First Majestic Silver - LATAM Stocks Investment Analysis #19

First Majestic is a precious metals mining company with 3 producing mines in Mexico and a portfolio of mining assets in Mexico and Nevada.

Dear LATAM Stocks Readers,

This edition will cover a silver mining company focused on Mexico, First Majestic Silver. 51% of First Majestic’s total production is silver, making it one of the biggest and purest silver stocks in the world. The company was the 17th largest silver producer globally in 2022.

Mexico is the world’s leading silver mining jurisdiction, with significantly more annual production than second place China. All 3 of First Majestic’s producing mines are located in Mexico. The company also owns several other mines in Mexico that are not currently operating, as well as exploration stage projects.

I personally have no strong opinion on the price of silver, but I know there are many silver bulls out there. Given that Mexico is the world’s most important silver jurisdiction, I wanted to highlight an investable silver focused company operating in Mexico.

First Majestic fits that bill.

That being said, I have serious concerns about First Majestic. The most important of which is their Jerritt Canyon acquisition. The Jerritt Canyon mine is a gold mine in Nevada. First Majestic acquired the mine in March of 2021 and two years later, in March of 2023, suspended operations.

This acquisition was an expensive failure. The mine was responsible for many of the financial issues present in First Majestic’s 2021 and 2022 financial statements.

Consistent dilution has been another issue for First Majestic shareholders.

However, now that the Jerritt Canyon project is in the rear view mirror, I believe First Majestic is back on the right track. Its producing mines in Mexico are solid, low cost assets. Their balance sheet is clean and unlevered. The company’s financial health should improve significantly in the second half of 2023 and 2024.

Despite its many warts, I believe First Majestic stock is worth considering for silver bulls. The stock provides significant leverage to the underlying silver price. The company also serves as a useful way to study one of the worlds most important silver mining jurisdiction.

I hope you like this analysis!

Let me know what you think of First Majestic in the comments below!

If you haven’t already subscribed, be sure to subscribe to LATAM Stocks to receive all of our future write ups for free!

Common Stock: First Majestic (NYSE: AG - TSX: FR)

Current Market Price: $6.15

Market Capitalization: $1.7 Billion

*All values in this article are expressed in US Dollars (USD) unless otherwise noted.

**A complete Disclaimer about LATAM Stocks Investment Overviews can be found by following this link.

*** I own a small position in First Majestic stock, less than 1% of my portfolio. I will benefit from price appreciation in the stock.

Summary of the Company

First Majestic is a silver and gold mining company focused on the acquisition, exploration, development, and operation of precious metals properties. The company is 100% focused on properties in North America. They own 3 mines in Mexico that are currently producing and 5 that are currently in care and maintenance. 4 of their non-producing mines are in Mexico and the other is the Jerritt Canyon mine in Nevada, which suspended operations in March 2023.

In addition to their mining properties, they have several exploration and development stage projects in Mexico and Nevada.

First Majestic was founded in 2003 and is headquartered in Vancouver Canada.

Overview of First Majestic’s 3 Producing Mines:

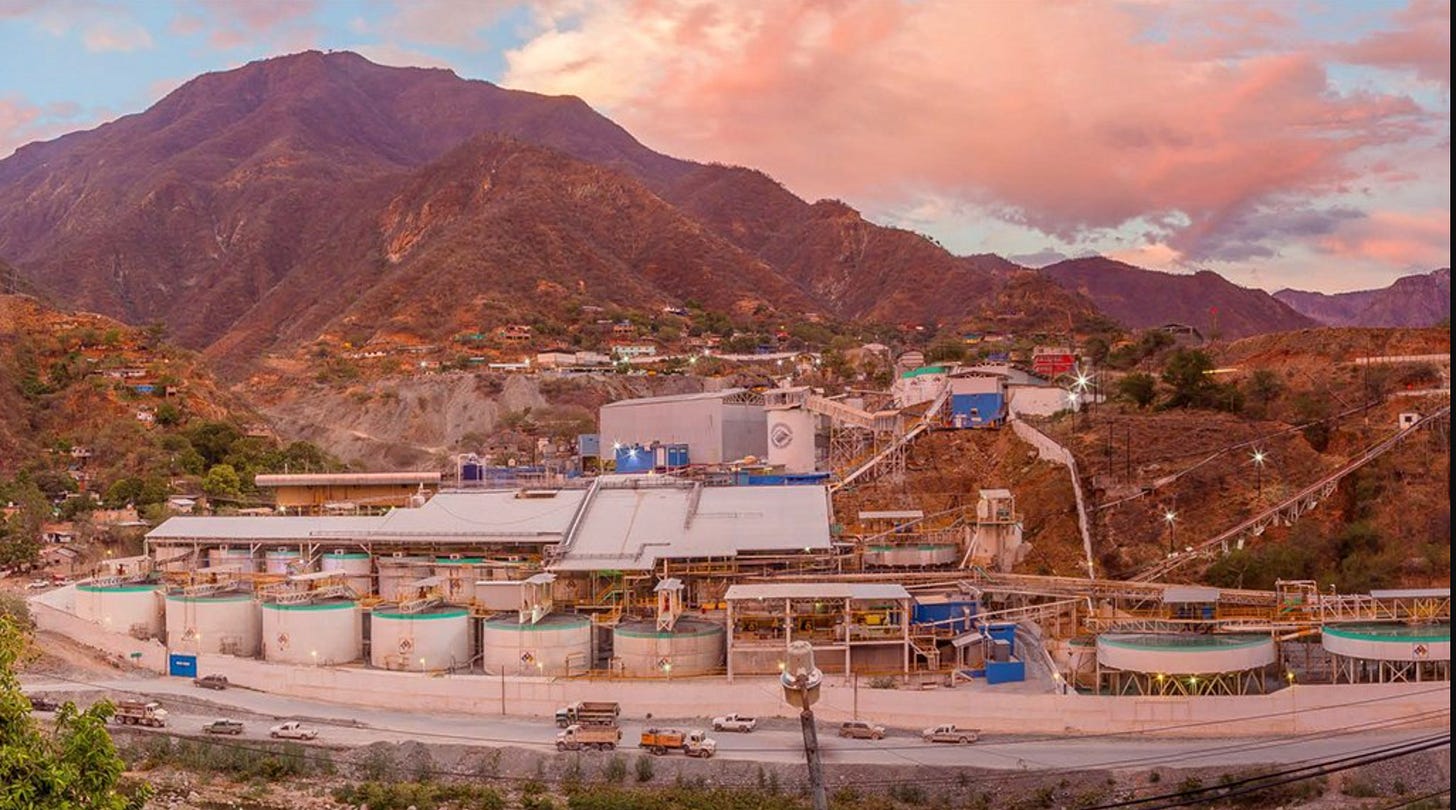

San Dimas: Located approximately 130 kilometers northwest of Durango Mexico, the property consists of 71,868 hectares of mining claims. San Dimas is one of the country’s most prominent silver and gold mines and the largest producing underground mine in the state of Durango, with over 250 years of operating history.

Santa Elena: Located approximately 150 kilometers northeast of the city of Hermosillo in Sonora Mexico. The operating plan for Santa Elena involves the processing of ore in a 3,000 tons per day cyanidation circuit from a combination of underground reserves. First Majestic owns 100% of the Santa Elena mine which include mining concessions totaling over 102,244 hectares.

La Encantada: This is an underground mine located in the northern México State of Coahuila, 708 kilometers northeast of Torreon. La Encantada has 4,076 hectares of mineral concessions. La Encantada also has a 4,000 ton per day cyanidation plant, a camp with 120 houses as well as administrative offices, laboratory, general store, hospital, airstrip as well as other infrastructure.

The mine is accessible via a two-hour flight from Durango International Airport to the mine’s private airstrip, or via road from the closest city, Muzquiz, which is 225 kilometers away. First Majestic owns 100% of the La Encantada mine.

The Mining Industry in Mexico

Mining is an important industry for Mexico. According to the US Department of Commerce:

“About half of Mexico’s mining production consists of the extraction of precious metals, with the remaining output composed of forty percent Non-Ferrous, five percent Metallurgy, and five percent ores. In 2021, production in mining reached USD 16.68 billion. Mexico is a large exporter of mining products; with a trade balance surplus of USD 14.87 billion in 2021.”

According to the Fraser Institute’s annual mining survey, Mexico ranked 37th in the world in terms of mining investment attractiveness, which is one of the lowest scores in the Latin America region.

Mexico’s ranking in this survey has dropped from 29th in the world in 2018. This can be attributed to the current Mexican administrations anti-mining positions. For example, the current government has nationalized the country’s lithium deposits, banned open pit mining, and made it significantly more difficult to receive new mining permits.

Silver Mining in Mexico

Mexico is the largest silver producer in the world. In 2022 they produced 6,300 metric tons of silver. They are the clear cut leader with significantly more production than the second largest producer, China, who produced 3,600 metric tons in 2022.

The Financials

Revenue and Cost Analysis

In 2022 First Majestic produced 31.3 million silver equivalent ounces, this includes 248,385 ounces of gold. Total revenue was $624.2 million, up from $584.1 in 2021.

Gross profit was only $16.7 million in 2022, representing a gross margin of 2.7%, which is a significant decrease from a 17% gross margin in 2021. This deterioration is due mostly to cost overruns and inefficiencies at the now suspended Jerritt Canyon mine.

EBIT was -$39 million in 2022 compared to $49 million in 2021.

Net income was -$114 million in 2022 compared to -$5 million in 2021.

**21% of total production in 2022 came from the Jerritt Canyon mine in Nevada. In March 2023 operations were suspended at the mine. 2023 production and revenue should decrease significantly compared to 2022, but margins should improve.

Royalty and Streaming Agreements

The company has several important royalty and streaming agreements associated with its key mines:

The Santa Elena mine is subject to a gold streaming agreement with Sandstorm Gold (Ticker: SAND). This agreement requires First Majestic to sell 20% of the mines gold production, for the life of the mine, for the lesser of $450 or the prevailing market price.

The Santa Elena mine has two separate “Net Smelter Royalties.” One with Orogen Royalties and the other with Osisko Gold Royalties. Each NSR is for 2% of production, for a total of 4%.

The San Dimas mine has a purchase agreement with Wheaton Precious Metals (Ticker: WPM). This entitles Wheaton to 25% of the gold equivalent production at the mine, which they purchase for the lesser of $600 or the prevailing market price.

Mineral Resources

First Majestic’s three main mines have proven and probable mineral reserves totaling 781,000 ounces of gold and 136.7 million ounces of silver.

The company plans to spend $29 million on exploration drilling in 2023 across all its properties.

Balance Sheet Analysis

First Majestic has a sound balance sheet.

Their liquidity position is healthy, with a current ratio of 2.2.

They are not leveraged, with a debt to equity ratio of 0.5.

Debt Analysis

As of year-end 2022 the company has $210.4 million in total debt outstanding. Almost all of this debt is long term, due in 2027.

In December 2021 First Majestic issued $230 million in unsecured convertible debt bearing an interest rate of 0.375% per year and maturing in January 2027.

The notes are convertible into common shares at any time prior to maturity, at a conversion rate of 60.3 common shares per $1,000 of principal, representing an initial conversion price of $16.56 per common share.

Share Dynamics and Capital Structure

As of July 2023 First Majestic has 287 million common shares outstanding and no preferred shares.

Fully diluted shares outstanding is 301 million.

First Majestic has a history of dilution. In September of 2020 total shares outstanding was 221 million. In less than 3 years total share count has increased by ~30%.

Retail shareholders own 57% of the company. Management and insiders own 2%. The remaining 41% is owned by institutional investors, the most important of which are two gold mining ETF’s which own over 10% of the company.

Dividends

First Majestic pays a quarterly dividend based on revenues. They aim to payout 1% of total revenues as dividends.

The dividend for Q1 2023 was $0.0057 cents per share. Annualized this would imply an annual dividend of $0.0228 cents per share.

At the current market price this implies a dividend yield of 0.4%.

Valuation Metrics

Price to Book – 2.6x

Price to Sales – 2.7x

Price to EBIT – N/A – negative EBIT in 2022

Price to Net Income – N/A- net loss in 2022

Technical Analysis Notes

First Majestic stock has been in a clear down trend since retesting it’s all-time high around $24 per share in January of 2021.

It is currently trading below its 50 and 200 week moving averages, with no signs of a bottom or reversal.

There is a long term support range around $5 that has held since 2018.

Until I see clear signs of a reversal/bottom, I will assume that the stock will remain in a downtrend.

Summary and Conclusions

Positives

Sound, unlevered, balance sheet with sufficient liquidity.

Debt is long term and bears a very low interest rate.

Jerritt Canyon has been shut down, so margins should improve moving forward.

One of the purest play silver mining stocks in the world.

Proven competence operating in Mexico, the world’s leading silver jurisdiction.

Negatives

Consistent dilution.

A lot of value destruction from the Jerritt Canyon acquisition.

Valuation is not cheap considering the company’s recent performance.

Mexico has become less mining friendly over the past 5 years.

Conclusion

Like any precious metals miner, as goes the silver and gold price, so goes their business. First Majestic is no exception.

What makes First Majestic interesting is that it is primarily a silver producer, and there aren’t many of those out there. First Majestic stock is one of the “purest play” publicly traded silver miners in the world.

First Majestic’s focus on Mexico is also interesting. Mexico is by far the most important silver mining jurisdiction in the world. If silver prices do move higher for longer, the company is a competent operator in the world’s leading silver jurisdiction.

I don’t want to gloss over the current state of the company, particularly its financials. The last 2 years have not been good. Jerritt Canyon was a failure. But now that it has been shut down, I believe there is a reasonable case that operating performance will improve moving forward. The company’s balance sheet is sound, so they have plenty of runway to continue righting the ship.

If you are bullish silver prices, First Majestic certainly merits a look. The company’s stock is highly levered to the metal’s price and the company is well positioned in a globally relevant silver market.

I hope you liked this analysis!

Let me know what you think of First Majestic in the comments below!

Also, be sure to subscribe to LATAM Stocks so you will receive all of our future write ups for free!

Disclaimer

**A complete Disclaimer about LATAM Stocks Investment Overviews can be found by following this link.

*** I own a small position in First Majestic stock, less than 1% of my portfolio. I will benefit from price appreciation in the stock.