Gruma - LATAM Stocks Investment Analysis #13

Gruma is a Mexican company that is the largest producer of corn flour and tortillas in the world. Their core brands, Mission and Maseca, are globally recognized category leaders.

Dear LATAM Stocks Readers,

This edition will cover Gruma, a Mexican company that is the largest producer of corn flour and corn tortillas in the world. They have a truly global presence in over 110 countries. But their core markets are The United States and Mexico, where they dominate the corn flour and corn tortilla categories under three major brands; Mission, Maseca, and Guerrero.

Management expects the Mexican food category to continue to grow globally, so their strategy is simple, continue to focus on their core products.

Gruma is solid financially with sufficient liquidity and healthy margins. The company consistently pays a dividend and has a share buyback program. However the current valuation is not cheap. Investors have been willing to pay up for this well managed category leader.

Gruma has quality financial disclosures making it a great company to study, not just for prospective equity investors, but also for anyone interested in global food production, corn markets, Mexican food, or the gluten free food market.

I found Gruma to be an impressive business. Their core products are uniquely Mexican, but they have successfully established well recognized brands and sold these products globally, making the company an interesting case study on Latin American exports.

I hope you find Gruma as interesting as I did. If you liked this analysis please like and share to help grow the LATAM Stocks community.

Common Stock: Gruma (BMV:GRUMA – OTC: GPAGF)

Current Market Price: MXN 265.02 : USD $14.66

Market Capitalization: MXN 98.17 Billion : USD $5.3 Billion

*All values in this article are expressed in US Dollars (USD) unless otherwise noted.

*The bulk of this analysis is based on the company’s most recent annual, audited financial report, as well as their Q4 2022 financials, since the 2022 annual report has not been released yet. Their investor relations page can be found here.

*A complete Disclaimer about LATAM Stocks Investment Overviews can be found by following this link.

Summary of the Company

Gruma is the world’s largest producer of corn flour, tortillas and wraps. In addition to these core products they offer other food products such as flat breads, rice, beans, snacks, pasta, condiments, and palm hearts, among others.

The company has a truly global footprint, with a presence in 110 countries and 73 production plants throughout the Americas, Europe, and Asia.

Gruma was founded in 1949 and is headquartered in Monterrey, Mexico. The company employees over 23,000 people globally.

Operations by Region

United States

In the United States, Gruma is one of the leading corn flour and tortilla producers, serving industrial, retail, and food service customers. Its tortilla business operates 20 plants producing tortillas, tortilla chips, and other related products. Their main brands include Mission, Guerrero and Calidad. Their corn flour business operates six plants in The U.S. and their main brand is Maseca.

Mexico

GIMSA ("Grupo Industrial Maseca S.A.") is Mexico's leading corn flour manufacturer. It is principally engaged in the production, distribution, and sale of corn flour under the Maseca brand and has 18 plants throughout the country, serving mainly industrial, retail, and wholesale corn flour customers. GIMSA also owns one plant that makes corn grits.

Mission Mexico is a producer of corn flour tortillas, wheat flour tortillas, and tortilla chips that serves retail customers through two plants and distribution centers located principally in northern Mexico, although its products are sold throughout Mexico.

Europe

Gruma operates six plants in Europe; two in the United Kingdom, two in Spain, and two in Russia, producing tortillas, tortilla chips and several types of flatbreads such as pitta, naan, chapati, and piadinas. Its main brand in Europe is Mission. Gruma also has three corn milling plants in Europe located in Italy, Ukraine and Turkey.

Central America

With 10 plants located throughout Central America, Gruma serves industrial and retail customers in Guatemala, El Salvador, Honduras, Nicaragua, Costa Rica, and Ecuador. The company’s Central American operation manufactures corn flour and, to a lesser extent, tortillas and snacks.

Gruma’s Central American Operation also cultivates hearts of palm and processes rice. Its signature brands include Maseca corn flour, TortiRicas and Mission tortillas, and the snack brand Tosty.

Asia-Oceania

The Asia-Oceania division produces and distributes wheat flour tortilla, corn flour tortilla, snacks, and other types of flatbreads such as pitta, chapatti, naan and pizza bases. With 3 plants located in China, Malaysia, and Australia, the company’s main brand in Asia is Mission.

Core Brands

Maseca

Maseca is Gruma’s original brand created by its founder in 1949. Maseca stands for “Masa Seca” which means dry dough in Spanish. The Maseca brand has grown to become the leading global corn flour brand, present throughout the world. The Maseca brand also sells corn grits in certain markets.

Mission

Mission is Gruma’s leading brand for value-added products. It is the largest tortilla brand in the world and an important producer of flatbreads such as wraps, naan and pita, among others, as well as tortilla chips and Tex-Mex products, such as dinner kits and taco shells.

Gruma acquired Mission in 1997 and has since grown its presence to over 50 countries.

Guerrero

Guerrero is a tortilla and tostada brand focused entirely on the US market. Gruma purchased Guerrero in 1989 due to its popularity with Mexicans in Los Angeles. Guerrero has since grown into one of the leading Hispanic food brands in The United States.

La Cima

La Cima is Gruma’s palm heart brand. La Cima was founded in 1978 in Costa Rica and has since grown into one of the largest palm heart companies in the world. La Cima products are sold globally in countries such as France, Spain, Belgium, Germany, the United States, Italy, Japan, Canada, Mexico, Morocco, Chile, Lebanon, among others.

Strategy

Management plans to focus on the company’s core business, corn flour and tortillas. With the growing popularity of Mexican food globally, they believe there is still plenty of growth potential for their core products. This strategy implies maintaining their category leadership position in The U.S. and Mexico, and continued brand building work in Europe and Asia.

In addition they plan to expand their product portfolio towards the flatbread category in general.

The Financials

Revenue and Cost Analysis

Gruma had total revenue of $5.6 billion in 2022, an increase from $4.6 billion in 2021.

Gross profits were just under $2 billion in 2022, representing a gross margin of 35.4%, roughly equal to the company’s gross margin of 36% in 2021.

EBIT was $610.1 million in 2022, up from $553.7 million in 2021.

EBITDA was $808.8 million in 2022, an increase from $735.5 million in 2021.

The company has been consistently profitable. In 2022 Gruma had net income of $319.2 million, representing a profit margin of 5.7%, slightly lower than their 6.5% margin in 2021.

Balance Sheet Analysis

The company’s liquidity position is OK, their current ratio is around 1.9 as of year-end 2022. Inventories and accounts receivable look normal.

For the full year 2022 Gruma had $298 million USD in total CAPEX. This CAPEX was invested in new plant construction, general maintenance, and production increases in some of the companies China facilities.

Gruma is leveraged, with a debt to equity ratio of 2.1.

Debt Analysis

Gruma has 1.8 Billion USD in total debt outstanding as of year-end 2022. $196 million of this debt is current and due in 2023.

Roughly 68% of the company’s debt is denominated in US Dollars.

Valuation Metrics

Price to Book – 4x

Price to Sales – 0.95

Price to EBIT – 8.75x

Price to EBITDA – 6.6x

Price to Net Income – 16.7x

Share Dynamics and Capital Structure

The company has 370,308,994 common shares outstanding as of year-end 2022. A primary group of shareholders owns and controls 51% of the company, with the remaining 49% floating.

Gruma implemented a share buyback program in 2018 and has repurchased 15.5% of the company’s outstanding shares since beginning the program.

Dividends

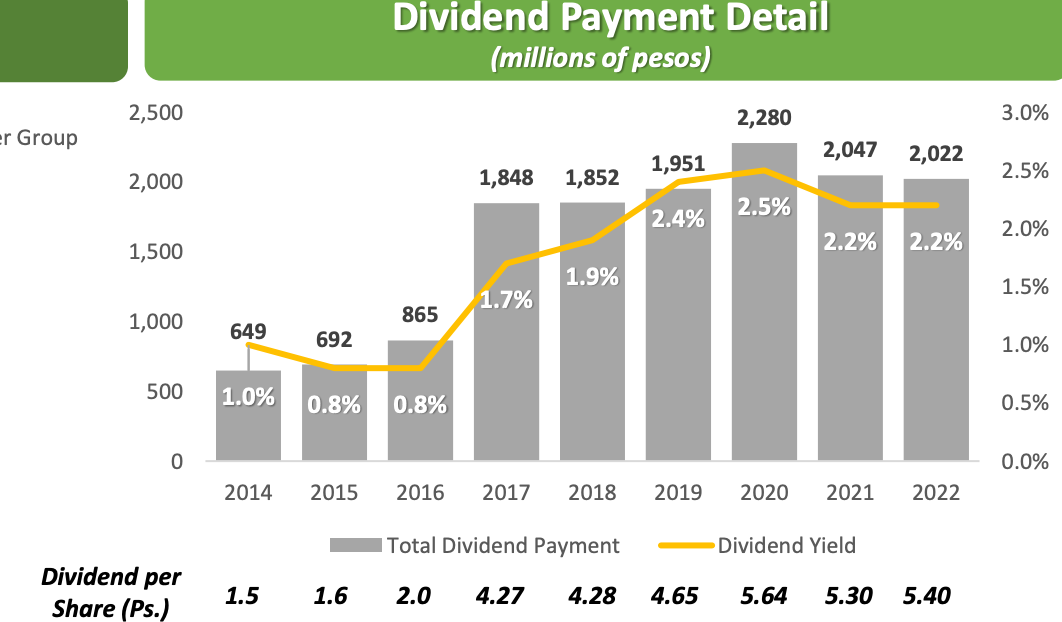

Gruma has consistently paid a dividend every year since 2014. The company increased this dividend year over year in ever year except one.

In 2022 Gruma paid total dividends of 5.40 Pesos per share. At the current price this implies a yield of around 2%.

Technical Analysis Notes

Gruma’s stock had a steep uptrend from 2011 to 2016, increasing from ~20 Pesos per share, to its all time high of ~300 Pesos per share.

Since 2016 the share price has been range bound between 300 Pesos and 175 Pesos.

Price is currently at the higher end of this range, trading above its 50 and 200 daily and weekly moving averages. Volumes have remained stable throughout this range.

There is nothing on the chart that indicates an imminent breakout of the stocks well established ~7 year range.

Bonus Content

Before I give my final summary and conclusion I wanted to share an interesting story about Gruma’s Venezuelan operations. The story isn’t relevant to investors today and will have no impact on the company’s performance, but it’s a relevant story for investors in Latin America.

In 2010 the Venezuelan government tried to expropriate all of Gruma’s assets in the country. The complex legal battles have been playing out for almost 13 years!

This Twitter thread details the expropriation process based on Grumas’ disclosures.

Summary and Conclusions

Positives

Gruma is a truly global company dominating a unique and growing food niche.

Solid margins, profitable, returns capital to shareholders via dividend/buybacks.

Strong brands.

Quality financial disclosures.

Negatives

Leveraged and increasing its absolute debt burden.

Valuation is not cheap. At nearly 17 time earnings and 4 times book value, the company is certainly not undervalued.

Increasing input costs (inflation) could strain the company’s margins and/or growth moving forward, if they are not able to pass through these costs to consumers via higher prices.

Conclusions

Gruma is an impressive company. They have been steadily expanding their core products across the globe for decades. The company appears to be well managed and dividends/buybacks indicate that it is shareholder friendly.

The company’s financials are healthy and it seems likely they will be able to continue capturing some of the global growth in the Mexican food and gluten free food categories.

From an investors perspective I like almost everything about Gruma except its current valuation. Investors must decide if and how much they are willing to pay up for this global category leader.

If you liked this analysis and want to receive more free research about investments in Latin America, subscribe here:

You can also connect with me on LinkedIn or follow me on Twitter.

One of the funds I looked at last week (https://emergingmarketskeptic.substack.com/p/em-fund-stock-picks-commentary-february-21-2023) went into detail about them - said they continue to shift to higher value food products while controlling costs - and price increases are helping to cover rising costs...

Some years ago, I was surprised to find out that Mission has a good sized factory operation here in Malaysia where there is a big market for Indian and Middle East style breads and "wraps." Mission brand wraps have always been in the stores here...