Odontoprev - LATAM Stocks Investment Analysis #24

Odontoprev is the largest dental insurance company in Brazil.

Dear LATAM Stocks Readers,

This edition will cover the largest dental insurance company in Brazil, Odontoprev. They have over 8.6 million beneficiaries and a network of over 27,000 dentists.

I'm very excited about this write up because for the first time I will be interviewing the CFO of the company, Jose Pacheco, on the LATAM Stocks Podcast!

The episode will be out next week, so be sure to subscribe to the podcast so you don't miss it!

Youtube: https://www.youtube.com/@LatamStocks

Spotify:

Apple Podcasts:

Now a little bit more about the company and why I covered it…

Odontoprev is the clear market leader in Brazil, with over 1.5 million more beneficiaries than its closest competitor and over 6 million more beneficiaries than its next closest competitor. It is unique because it is 100% focused on dental, whereas many of its competitors offer both medical and dental insurance.

The dental insurance market in Brazil is intriguing. Brazil has more than twice as many dentists as the United States, but there are many fewer private dental insurance plans compared to private medical insurance plans.

It seems reasonable to assume that the total number of dental insurance plans in Brazil will continue to grow and Odontoprev is as well positioned as any company to capture that growth.

Odontoprev’s financials are healthy. They have a proven business model. Shares are tightly held and management has a history of consistently paying dividends. In fact they recently announced the largest annual dividend in the company's history. The current valuation seems reasonable, it certainly doesn’t look overvalued to me.

The stock price is pretty stable and the company operates with no debt. So while this might not be the most interesting stock for shorter term traders, Odontoprev is a compelling company for longer term, buy and hold oriented investors.

I hope you like this analysis. Let me know what you think of Odontoprev in the comments below.

Subscribe to The LATAM Stocks Newsletter to receive all our investment write ups for free!

Common Stock: Odontoprev (Ticker: ODPV3)

Industry: Financial Services - Dental Insurance

Current Market Price: R$ 12.17: $2.43 USD

Market Capitalization: R$ 6.7 Billion: $1.34 Billion USD

*All values in this article are expressed in Brazilian Reais (BRL) unless otherwise noted.

**A complete Disclaimer about LATAM Stocks Investment Overviews can be found by following this link.

Summary of the Company

Odontoprev is the largest private dental insurance company in Brazil. They have over 8.6 million beneficiaries and an accredited network of over 27,000 dentists. These dentists are located across more than 2,500 Brazilian municipalities.

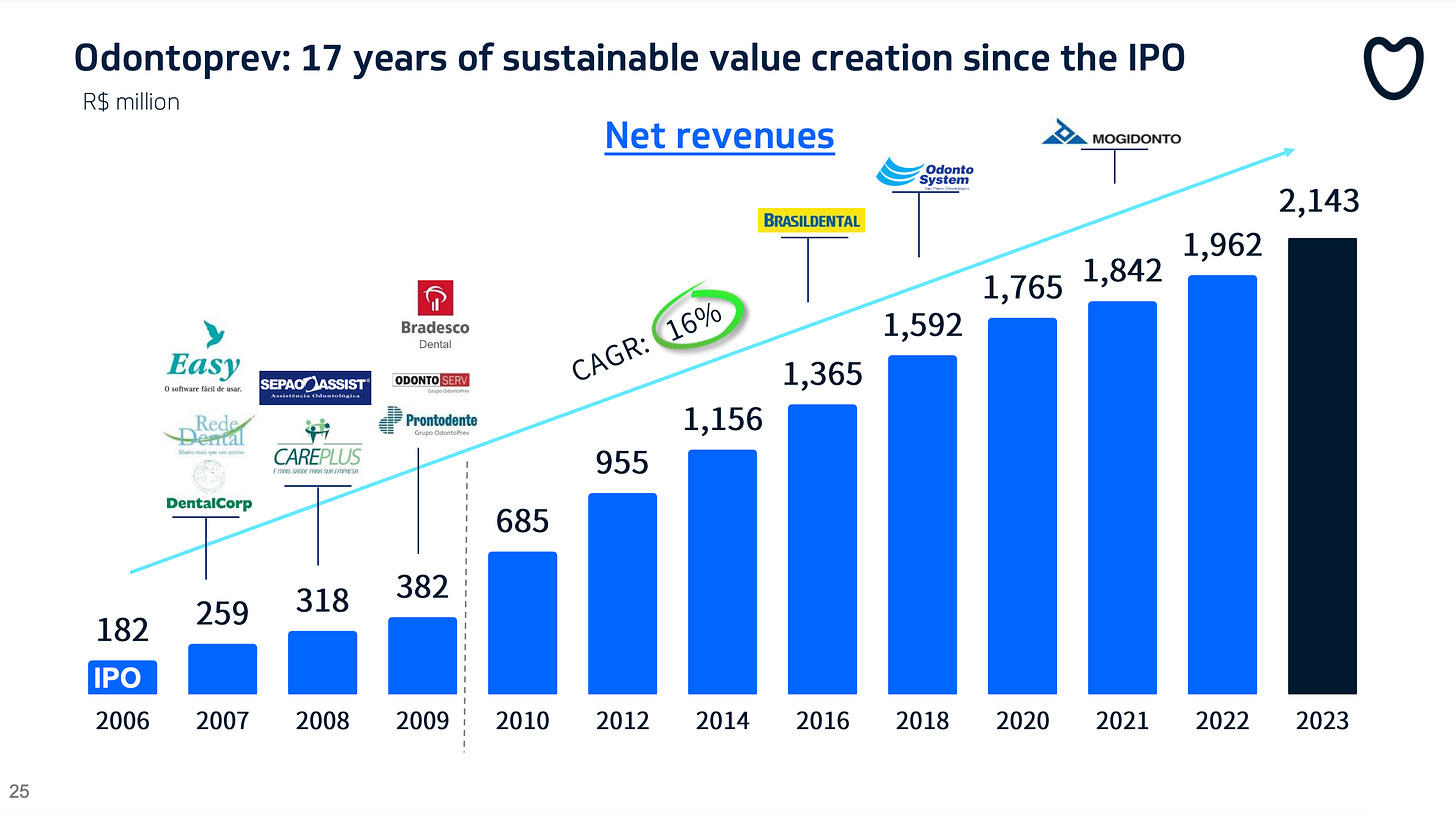

At the time of their IPO in 2006, Odontoprev had just under 1.5 million beneficiaries. They have grown their client base at a compound annual growth rate of 11% for the past 17 years.

Over that same time period, revenue has grown at a CAGR of 16% and net income at 23%.

Odontoprev has 3 core operating segments:

Individual – Plans sold to individuals and families, not associated with any business. This segment accounts for around 12% of total beneficiaries and 23% of revenue.

Small and Medium Enterprises (SME) – Clients sized between 3 and 199 beneficiaries. This segment accounts for around 17% of total beneficiaries and 20% of revenue.

Corporate – Clients with over 200 beneficiaries. This segment accounts for around 71% of total beneficiaries and 55% of revenue.

The average ticket size in 2023 for all 3 segments combined was R$ 21 per month, per member.

Odontoprev has 4 main sales channels:

An internal sales team

External brokers

Commercial partnership

Bradesco (Controlling shareholder and one of Brazil’s largest banks)

Odontoprev’s IT Platform

It is important to highlight the company’s proprietary IT platform. This platform has the dental records of all 8.6 million of the company’s beneficiaries. Odontoprev has over 30 years of actuarial data on its platform. This provides the company with significant informational and pricing advantages over its competitors, as well as fraud prevention capabilities that are relevant to the company’s bottom line.

Strategy and Acquisitions

Odontoprev is entirely focused on the dental care market. Part of their strategy is, and has been, to consolidate this market. After their IPO in 2006 Odontoprev was quite active in the M&A market, making 8 acquisitions from 2007 to 2009.

They have only made 3 acquisitions since 2009, but industry consolidation remains a major focus.

Their most recent acquisition was in 2021 when they acquired Mogidonto, a dental insurer with 62,000 beneficiaries.

The Brazilian Dental Market

I have lost count of how many Brazilians have told me something along the lines of “Dentists in Brazil are better and cheaper than in the U.S.”

I do my best to avoid the dentist, but I had a cavity filled earlier this year. Anecdotally I can tell you that dentists in Brazil are a great value. My dentist’s work was excellent. It cost me about $60 USD for the cavity and another $60 for a cleaning. Not Bad.

So why is dental care so good in Brazil?

One explanation is that Brazil has a lot of Dentists!

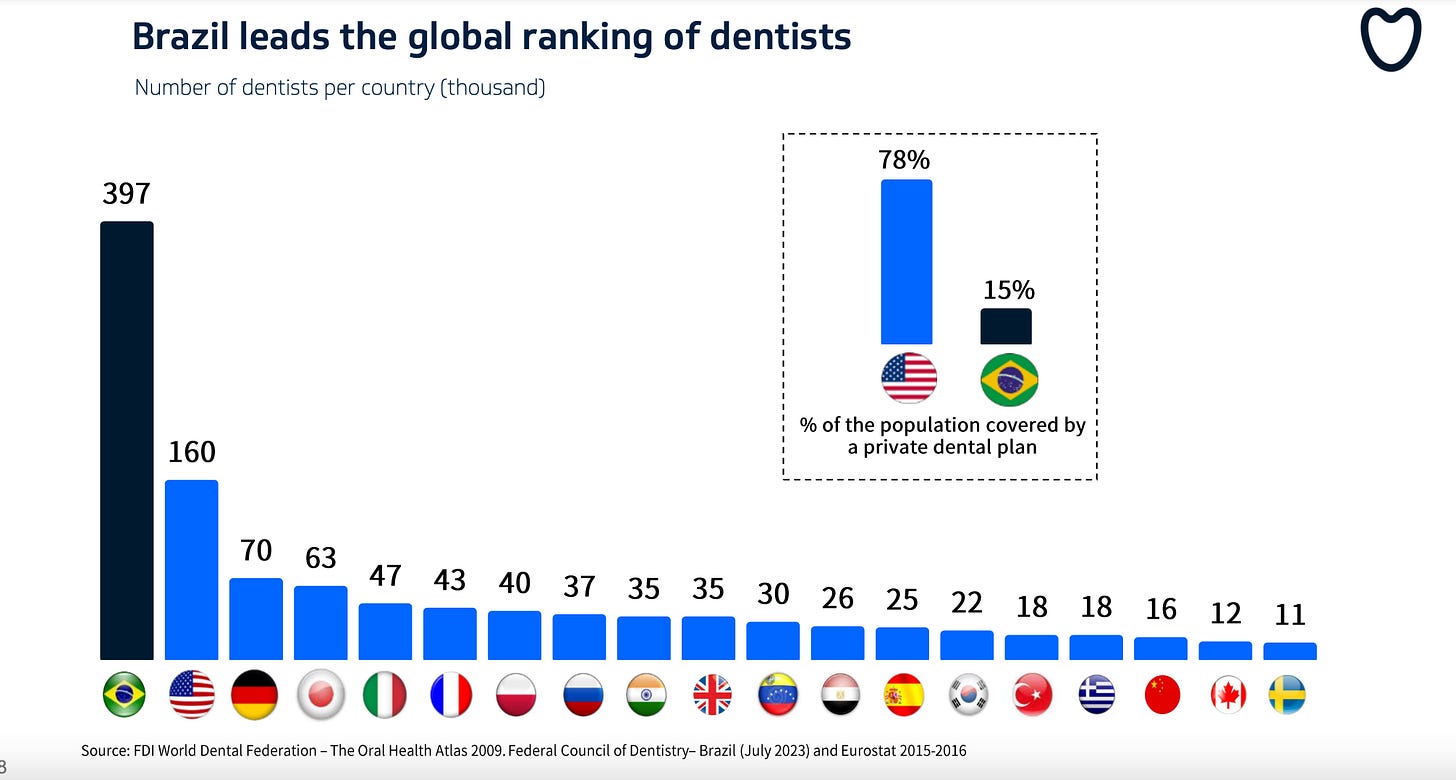

You can see in the chart below that Brazil has around 397,000 dental professionals, significantly more than other large countries like The U.S. and Germany.

What about dental insurance?

You’ll also notice in the chart above that market penetration for dental insurance is still quite low in Brazil. Especially when compared to the market penetration of dental insurance in The U.S., as well as the number of private healthcare plans in Brazil. But dental insurance is growing.

Odontoprev management highlights 5 key drivers for the growth of the Brazilian dental insurance market:

1. A structural imbalance between the supply and demand of services

2. A lack of alternatives in the public system

3. The inclusion of dental care plans in employee benefit programs

4. Opportunities represented by the increasing interest of new distribution channels

5. Regulation

Here is my take away from the above market data…

Brazil takes dental care seriously. They train and produce a lot of dentists. The dental insurance market is still undersized relative to health insurance and relative to more developed markets like The United States. Dental insurance looks like a growth market in Brazil for the foreseeable future.

The Financials

Revenue and Cost Analysis

Revenue was R$ 2.14 billion in 2023, up from R$ 1.96 billion in 2022.

EBITDA was R$ 647 million in 2023, up from R$ 576 million in 2022.

Net income was R$ 537 million in 2023, representing a profit margin of 25.3%. This is an improvement compared to net income of R$ 451 million in 2022, and a profit margin of 23.7%

Balance Sheet Analysis

Odontoprev’s short term liquidity position, as measured by their current ratio, has decreased over the past several years.

Current ratio at year end:

2020 – 1.81

2021 – 0.99

2022 – 0.70

2023 - 0.80

A large part of this can be attributed to significant increases in the current liability account “dividends payable”. Dividends payable increased from R$ 95.9 million at year end 2022 to R$ 184.7 million at year end 2023. This means that Odontoprev is paying out more cash to shareholders rather than keeping it on its own balance sheet, thus reducing their liquidity metrics.

I don’t think Odontoprev’s liquidity position is a reason for concern. But nonetheless, lower liquidity does increase risk, so investors should monitor this closely, especially dividend oriented investors.

Odontoprev’s balance sheet is not leveraged, with a debt to equity ratio of 0.56

Debt Analysis

Odontoprev does not have any debt outstanding. Management highlights “zero debt” in their filings, so I don’t believe it’s likely Odontoprev plans to issue debt anytime soon.

Valuation Metrics

Price to Book – 4.9x

Price to Sales – 3.2x

Price to EBITDA – 10.4x

Price to Net Income – 12.5x

Share Dynamics and Capital Structure

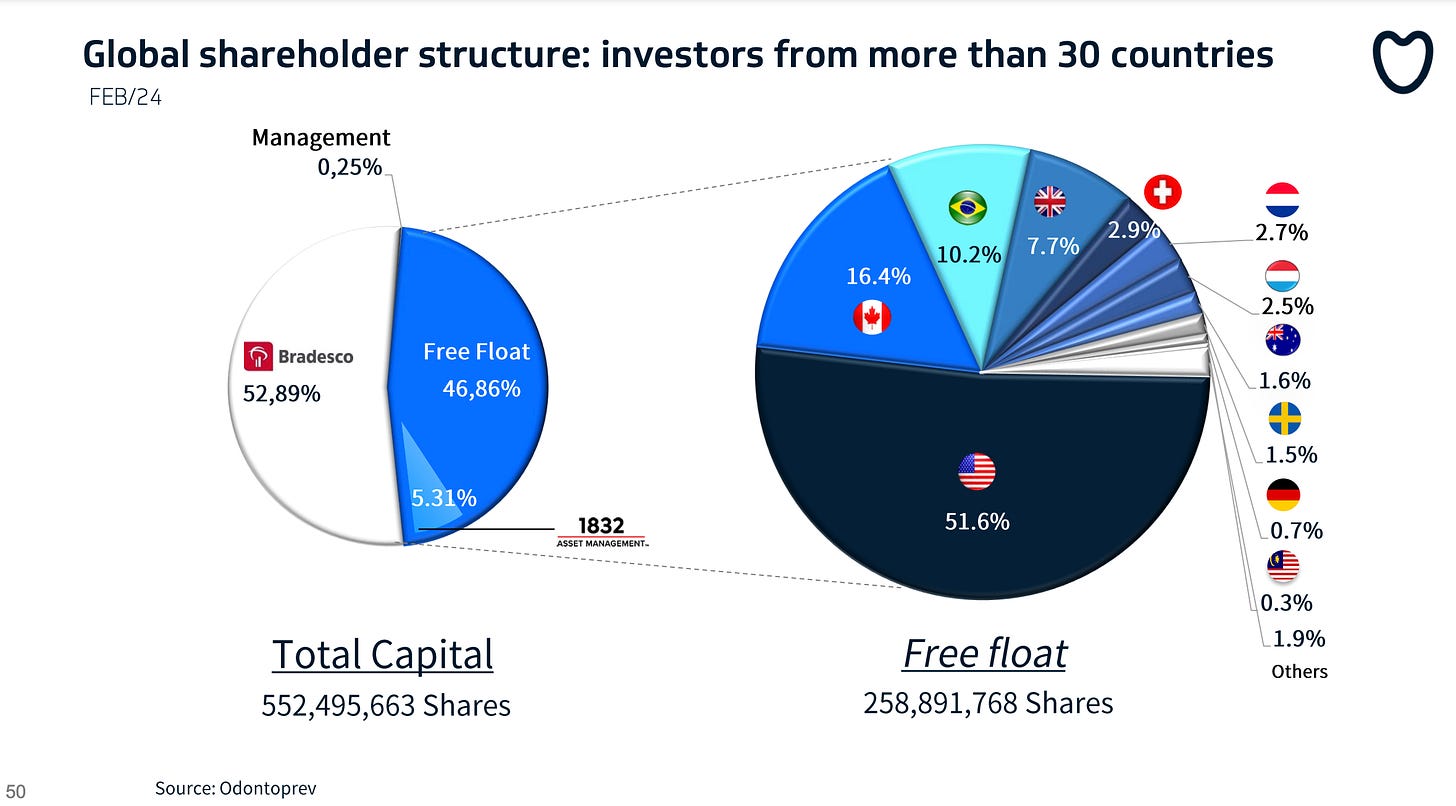

As of February 2024, Odontoprev has 552,495,663 common shares outstanding and no preferred shares.

53% of Odontoprev’s shares are owned by Bradesco, one of Brazil’s largest banks.

1832 Asset Management owns 5% of the company.

The remaining 42% are owned by smaller shareholders, representing over 30 different countries.

Dividends

Odontoprev expects to payout a total of R$ 427 million in total dividends based on 2023's results, representing R$ 0.77 cents per share.

At the current market price this implies a dividend yield of 6.4%.

Technical Analysis Notes

Odontoprev stock has been in a stable uptrend for over a decade.

Price is currently just above 50 week moving average and well above the 200 week moving average.

I don’t see any reason to assume the stocks long term uptrend has been invalidated. So unless something changes, my assumption is that the technical trend is up, and price will continue a slow and steady grind upward over the long term.

I will also highlight this chart from Odontoprev showing that when considering total shareholder returns (includes dividends), Odontoprev stock has outperformed its benchmark since its IPO.

Summary and Conclusions

Positives

No debt. Very low CAPEX and working capital requirements.

Dental only. Dental insurance is a more stable/predictable than health insurance.

Valuation looks reasonable give the company’s historical growth rates. However it certainly doesn't scream cheap.

Proprietary IT platform is a significant competitive advantage.

Strong commitment by management to return capital to shareholders.

Negatives

Dental insurance market is still relatively new/small in Brazil. It’s not clear to me if/when the private dental insurance market will plateau. Will the number of dental plans eventually equal the number of medical insurance plans? Will it plateau at 80% of medical insurance plans? 70%?

Operating on tighter liquidity increases risk.

A cut or pause in dividends would hurt the stock price, at least in the short to medium term.

Conclusion

Odontoprev is a strong company. They have a proven business model and are entirely focused on the dental insurance market, where they are the market leader. Their financials are sound and its is a shareholder friendly company.

The dental insurance market should continue to grow in the short to medium term. Eventually the total number of plans will plateau, but I don’t see any signs of that happening anytime soon. Odontoprev should continue to capture a significant portion of this growth.

The current valuation seems fair. It’s not overpriced, but it also doesn’t look cheap.

The only real bear case I can make for the company in the short to medium term is a dividend cut because they need more liquidity on their balance sheet. The stock price would take a hit. I don’t view this as likely.

Long term I don’t see a strong bear case. Maybe the dental insurance market growth stagnates, which I think would lead to more of a “mediocre performance” case than a bear case.

I think the most likely scenario, on a long term time frame, is a continued slow grind up as the company continues to grow along side the Brazilian dental market, returning capital to shareholders along the way.

If you liked this analysis, subscribe to The LATAM Stocks Newsletter to receive all our investment write ups for free!

Disclaimer

**A complete Disclaimer about LATAM Stocks Investment Overviews can be found by following this link.