International Meal Company - MEAL3 - LATAM Stocks Investment Analysis #11

IMC is a Brazilian fast food restaurant operator that operates Pizza Hut and KFC franchises in Brazil, among other brands.

Dear LATAM Stocks Readers,

Happy New Years! Thanks for reading the first edition of 2023. I’m excited to be back publishing these investment overviews and learning about investments in Latin America with you!

This edition covers a Brazilian restaurant group, International Meal Company (“IMC”). They operate 562 restaurants in Brazil, Colombia, and The U.S. Their focus is on four major brands, Pizza Hut, Kentucky Fried Chicken, Frango Assado, and Margaritaville.

I believe IMC has the potential to be a great turnaround story. New management took over in March 2021 and in my opinion, they have been effectively executing their strategy of simplification and financial discipline. The market hated this stock during the covid lockdowns and price never recovered. I believe the stock was overly penalized for heavy interest expenses that caused the company to show net losses.

However, IMC owns plenty of non core assets that management has and will continue to sell. I expect the company’s financials to improve significantly in 2023. If management continues to execute their restructuring strategy in 2023, then longer term I think there is huge growth potential for the company’s core brands in Brazil.

***Disclosure: I own shares in International Meal Company.

Common Stock: International Meal Company (MEAL3)

Industry: Food Services

Sub Category: Fast Food Restaurant Operator

Current Market Price: R$ 2.73

Market Capitalization: R$ 781.8 Million

*All values in this article are expressed in Brazilian Reais (BRL) unless otherwise noted.

*The basis of this analysis is the company’s most recent audited annual report, which can be found here.

*You can find a complete disclosure about LATAM Stocks investment overviews here.

Summary of the Company

OVERVIEW

International Meal Company (“IMC”) is a Brazilian fast food restaurant operator. The company was founded in 2006 by private equity firm Advent International and has been growing via acquisition ever since. IMC had its IPO on the Brazilian stock exchange in 2011. In 2019 Advent announced it had fully exited its ownership position.

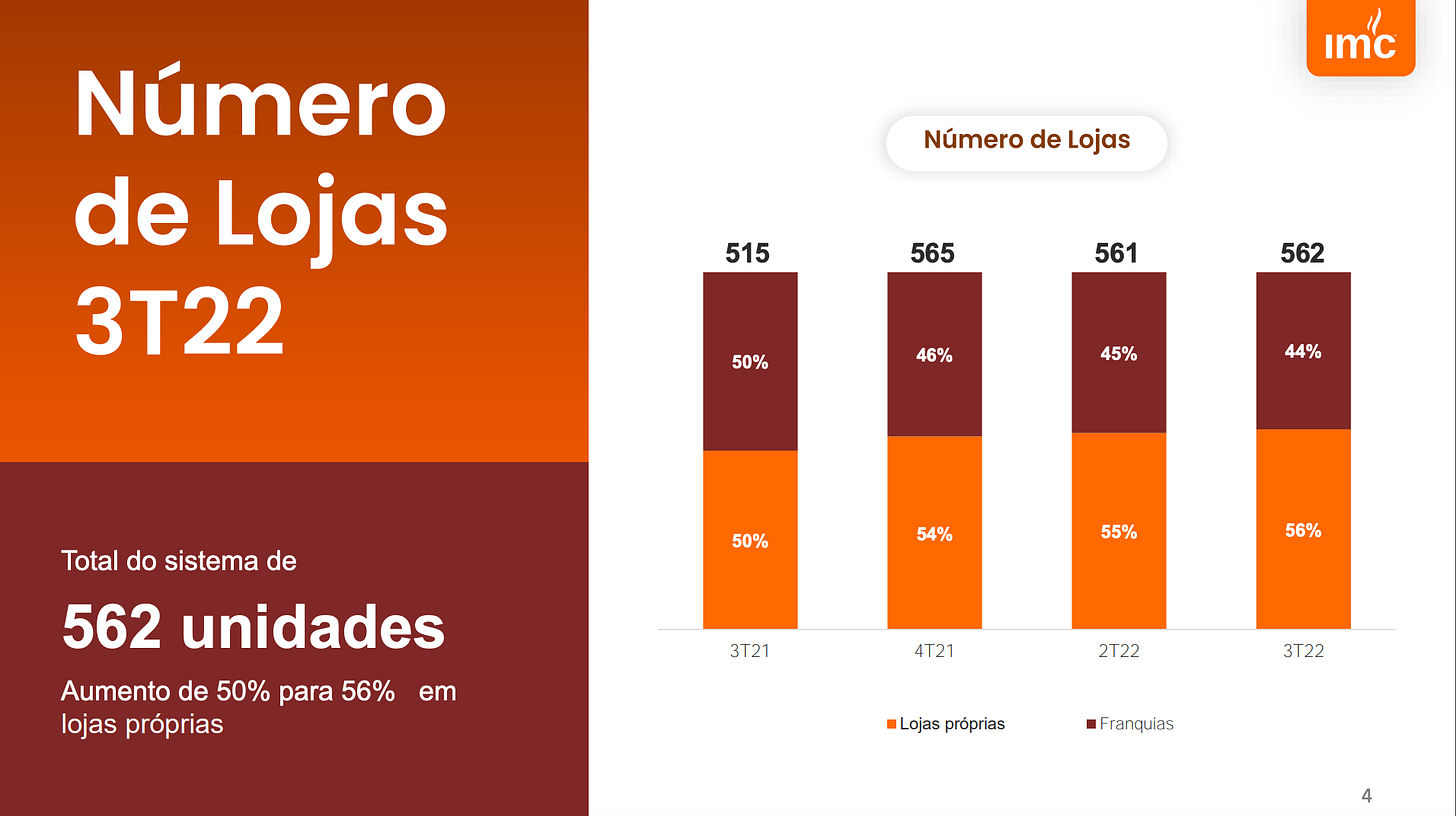

IMC operates 562 restaurant locations throughout Brazil, The United States, and Colombia. The company opened 70 new restaurants in 2021.

The 4 major brands operated by IMC are:

Pizza Hut – An American fast food restaurant chain with over 17,000 locations worldwide. This makes it the largest pizza restaurant in the world by number of locations. Pizza Hut is owned by YUM brands.

Kentucky Fried Chicken – An American fast food restaurant chain present in over 150 countries with over 22,000 locations. They are the second largest fast food company in the world after MacDonalds. KFC is owned by YUM Brands.

Frango Assado – The leading operator of highway restaurants in Brazil. The company has a strong brand and is famous for being Brazil’s “rest stop restaurant”.

Jimmy Buffet’s Margaritaville – A U.S. based casual dining restaurant. The brand is associated with the “island vacation” lifestyle, so their restaurants are strategically located in airports, resorts, and casinos.

In addition to these brands, IMC also operates several other restaurant brands, including Carl’s Jr, Olive Garden, and Vienna, among others.

STRATGEY

Alexandre Santoro was announced as IMC’s new CEO in March of 2021. Since taking over as CEO the company has pursued a strategy of simplifying its portfolio and reducing its debt burden.

Moving forward, IMC plans to focus on brands and countries with the highest returns. So while total restaurants has grown steadily, the number of brands in the company’s portfolio, as well as the number of countries where it is present, has declined. Over the past several years IMC has sold/discontinued 4 brands and exited 4 countries. This trend is likely to continue.

Most recently the company announced the sale of its Panama operation for $40 million USD.

The company’s strategy focuses on 4 key segments:

Shopping Centers – IMC seeks to operate restaurants in major shopping centers throughout Latin America. Shopping center locations are mostly KFC and Pizza Hut brands. In Brazil shopping centers are typically located to be conveniently accessible in densely populated areas. By locating its restaurants in shopping centers IMC can easily grow its delivery business and is not necessarily dependent on foot traffic in the mall. In 2021 delivery represented 28% of Pizza Hut and KFC revenues.

Airports – Airport locations and catering has been a core component of IMC’s business since it was founded. In 2007 the company acquired RA Catering. In addition to operating restaurants in airports, the company also has licenses to cater on flight food. IMC is present in some of the busiest airports in LATAM such as São Paulo and Bogota.

Highway Rest Areas – Frango Assado is one of the most famous “rest stop restaurants” in Brazil. The company has locations on many of the most traveled highways in the country. Its brand recognition and strategic geographic footprint are hard to replicate. There is significant potential to grow this brand.

The United States – The Margaritaville brand is the company’s main focus in The U.S. IMC has demonstrated its ability to manage travel related restaurants in airports and on highways in LATAM, so a travel related restaurant brand in The U.S. fits IMC’s core competencies.

Master Franchisee

When IMC acquired MultiQR in 2019 they became the master franchisee for YUM Brands in Brazil, granting them the exclusive right to operate Pizza Hut and KFC restaurants in Brazil.

IMC’s master franchise agreement is a valuable asset to the company, it gives them the right to operate two of the most successful fast food brands in the world, in the worlds 5th most populous country.

So what exactly is a YUM Brands Master Franchisee? From YUM Brands 2021 annual report:

Under master franchise arrangements, the Company enters into agreements that allow master franchisees to operate restaurants as well as sub-franchise restaurants within certain geographic territories. Master franchisees are typically responsible for overseeing development within their territories and performing certain other administrative duties with regard to the oversight of sub-franchisees. In exchange, master franchisees retain a certain percentage of fees payable by the sub-franchisees under their franchise agreements and typically pay lower fees for the restaurants they operate.

*Update: After a long arbitration process, YUM brands renewed IMC’s master franchisee agreement for KFC. It covers the South and Southeast region of Brazil and is valid for 10 years.

The Financials

Revenue and Cost Analysis

IMC had revenues of R$ 1.85 billion in 2021, a significant increase from R$ 1.15 billion in 2020. 2020 revenue was obviously lower than normal due to the effects of lockdowns on the restaurant industry. Since the normalization of the economy, IMC has continued to grow its top line revenue.

Gross margins increased significantly from 2020 to 2021, rising from 23% in 2020 to 32% in 2021. However this increase in gross margins was not enough to bring IMC back to profitability.

The company had an EBITDA of R$ 180 million in 2021.

The company had a net loss of R$ 80.5 million in 2021, a significant improvement from a loss of R$ 473.5 million in 2020, but still a large loss.

IMC’s lack of profitability can be attributed mainly to its heavy debt burden and the associated interest expense. Interest rates in Brazil are currently 13.75%. However the new management team has plenty of assets it can sell off to lower their debt. And that is exactly what they plan to do. For example, a portion of the $40 million USD the company will receive from the sale of its Panama operation will be used to pay down debt. Regardless of what happens with interest rates in Brazil, I expect IMC’s debt burden to decrease and its net margins to improve.

Balance Sheet Analysis

The company has a sound balance sheet as of year-end 2021. Their short term liquidity position is solid, with a current ratio well above 1. IMC is leveraged, with a debt to equity ratio of 1.6.

Inventory and accounts receivable look normal, I don’t see any red flags.

Debt Analysis

As of year end 2021 IMC has total debt outstanding of R$ 736.2 million, R$ 86.8 million of which is current. The majority of the company’s debt is due in 2025 and 2026.

Around 40% of the company’s debt is denominated in foreign currency. Normally a large carry trade is a red flag for Brazilian companies. But given that roughly 45% of the company’s revenue is in foreign currency, I think it’s OK. None the less, investors should monitor the company’s foreign debt position closely.

Valuation Metrics

Book value per share - R$3.70

Price to Book – 0.74

Price to Sales - 0.42

Price to EBITDA - 4.3x

Share Dynamics and Capital Structure

The company currently has 286.4 million common shares outstanding. They do not have any preferred shares.

IMC’s largest single shareholder is a Brazilian family office and investment fund, UV Gestora, which owns around 30% of the company. KFC and Pizza Hut International own a combined 1.5%. Three individual shareholders own 2-4% each, but none of these individuals are a part of management or on the board.

The remaining 60% of the company’s shares are owned by smaller shareholders with less than 5% ownership each.

Dividends

The company did not pay a dividend based on 2021’s results. The last time IMC paid a dividend was based on 2018’s results and totaled R$ 0.64 cents per share.

As part of the company’s renegotiated debt covenants, IMC cannot pay a dividend until 2023 at the earliest.

Technical Analysis Notes

The company’s stock sold off hard on the lockdown news, and never recovered. You can see clear distribution from 2020 to early 2022 on historically high volumes. During the highest volume week in the stocks history, in December 2020, over 108 million shares traded, representing ~38% of the float!

More recently price and volumes have stabilized. Currently the price trades above the 50 and 200 daily moving average, and just broke above the 50 week moving average for the first time in over a year.

In summary I believe the technicals indicate that there are not many sellers remaining, and that long term investors have been, and are continuing to accumulate.

Summary and Conclusions

Positives

In Brazil the pizza market is estimated to be larger than the hamburger market. Currently major pizzeria chains like Pizza Hut and Dominos only account for 3% of the Brazilian pizza market. This presents a huge opportunity for an efficient operator like IMC to consolidate the Brazilian pizza market.

The Frango Assado brand is uniquely positioned as the most famous rest stop restaurant in Brazil. Its strategic locations on major highways make its market position hard for new entrants to replicate. Furthermore this brand has plenty of room for growth.

In 2021 delivery represented 28% of Pizza Hut and KFC revenues. By locating their restaurants mainly in shopping centers, they are well positioned geographically to deliver to a large portion of the population.

De-risked – The renewal of the master franchise agreement with YUM brands is a huge deal, and was a major unknown for shareholders. Furthermore the sale of the company’s Panama operation will significantly improve debt and profitability metrics moving forward.

The current valuation looks reasonable. Price to Book ratio below 1. Price to EBITDA 4.3x

The technicals look compelling. Sellers are exhausted. Long term capital has accumulated.

Negatives

The company is leveraged and financing expenses have been a relevant drag on earnings, so much so that the company is not profitable.

Difficulty selling non-core assets, for example a long sales process or sales prices well below carrying value, could cause the company’s financials to stay ugly for longer.

They are not the master franchise for YUM Brands in all of LATAM, only Brazil. And for KFC only South and Southeast Brazil. (Granted these are the most desirable regions in Brazil). So Pizza Hut and KFC expansion will be limited to Brazil.

Conclusion

IMC is well on its way to becoming a successful turnaround story. The new management team has come in and executed on their strategy. I expect the company’s financials to improve significantly in 2023. I see no reason for top line revenue growth to stop. Debt metrics should improve as the company sells off non core assets, and a return to profitability is likely.

Longer term I see huge growth potential for IMC’s core brands. I don’t know how many Pizza Huts and KFC’s the Brazilian market can handle, but with a population of over 210 million people, I am sure the number is a lot more than 500. Additionally the rest stop market is wide open in Brazil, and Frango Assado is Brazil’s most iconic highway brand.

I own IMC stock. I think it has the potential to be a long term position in my portfolio. I will monitor the companies financials closely in 2023. If management can continue to execute on its turnaround strategy in 2023, the company’s financials will look much different a year from now and IMC could be poised years of steady growth starting in 2024.

Thanks for reading! If you would like to receive more free research about investments in Latin America, subscribe here:

You can also connect with me on LinkedIn or follow me on Twitter.

Hello Patrick, which Brazilian broker do you recommend? I don't see stocks like Meal3 on IB or Degiro. Thanks.

Will include in my Monday links post... This sounds like a Brazilian version of Mitra Adiperkasa, Minor Food Group, Americana Restaurants etc - although its typically better to do a mix of foreign franchises while developing your own brands for the long-haul (an expensive learning process...) e.g. Pizza Company was developed by Minor after they had the Pizza Hut franchise in Thailand, but I guess had a falling out with the parent many years ago and the contract was not renewed.

Are there any good media sources for objective Brazil + Latin America news - especially business and investment related? The Latin America Risk Report substack does a Friday links post that reads like a Council on Foreign Relations PR piece or rather all the links come from sources reflecting "correct" USA-western political opinions... I have links to Brazil media that I know of at http://www.emergingmarketskeptic.com/emerging-market-adrs/latin-america-adrs/south-america-adrs/investing-in-brazil-adrs-brazilian-stocks/ and at the bottom of http://www.emergingmarketskeptic.com/

I am thinking the only good sources for objective Latin America investment relevant news (in English albeit browser translators can work ok) will come from fund commentaries or IB / research reports e.g. see some of the Latam funds I found and their investments mentioned at https://emergingmarketskeptic.substack.com/p/em-fund-stock-commentary-january-10-2023