Enaex - LATAM Stocks Investment Analysis #12

Enaex is a Chilean rock fragmentation service provider and the 3rd largest producer of ammonium nitrate in the world.

Dear LATAM Stocks Readers,

This edition will cover the Chilean company Enaex. Enaex is the 3rd largest manufacturer of ammonium nitrate in the world, their Prillex facility in Chile is the largest single production location in the world. They also offer a wide range of rock fragmentation products and services to the mining industry.

The company has seen significant growth over the past several years, despite volatile prices in the commodities its clients mine. Management has expanded Enaex’s geographic footprint and product offering by making major acquisition in Brazil and France. The company is financially healthy, with consistent revenue growth, low debt, and a dividend.

Enaex stock is a unique vehicle for investors seeking exposure to the commodity markets without taking specific commodity price risk or mine specific risk. In an inflationary environment with continued money printing by central banks and supply chain constraints, I expect Enaex stock to provide value to shareholders long term.

I found Enaex to be a fascinating and unique company, so I hope you enjoy this analysis! As always, if you have any questions, doubts, or criticisms, leave a comment at the end of the article!

If you would like to receive more free research about investments in Latin America, subscribe here:

You can also connect with me on LinkedIn or follow me on Twitter.

Common Stock: Enaex S.A.

Current Market Price: $11.70 USD ($9,432 CLP)

Market Capitalization: $1.4 Billion USD ($1.16 Trillion CLP)

*All values in this article are expressed in US Dollars (USD) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent annual, audited financial report, which can be found by following this link.

*A complete Disclaimer about LATAM Stocks Investment Overviews can be found by following this link.

Summary of the Company

Enaex is a Chilean manufacturer, supplier, and service provider of rock fragmentation products and services, for the mining industry. They are the largest supplier of these products and services in Chile and Latin America.

Directly and indirectly, approximately 44% of their sales are tied to copper production, 14% to coal, 11% to gold, 10% to iron, and 7% to platinum. The remainder of the company's sales are linked to the production of other minerals by small and medium-scale mining operations, civil works and chemical sales.

Their main product is ammonium nitrate, which they manufacturer and sell. They are the 3rd largest ammonium nitrate manufacturer in the world with 22 production plants globally. The company’s Prillex facility in Chile is the largest single ammonium nitrate production facility in the world. Prillex produced 745,000 tons of ammonium nitrate in 2021.

The company manufactures and sells other blasting accessories, such as:

Ignition systems (detonators) – electric and non-electric

Cords

Cartridges

Packages emulsions

Dynamite

Boosters

Plugs

Expansion cement

In addition to their manufacturing business, Enaex also provides fragmentation and blasting related services to their mining clients, serving both open pit and underground mines. The company is Chiles leading provider of these services. Some of the services provided are as follows:

Shot blasting

Loading blasting agents

Shallow mooring

Plugging blast holes

Checking blasting holes

Magazine management.

Enaex offers the entire value chain for comprehensive rock fragmentation services.

To provide these services, Enaex has specialized trucks and mobile manufacturing units. The company has a total of 893 transportation units, including 20 cranes, 131 ammonia and emulsion transportation trucks, as well as 385 specialized trucks for open pit mines and 55 for underground mines.

The company has operations in Chile, Argentina, Brazil, Australia, Canada, Colombia, The United States, South Africa, Thailand, France, Mexico, Peru, Lesotho, Namibia, and Bolivia.

Chile is by far the company’s most important market, accounting for 36% of revenue in 2021. The company’s strategy of international expansion to diversify its reliance on the Chilean market is clearly working, as Chile accounted for 51% of revenue in 2020.

Brazil, Australia, and South Africa are the company’s most important international markets.

Outside of its core business, Enaex has made significant investments into the development of new technologies, particularly robotics. In 2017, the company developed two new technologies—the RoboMiner® and Mine-iTruck® teleoperated robotics solutions—in conjunction with the Stanford Research Institute (SRI), ASI Robots, Terainox, Thecne and SK Godelius. After conducting the first teleoperated loading in 2018, the following year the company performed the world’s first 100% on-site teleoperated blasting tests. Developing and implementing new technologies continues to be a key focus for the company.

Enaex was founded in 1920 and is headquartered in Santiago, Chile. The company currently employs over 5,400 people globally.

Acquisitions and Divestitures

In 2015 the company acquired Britanite, Brazil’s largest manufacturer and seller of explosives.

In Peru, Enaex acquired an 85% interest in Chemtrade, and a 100% interest in Industrias Cachimayo, Peru’s only producer of Ammonium Nitrate, thus consolidating their position as the region’s largest producer.

In June 2015, Enaex began expanding beyond Latin America. It currently owns 100% of Davey Bickford, a world leader in manufacturing electronic detonators and initiation systems. The France-based company has subsidiaries in Australia, Canada and the United States.

In 2021 it fortified its position in the Australian market through the acquisition of Downer Blasting Services.

Financial Analysis

Revenue and Cost Analysis

Enaex has consistently grown its revenue year over year since 2017. In 2021 the company had revenues of $1.28 billion, up from $824.9 million in 2020 and $766.5 million in 2019.

Their gross profit was $299.3 million in 2021, representing a gross margin of 23%, significantly lower than their 30% margin in 2020. This deterioration can be attributed mostly to a ~30% increase in the price of ammonia, which has been affected by short-term supply problems worldwide.

EBITDA was $211.5 million in 2021, up from $ 178.6 million in 2020.

Enaex has been consistently profitable for the past several years. In 2021 they had net income of $97.6 million, representing a profit margin of 9.6%, a decrease compared to 9.9% in 2020 and 10.7% in 2019.

Balance Sheet Analysis

Enaex has a solid balance sheet. They have a strong base of long term assets and a sound liquidity position in the near term, with a current ratio well above 1. The company uses a moderate amount of leverage, with a debt to equity ratio just above 1.

Debt Analysis

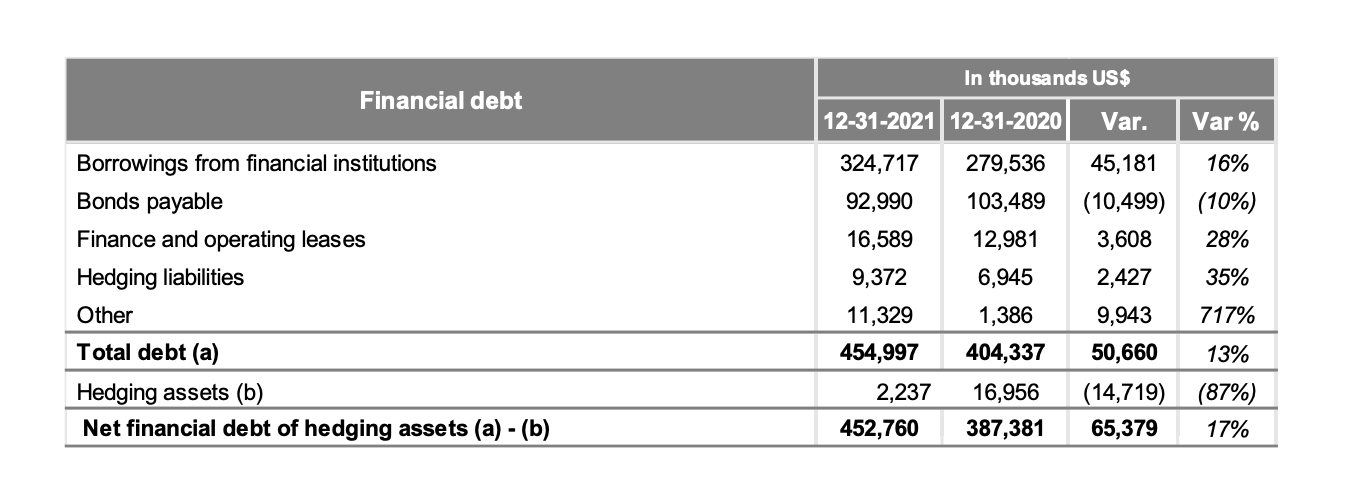

As of year-end 2021 the company had $455 million in total debt outstanding. Total debt increased from $404.3 million at year-end 2020.

The company’s credit profile is sound. In August 2022 Fitch Ratings maintained Enaex’s AA credit rating, a high investment grade rating.

Share Dynamics and Capital Structure

As of year-end 2021 the company has 123 million common shares outstanding and no preferred shares. The company’s 3 largest shareholders own a combined ~85% of the company.

The company’s majority shareholder, Sigdo Koppers S.A. owns 60.7% of the company. Sigdo Koppers is a Chilean conglomerate with operations in a wide range of industries, they have been the company’s controlling shareholder since 1993.

Dividends

The company paid total dividends of $0.50 cents per share in 2021. At the current price this implies a dividend yield of 4.3%.

Valuation Metrics

Book value per share - $5.73

Price to Book – 2x

Price to Sales – 1.1x

Price to EBITDA – 6.8x

Price to Net Income - 14x

Technical Analysis Notes

Enaex’s stock price is currently in an uptrend, trading above its 50 week moving average, and close its all-time high in CLP terms.

The company’s shares are tightly held, so the stock has a low float, and trading volumes are low. This might not be the best vehicle for short term traders. But a breakout to a new all-time high may provide some signal as to the direction of the global mining industry, so the chart is worth paying attention to.

Summary and Conclusions

Positives

Clean balance sheet with reasonable leverage and sufficient liquidity.

Consistent year over year revenue growth despite the cyclicality of the industry the company serves.

Large fleet of specialized trucks and mobile manufacturing units, very hard to replicate.

Effectively implemented an M&A growth and expansion strategy in the past, which gives confidence that management could execute on additional acquisitions if opportunities arise.

Forward thinking company that makes relevant investments into new technology that could benefit its business long term.

Unique investment vehicle for investors seeking exposure to the mining and commodity industries.

Negatives

Long term success will be dependent on the growth of the global mining industry. The industry faces significant headwinds such as increased regulation and the potential for sustained lower commodity prices.

Although the company has diversified geographically, they are still highly dependent on the Chilean mining industry.

High risk markets such as South Africa and Peru are relevant to the company’s performance and could negatively impact results.

Conclusion

Enaex stock is an interesting and unique way for investors to gain exposure to the mining and commodity industries, without having to take specific mine or commodity risk. The company is sound financially and continues to grow revenues profitability. Management returns capital to shareholders via a dividend.

Given how tightly held the company’s shares are, I’m not sure if it will be an effective trading vehicle for short term traders looking for commodity price exposure. However, longer term I believe it will provide exposure to global commodities prices, with a unique risk profile. Regardless of wether you view the company as investable or not, they have strong disclosures, so a wide range of investors can benefit by studying and monitoring Enaex’s business.

If you liked this analysis and would like to receive all of our future LATAM investments newsletters, you can subscribe for free here:

You can also connect with me on LinkedIn or follow me on Twitter.

**A complete Disclaimer about LATAM Stocks Investment Overviews can be found by following this link.

Interesting company. Only concern is the attitude-mentality of the controlling shareholder. In Asia (and I think Brazil as well), there is a tendency for them to r*pe minority investors and siphon off all the money (e.g. the book "Asian Godfathers: Money and Power in Hong Kong and Southeast Asia")