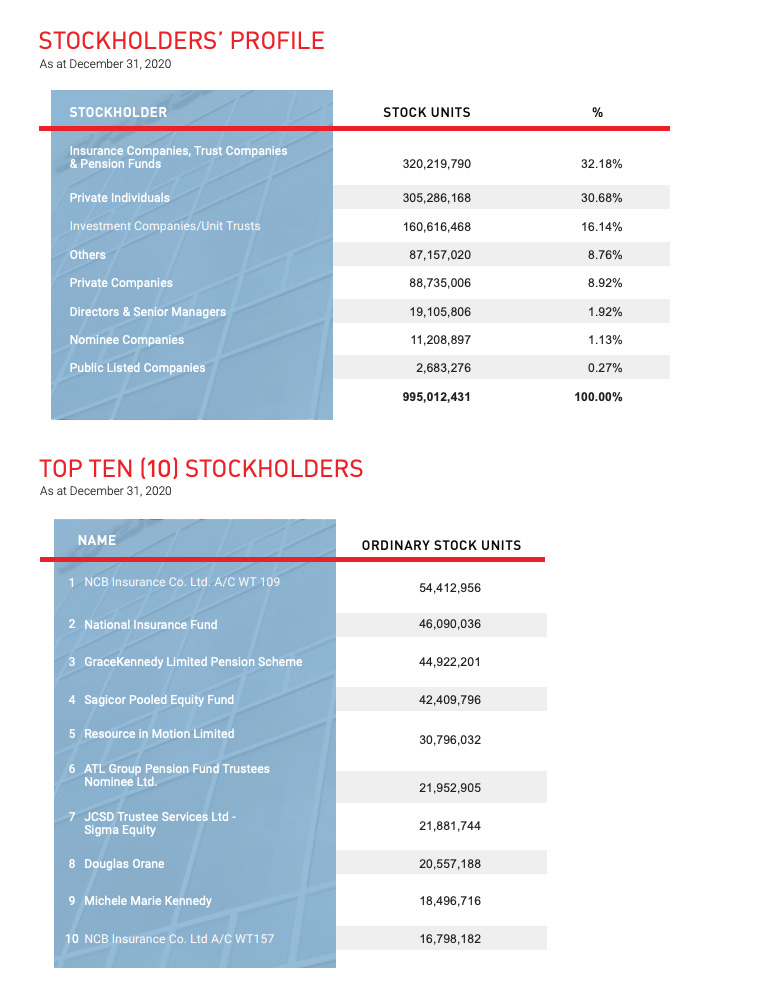

As of year-end 2020 the company has 995 million common shares outstanding. Insider ownership by directors and senior managers is low, less than 2%. The majority of the company’s stock is owned by institutional investors such as pension funds, as well as private individuals.

The company’s 10 largest shareholders own around 32% of the company’s outstanding shares.

Dividends

Grace Kennedy has consistently increased its dividend for the past five years. In 2020 the company paid total dividends of $1.59 per share. At the current market price this implies a dividend yield of 1.6%.

3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

$109 billion / $62.8 billion = 1.7

A debt to equity ratio of 1.7 indicates that Grace Kennedy uses a mix of debt and equity in its capital structure, but is leveraged, and relies more heavily on debt financing for funding.

Price to Book Ratio

Current Share Price/Book Value per Share.

$99.22 / $63.10 = 1.6

Grace Kennedy has a book value per share of $63.10. At the current market price this implies a price to book ratio of 1.6, meaning the company’s stock currently trades at a slight premium to the book value of the company.

Price to Cash Flow

Current Share price / Operating Cash Flow per Share

$99.22 / $13.95 = 7.1

In 2020 Grace Kennedy had operating cash flows per share of $13.95. At the current market price this implies a price to cash flow ratio of 7.1, meaning investors are currently paying $7.1 per $1 of operating cash flow generated by the company.

Summary and Conclusions

Positives

Vertically integrated food business with diversified manufacturing, global distribution, and retail presence.

Diversified financial services offerings with a presence throughout the Caribbean. Room for growth as some of these markets are underserved.

Strong financially with a history of consistent revenue growth, profitability, and dividend growth.

Negatives

Complex balance sheet due to the financial services business. Insurance business presents a tail risk to investors in the form of large unexpected claims.

Debt levels are high, some of which bears a relatively high interest rate.

Financial service business is ripe for disruption. Remittances are being disrupted by crypto native companies. For example in 2020 Bitso processed 3% of all US-Mexico Remittances. The traditional brokerage model is being disrupted by companies like Robinhood. If Grace Kennedy cannot evolve its business then the financial service segment could become more of a liability than an asset.

Increasing input costs due to inflation and/or global supply chain constraints could decrease margins for the food manufacturing segment.

Conclusion

Grace Kennedy is an impressive company. They have a long history of successful operations both in Jamaica and internationally. Revenues and dividends have grown consistently for the past 5 years. The company is well positioned strategically in both industries in which it operates, particularly the food business.

Their balance sheet is complex and difficult to analyze based on their financial disclosures. Given that I believe their financial services segment is ripe for disruption, it was hard to assess the risks associated with their financial service business. If I could buy the food business without the financial services business, I would.

But that’s just my opinion. Investors who are bullish on traditional financial services like Western Union will find that Grace Kennedy is very well positioned. In summary, Grace Kennedy stock provides investors and intriguing vehicle to gain exposure to the Jamaican consumer and financial services markets. I don’t see many short term catalysts either on the upside or downside. But long term the company is well positioned in both its industries.

If you liked this analysis and would like to receive all of our future LATAM investments newsletters, you can subscribe for free here:

You can also connect with me on LinkedIn or follow me on Twitter.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.