BluMar Seafood - LATAM Stocks Investment Analysis #18

BluMar Seafood is a Chilean fishing and aquaculture company. They are a globally relevant salmon exporter.

Dear LATAM Stocks Readers,

Before I talk about this editions company, I wanted to take a second to thank all of you for reading. Our community has grown to over 2,200 members!

I have been pleasantly surprised not only by the amount of interest in Latin American stocks, but also by the quality of the subscribers in our community. The comments and feedback I have received from readers has been amazing.

I want to sincerely thank all of you for reading!

I hope you will continue to participate and I am excited to keep learning about Latin American investments with all of you!

So without further ado, let’s talk about fish…

This edition will cover BluMar Seafood, a Chilean fishing and aquaculture company.

The global salmon market is a duopoly, dominated by Norway and Chile. BluMar is a top ten fishing company in Chile, meaning it is also a globally relevant player. BluMar has large extractive fishing operations as well as aquaculture operations.

The company has emerged from a few difficult years and has returned to revenue growth, profits, and a clean balance sheet.

BluMar’s stock currently trades at a reasonable valuation and pays a healthy dividend. However the shares are tightly held and there is not much trading volume.

I realize this might not be the most viable investment for many readers. However I think the Chilean fishing industry is fascinating. I choose to cover BluMar because I wanted to highlight both the industry and also an investable public company operating within the industry in Chile.

I hope you find this salmon and mackerel company as interesting as I did. As always, doubts, questions, and criticism are welcome in the comments below!

Common Stock: BluMar Seafood (Ticker: BCS: BLUMAR)

Industry: Food Production - Fishing and Aquaculture

Current Market Price: 237.60 CLP: $0.29 USD

Market Capitalization: 384.4 Billion CLP: $470.5 Million USD

*All values in this article are expressed in US Dollars (USD) unless otherwise noted.

**The USD/CLP exchange rate at writing was 817 to 1.

***A complete Disclaimer about LATAM Stocks Investment Overviews can be found by following this link.

Summary of the Company

Blumar Seafood is one of the leading fishing and aquaculture companies in Chile. They are vertically integrated, from their extractive fishing and fish farming operations, all the way through to the sale of value added products to retail customers.

The company’s extractive fishing operation has its own fleet of ships, but the company also purchases fish from artisanal fisherman. In 2022, this operation harvested 311,387 tons of fish. Of this, 64% came from the purchases from artisanal fishermen and 36% from BluMar’s fleet.

BluMar’ fish farming operations began in 2006 and have grown to account for 61% of total revenue in 2022. This operation consists of 18 active fish farms as well as various aquaculture concessions. The company’s aquaculture operations present significant growth opportunities.

BluMar Product Lines

Atlantic Salmon – This is the company’s most important product, it accounted for 57% of revenue in 2022. The company sells its salmon globally in various forms; fresh, frozen, etc…

Fish Meal and Oils – Both of these products are used mainly as raw material in the production of fish feed and for animal food (pets, livestock, etc…). Fish oil is also consumed by humans as a dietary supplement, which accounted for 16% of global fish oil use in 2021. This product line is BluMar’s second largest, accounting for 19% of revenue in 2022.

Frozen Mackerel – This is core product for the company and a major export. BluMar’s frozen mackerel products accounted for 13% of revenue in 2022.

White Fish and Others – BluMar has several retail brands that sell hake, breaded whitefish, as well as other whitefish derivative products. In addition to white fish the company also has other retail products, for example market ready mussels.

BluMar By The Numbers

20% Industrial share of Chile’s central South horse mackerel fishing quota

21% Industrial share of Chile’s central South sardine fishing quota

21% Industrial share of Chile’s central South anchovy fishing quota

51 Aquaculture concessions

18 Active salmon farms

6 Seiners in operation

2 Trawlers in operation

4 Fishmeal plants

5 Human consumption product plants

3 Cold storage facilities

BluMar was founded in 1948 and is headquartered in Santiago, Chile.

The Chilean Fishing and Aquaculture Market

Chile is a fish products powerhouse. In 2020 Chile exported around $4.5 billion USD in aquaculture products globally.

The top 10 exporting companies in Chile accounted for around 77% of all aquaculture exports.

The global salmon market is a duopoly, dominated by Norway and Chile. These two countries accounted for 79% of global salmon production in 2022.

Chile is the second largest salmon producer in the world after Norway. There is a significant production gap between Chile and the third largest producer, The United Kingdom. Chile produced over 3 times as much salmon in 2022 as the UK.

If you have liked this analysis so far, subscribe to get all future editions sent directly to your inbox!

You can also connect with me on LinkedIn or follow me on Twitter.

The Financials

Revenue and Cost Analysis

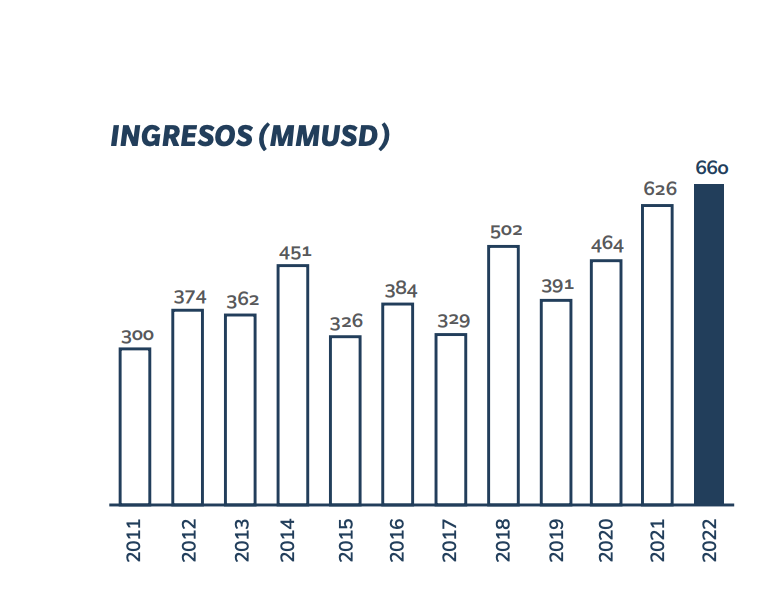

BluMar had sales of $660 million USD in 2022, an increase from $626 million in 2021.

Gross profit of $171.2 million in 2022, representing a gross margin of 26%, up from 23% the previous year.

EBIT of $101.6 million in 2022, up from $69.3 million in 2021.

EBITDA of $129 million in 2022, up from $100 million in 2021.

Profitable, net income of $63.2 million in 2022, representing a profit margin of 10%, up from 8% the previous year.

Balance Sheet Analysis

BluMar’s liquidity position is OK, with a current ratio of 1.3.

The company is not leveraged, with a debt to equity ratio of 0.99

Debt Analysis

As of year-end 2022 BluMar had $260 million USD in total debt outstanding.

$141 million of this debt was current at the beginning of 2022, but as of July 2023, only $94.5 million of current debt is still outstanding.

Valuation Metrics

Price to Book – ~1

Price to Sales – 0.71

Price to EBITDA – 3.6x

Price to EBIT – 4.6x

Price to Net Income – 7.4x

Share Dynamics and Capital Structure

As of December 2022 the company has 1,617,983,612 common shares outstanding.

The company’s 10 largest shareholders control 84% of the company.

**In August of 2020 the company issued 210 million new shares, raising $40 million USD in new capital.

Dividends

In 2022 BluMar paid total dividends of 19 CLP per share ($0.023 USD).

At the current market price this implies a dividend yield of ~8%.

Technical Analysis Notes

BluMar’s stock is relatively uneventful from a technical perspective. It has a clear support level around CLP 140 per share. It is still well below its all-time high of CLP 300 per share from 2019.

The shorter term trend is sideways with an upward drift. Current price is above the 50 and 200 daily and weekly moving averages.

BluMar is a low volume stock, so it’s likely unsuitable for most short term traders.

Summary and Conclusions

Positives

BluMar is a leading fishing and aquaculture company in one of the two most important salmon markets in the world. They have a huge export footprint, accounting for 5% of all Chilean salmon exports.

Diversified product portfolio.

Valuation is very reasonable trading at book value and 7.4x earnings

Healthy Dividend.

Negatives

Cyclical industry in which it does not have a dominant market position. Total price taker.

Highly regulated industry. Relevant risk of company losing certain fishing quotas, concessions or increased costs from regulatory burden.

Conclusion

Most people don’t think of Chile when they think of Salmon. But Chile is the second most important Salmon exporter in the world and its fish industry continues to grow.

BluMar is an interesting case study. It occupies a relevant, but not dominant position in the Chilean fish industry. Their financials are healthy, with good liquidity, reasonable debt levels, as well as decent revenue growth and profits over the past several years.

Management returns capital to shareholders via a healthy dividend. However the dilutive new share offering in 2020 was a negative.

The company’s current valuation is reasonable, if not cheap.

At the end of the day, an investment in BluMar stock is a bet on the Chilean fish industry. I think that’s likely to be a good bet in the long term. I don’t see any reason that Chile’s fish industry shouldn’t continue to flourish. In the short to medium term the cyclicity of food prices could negatively impact BluMar’s share price, but over say a 5 year horizon, I think investors will likely benefit from having exposure to this industry.

If you have liked this analysis, subscribe to get all future editions sent directly to your inbox!

You can also connect with me on LinkedIn or follow me on Twitter.

***A complete Disclaimer about LATAM Stocks Investment Overviews can be found by following this link.