Florida Ice and Farm Company - LATAM Stocks Investment Analysis #20

Florida Ice and Farm Company is a Costa Rican food and beverage company. They distribuite many leading domestic and international brands throughout Central America.

Dear LATAM Stocks Readers,

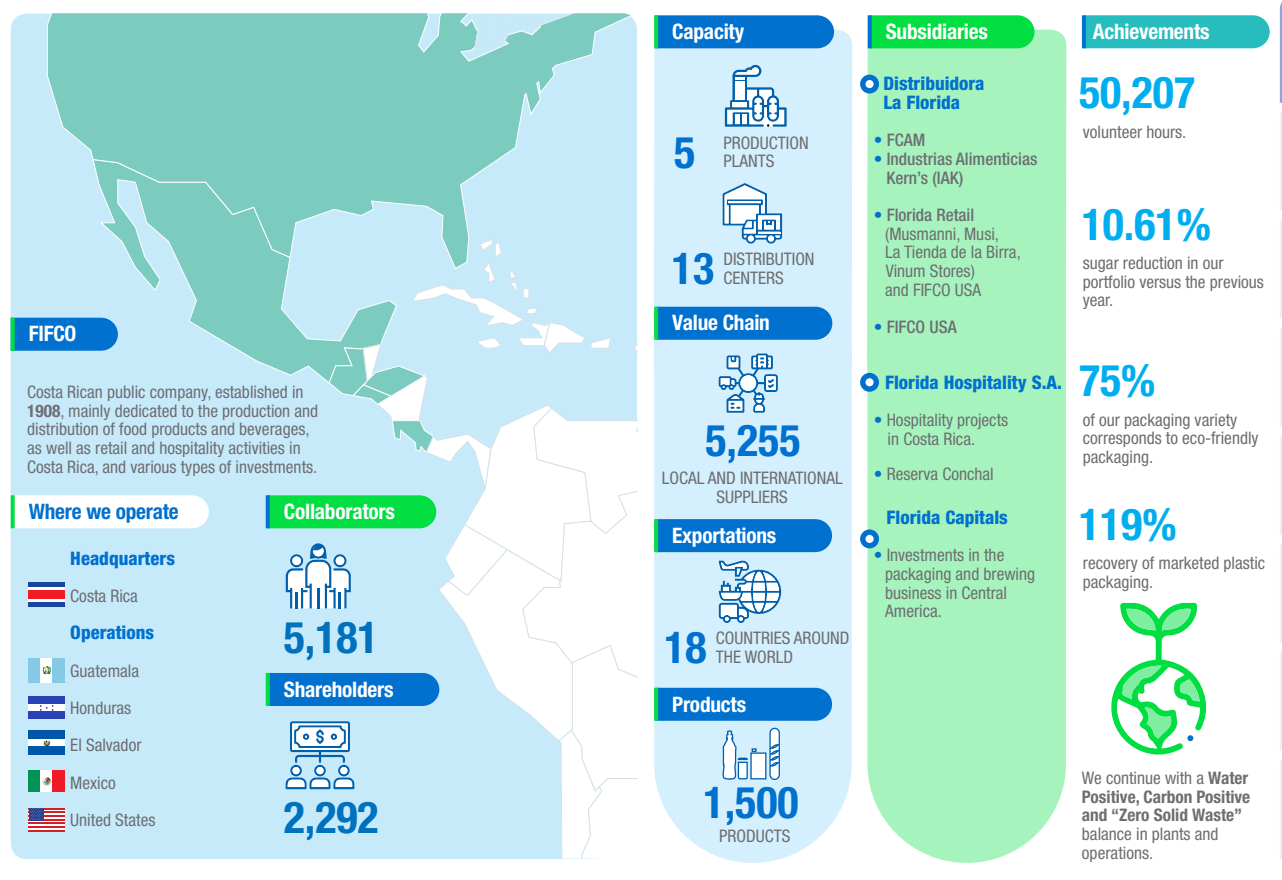

This edition of the newsletter will cover Florida Ice and Farm Company (“FIFCO”). FIFCO is a Costa Rican food and beverage company that also has a tourism and hospitality operation, as well as an investment arm. The company was founded in 1908, making it one of the oldest companies in Costa Rica.

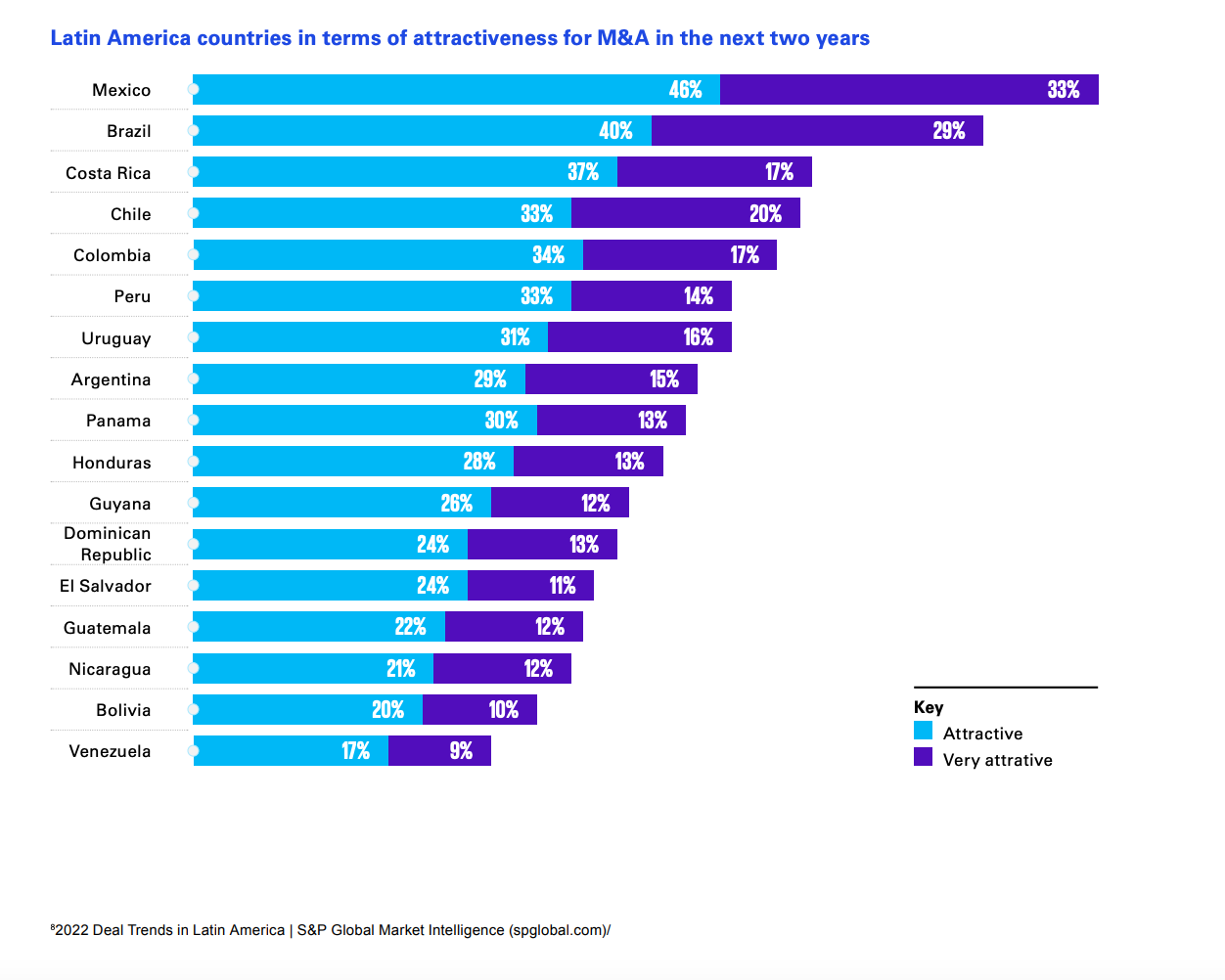

I recently read a survey by KPMG where the respondents ranked Costa Rica as the 3rd most attractive destination for M&A in all of Latin America. This peaked my interest, so I decided to revisit some Costa Rican stocks and cover one here.

There aren’t many stocks listed in Costa Rica. But FIFCO is a solid company that is on par with top quality food and beverage companies globally. They are financially healthy, have a strong product portfolio, and there is plenty of growth potential in the regions where they operate.

FIFCO is a great stock to follow to learn about, and stay up to date on, business in Central America.

I hope you enjoy this analysis! As always, questions, doubts, and criticisms are welcome in the comments section!

Subscribe to The LATAM Stocks Newsletter to receive all our investment write ups for free!

Common Stock: Florida Ice and Farm Company

Industry: Food & Beverage

Current Market Price: 649 CRC: $1.22 USD

Market Capitalization: 581 Billion CRC: $1.1 Billion USD

*All values in this article are expressed in Costa Rican Colones (CRC) unless otherwise noted. The USD/CRC exchange rate at the rime of writing was 534-1.

**A complete Disclaimer about LATAM Stocks Investment Overviews can be found by following this link.

Summary of the Company

Florida Ice and Farm Company (“FIFCO”) is a Costa Rican company whose main business is the production and distribution of food and beverage products. Their product portfolio has over 1,500 products which they export to 18 countries. In addition to Costa Rica, they also have operations in Guatemala, El Salvador, Honduras, The United States and Mexico.

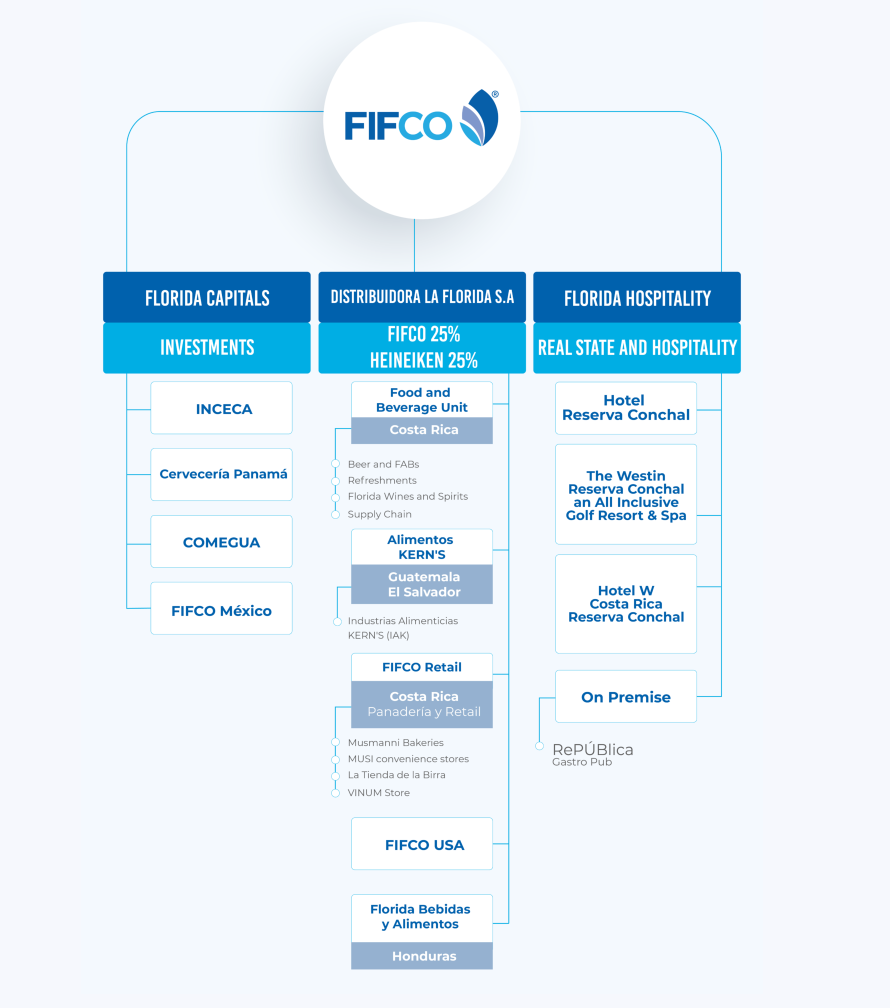

FIFCO has 3 Business Lines:

Food and Beverage – This is FIFCO’s core business. This unit includes food, beverage, and alcohol distribution. It also includes retail operations such as convenience stores and bakeries.

Real Estate and Hospitality – This business manages the company’s hotel operations as well as the associated real estate.

Investments – This business unit is responsible for making investments in related businesses such as packaging production and brewing operations.

Product Portfolio

Anyone that has traveled to Costa Rica has seen the Imperial beer brand. It is the country’s most popular beer and one of the crown jewels in FIFCO’s product portfolio. But the company’s portfolio also includes many international brands. For example they distribute Smirnoff vodka and Johnny Walker scotch. The also distribute Pepsi, acquiring the rights in 2007 from SAB Miller.

The Costa Rican Economy

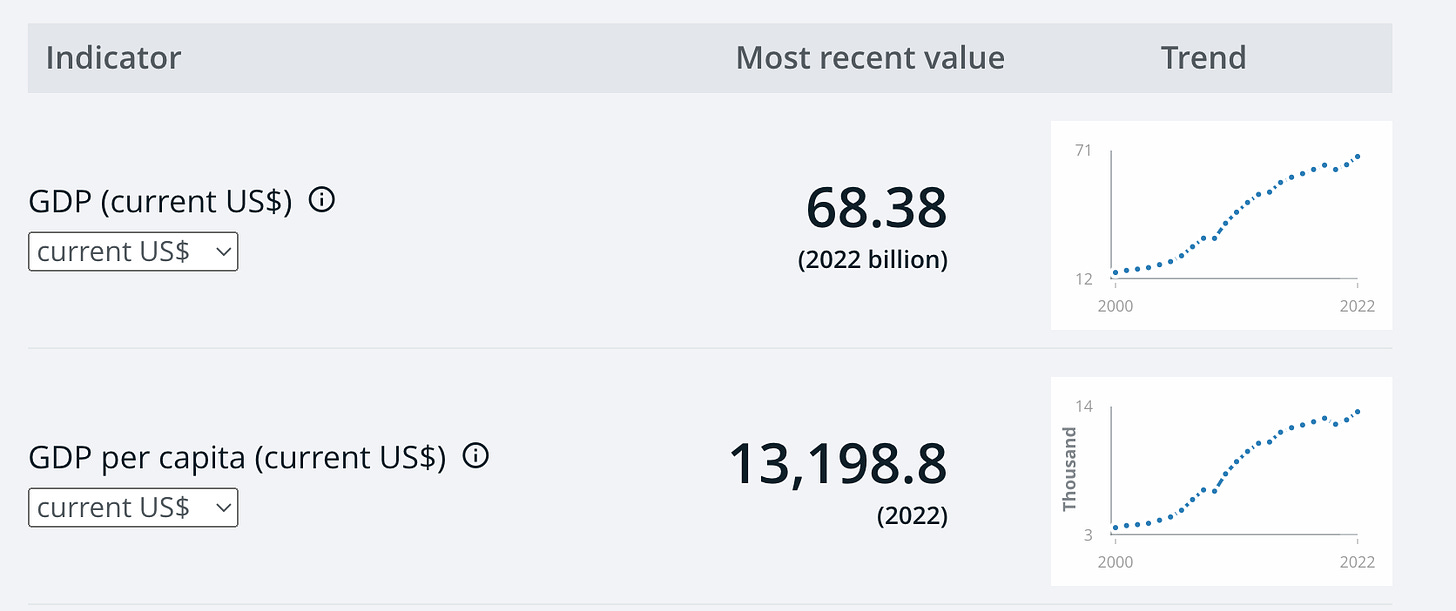

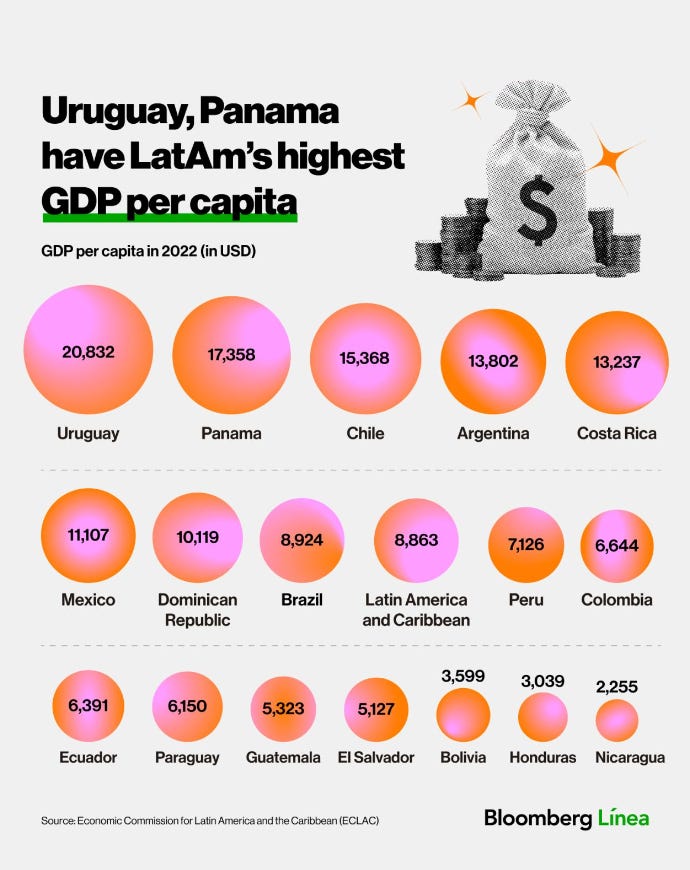

Costa Rica’s GDP in 2022 was 68.3 billion USD, giving it a GDP per capita of around $13,200 USD. This implies that Costa Rica has the 5th highest GDP per capita in Latin America.

The country has seen significant economic growth and development over the past several decades, and is well positioned to continue this growth. A recent survey by KPMG about M&A in Latin America ranked Costa Rica as the 3rd most attractive destination for M&A in all of Latin America.

So why is Costa Rica so appealing for foreign investors? Here is how the U.S. Department of Commerce describes Costa Rica:

“Costa Rica is the oldest continuous democracy in Latin America and the newest member of the Organization for Economic Cooperation and Development (OECD), with an established government institutional framework, stable society, and a diversified upper-middle-income economy. The country’s well-educated labor force, relatively low levels of corruption, geographic location, living conditions, dynamic investment promotion board, and attractive free trade zone incentives all appeal to investors. Foreign direct investment inflow in 2021 was USD 3.19 billion, or 4.9 percent of GDP, with the United States accounting for USD 2.55 billion.

Costa Rica has had remarkable success in the last two decades in establishing and promoting an ecosystem of export-oriented technology companies, suppliers of input goods and services, associated public institutions and universities, and a trained and experienced workforce. A similar transformation took place in the tourism sector, with a plethora of smaller enterprises handling a steadily increasing flow of tourists eager to visit despite Costa Rica’s relatively high prices. Costa Rica is doubly fortunate in that these two sectors positively reinforce each other as they both require and encourage English language fluency, openness to the global community, and Costa Rican government efficiency and effectiveness.”

Costa Rican Demographics

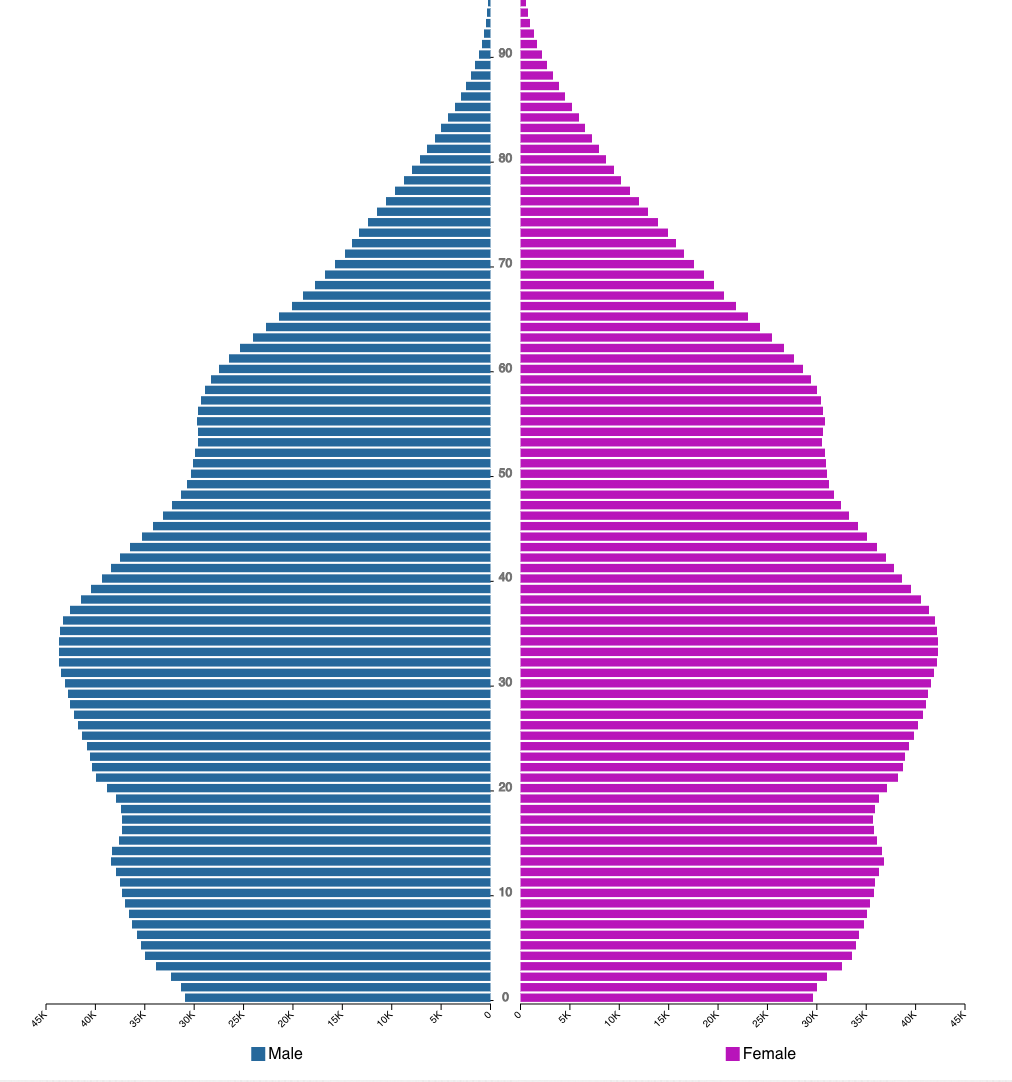

Costa Rica is a small and relatively young country. The total population of Costa Rica is 5.2 million people, with a median age of 33. The country’s population is expected to peak at 5.7 million around the year 2050.

Costa Rica has a fairly low population density, ranked 116th in the world. The capital city of San Juan, the country’s largest, has a metro area population of 1.4 million.

The Financials

Revenue and Cost Analysis

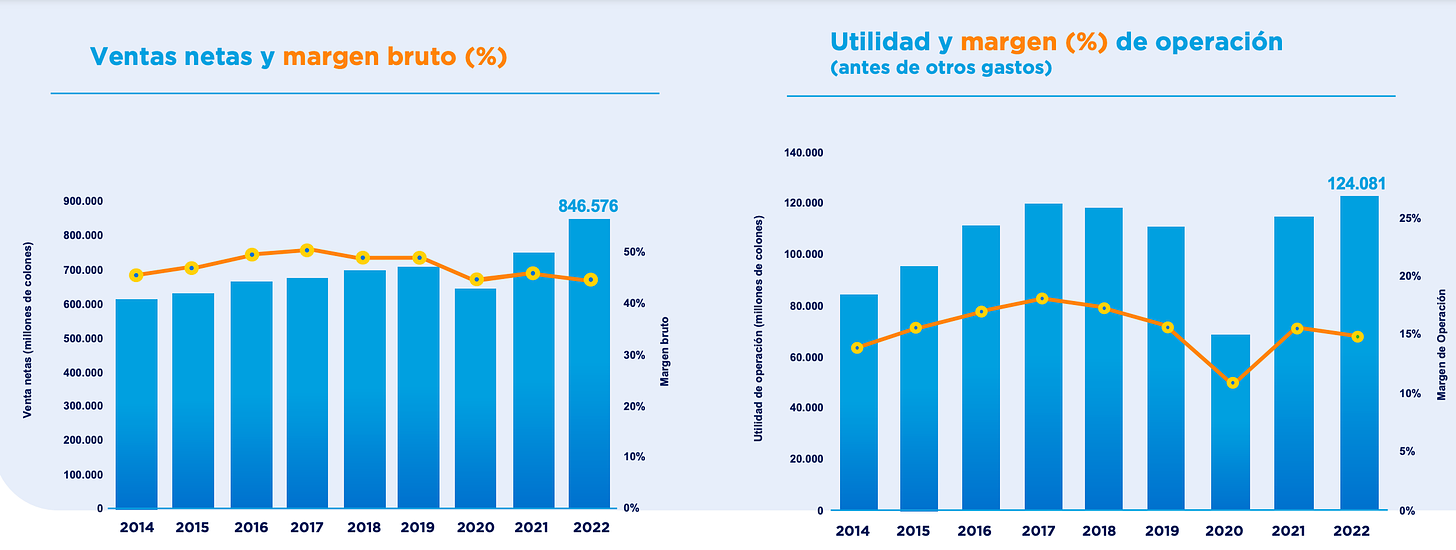

Revenue in 2022 was 847 billion CRC ($1.6 billion USD), a 13% increase from 752 billion CRC in 2021.

Gross profit margin was 44.5% in 2022, down slightly from 46% in 2021.

EBIT was 118 billion CRC ($220 million USD) in 2022.

Profitable, net income was 91 billion CRC in 2022, representing a profit margin of 10.8%, up from 9.5% in 2021.

Balance Sheet Analysis

The company’s liquidity is fine with a current ratio just over 1. However, their cash position is a little low and should be monitored.

FIFCO’s balance sheet is leveraged, with a debt to equity ratio of 1.25.

Debt Analysis

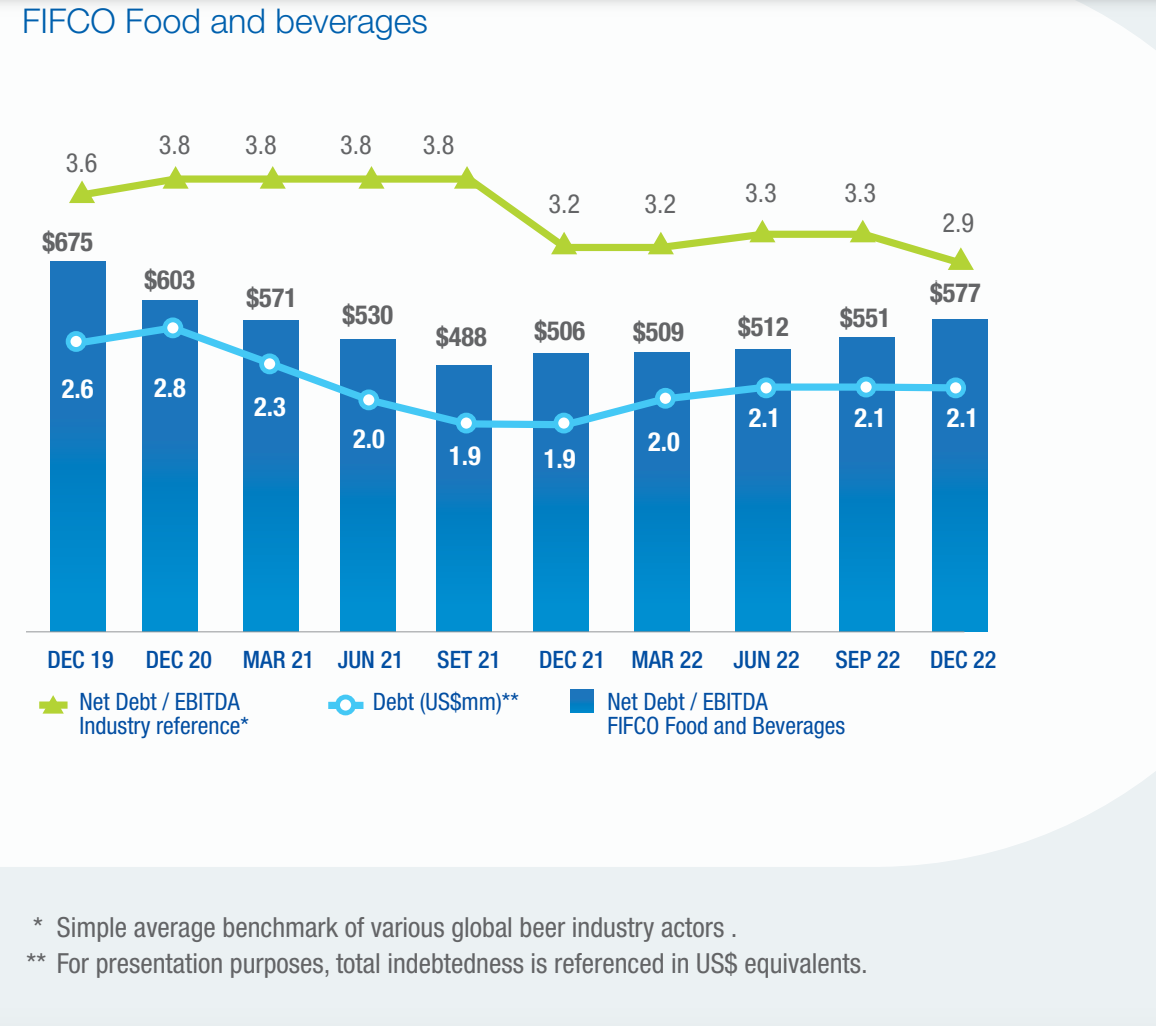

FIFCO has $577 million USD in total debt outstanding. Its leverage ratios are OK and have improved slightly over the past several years.

Valuation Metrics

Price to Book – 1.4x

Price to Sales – 0.69x

Price to EBIT – 4.9x

Price to Net Income – 6.4x

Share Dynamics and Capital Structure

FIFCO has 894.5 million common shares outstanding and no preferred shares.

Shares outstanding has decreased slightly since 2020, down from 920 million shares out.

No single shareholder owns more than 10% of the company.

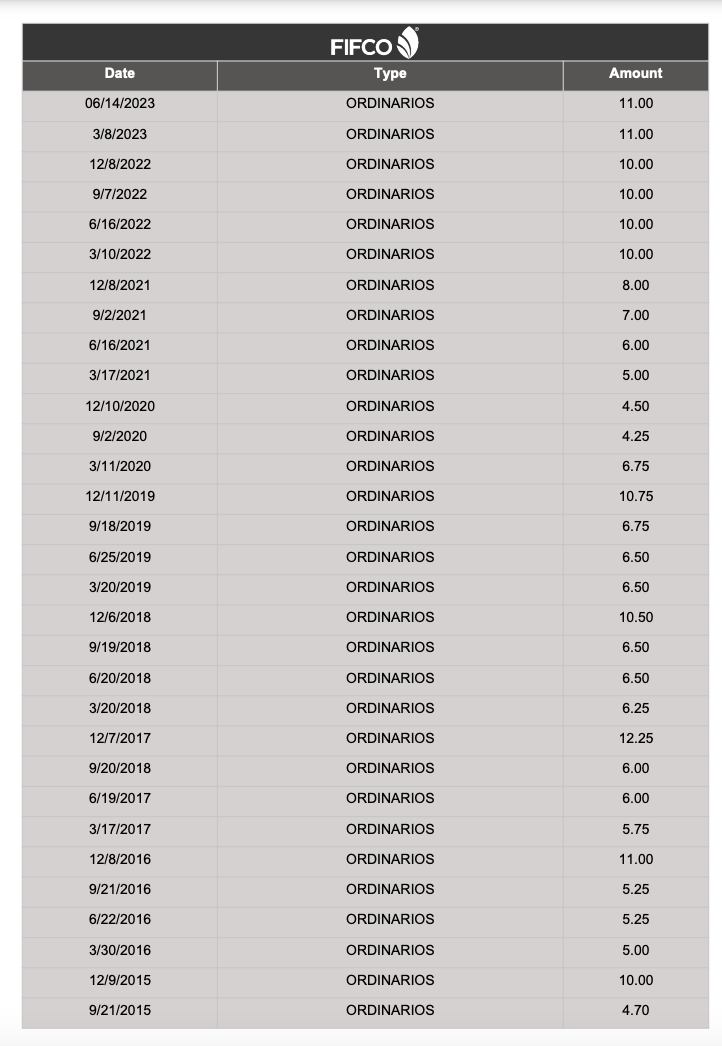

Dividends

The company has a long history of dividend payments. FIFCO has paid a dividend every year since 1990.

In 2022 total dividends were 40 CRC per shares. At the current market price this implies a dividend yield of 6.1%.

The image below shows FIFCO’s dividend history since 2015. I couldn’t fit the full history because it is a 5 page PDF!

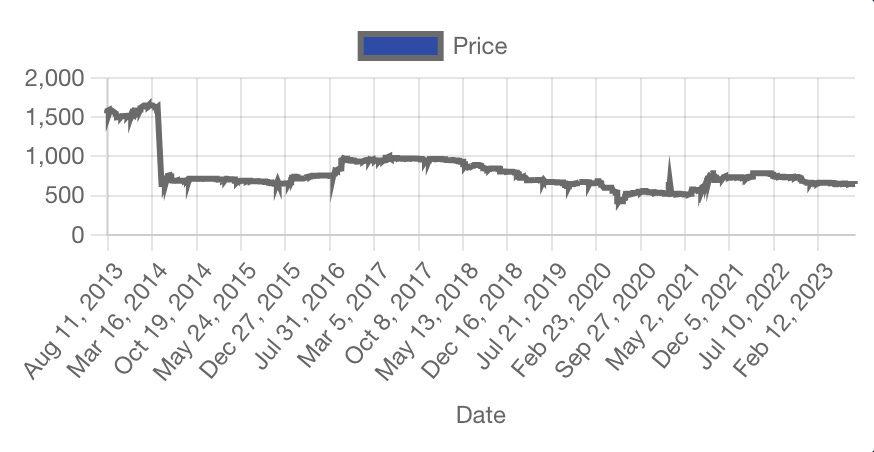

Technical Analysis Notes

FIFCO stock has been range bound for almost a decade. The drop from 1,650 CRC in 2014 is due to a stock split. The stock has traded between roughly 600 CRC to 950 CRC since. Current price is at the lower end of the range.

The stock has low trading volume and is likely not suitable for short term traders.

Summary and Conclusions

Positives

Favorable demographics over the next few decades. Not huge growth, but the Costa Rican population is growing slowly and steadily, which is good for FIFCO. Regional countries where FIFCO has operations, such as Honduras and El Salvador, also have favorable demographics.

Occupancy and rates at the company’s real estate/hospitality properties have normalized.

Central American beer business is growing faster than cost increases, with plenty of room for further growth moving forward.

Valuation is reasonable, if not cheap.

Healthy dividend with long history of payments.

Negatives

Stock only trades on the Costa Rica stock exchange, making it hard if not impossible to access for most investors. This is likely responsible for a part of the company’s valuation discount.

Central America is a poor region with a history of political upheaval. Any type of crisis in the countries where FIFCO operates could have a significant negative impact on the company.

Conclusion

FIFCO is a solid company. They are financially healthy and run a strong operation. Demographics in their markets are favorable, so it’s reasonable to assume they will continue to see slow and steady growth moving forward.

Many of the company’s brands are category leaders, which is a significant barrier to entry, especially in smaller, less competitive, Central American countries. I don’t think it’s likely anyone is going to make significant investments to compete with Imperial or Gatorade in Costa Rica.

FIFCO stock isn’t going to be a moon shot. But the company offers exposure to Central America, which is not common among public companies. In addition to the regional diversification benefit, investors are well compensated for holding the illiquid stock with a healthy and consistent dividend.

Regardless of your opinion of FIFCO as an investment, the company offers interesting insights into Costa Rica and Central America, an investment region almost entirely ignored by international investors. This alone makes FIFCO worth studying!

Subscribe to The LATAM Stocks Newsletter to receive all our investment write ups for free!

Disclaimer

**A complete Disclaimer about LATAM Stocks Investment Overviews can be found by following this link.