Orbia - LATAM Stocks Investment Analysis #16

Orbia is a diversified, vertically integrated, Mexican manufacturer. They are a global leader in PVC, Precision Agriculture, and Fluorspar production.

Dear LATAM Stocks Readers,

This edition will cover Orbia, a vertically integrated, diversified Mexican manufacturing company.

Orbia has 5 distinct, but synergetic, business units and is significantly vertically integrated. The company is a market leader in all 5 of its business segments.

It’s the 6th largest general PVC producer in the world, the largest water management system provider in LATAM and Europe, the largest precision irrigation provider in the world, and is the largest fluorspar producer in the world, accounting for 20% of global production.

This cocktail of market leadership across distinct but synergistic businesses, makes Orbia an extremely unique company. The company is an interesting study for a wide range of investors. Personally, digging into the Fluorspar market and its applications in electric vehicles was fascinating in and of itself.

I hope you find this analysis informative and useful. As always, comments, doubts, and criticisms are welcome!

Common Stock: Orbia (BMV:ORBIA - OTC: MXCHF)

Current Market Price: MXN 40.19: USD $2.16

Market Capitalization: MXN 80.8 Billion: USD $4.55 Billion

*All values in this article are expressed in United States Dollars (USD) unless otherwise noted.

*A complete Disclaimer about LATAM Stocks Investment Overviews can be found by following this link.

Summary of the Company

Orbia, formerly known as Mexichem, is a Mexican company that is a leading global provider of products and solutions in multiple sectors including construction, infrastructure, agriculture & irrigation, health, transportation, telecommunications, and energy & petrochemical sectors, among others.

It is one of the world's largest producers of plastic pipes, fittings and irrigation drippers, as well as fluorite.

The company has commercial activities in more than 110 countries and operations in 50, employing more than 24,000 people worldwide.

119 Production Plants

19 R&D facilities

2 Fluorspar mines

Orbia has 5 Business Units:

Polymer Solutions - Brands: Vestolit and Alphagary - Advantaged player in PVC and specialty PVC, serving infrastructure, health & well being and other industries.

Building and Infrastructure – Brand: WAVIN - Leading global provider of innovative water management solutions for resilient construction.

Precision Agriculture – Brand: Netafim - Global market leader in precision irrigation and other solutions that enable the world’s farmers.

Connectivity Solutions -Brand: Dura-Line - Market leader in data network solutions, including conduit and accessories.

Fluorinated Solutions – Brand: Koura - Largest global fluorspar provider for fluorine-based products with applications from medicine to refrigeration to energy storage – accounts for ~20% of world production. Orbia’s fluorintine solutions business is 100% vertically integrated.

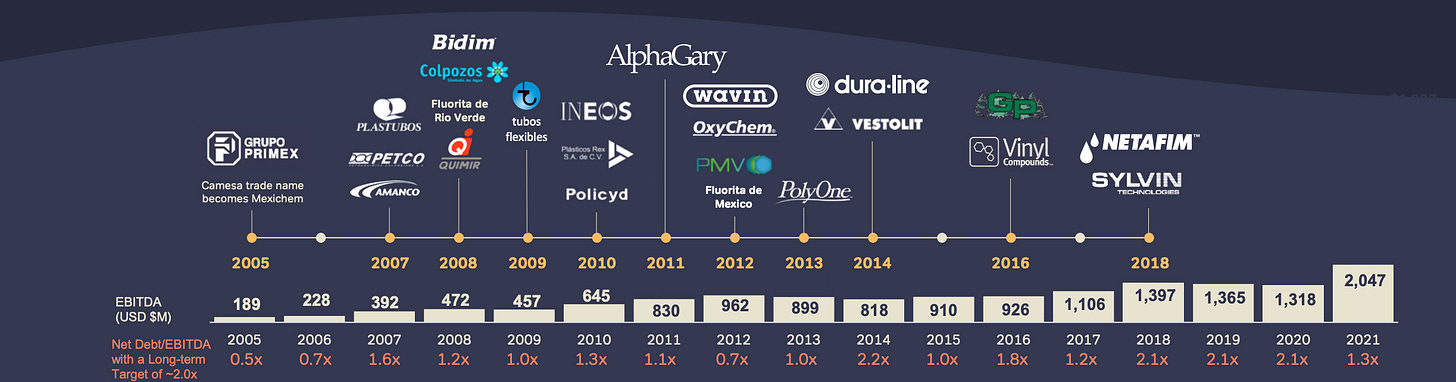

Acquisitions

Orbia is has been very active historically making acquisitions, and I believe it is likely they will continue to make acquisitions moving forward.

From 1997 through 2022 the Company acquired over 40 companies resulting in a truly global footprint.

General Business Strategy

Generally speaking, Orbia’s business strategy is vertical integration that adds to the synergies between its five business units. This strategy helps create economies of scale and improves margins, which in turn increases the company’s ability to produce organic growth within its business segments.

This vertical integration is achieved in part through an active strategic acquisition strategy. Additionally, Orbia has direct access to certain raw materials that are necessary for the production of their products and uses their own technology, which also helps improves the economics of its businesses.

A Brief Overview of Fluorspar

Since Orbia is responsible for 20% of the worlds production of Fluorspar, I think it’s worth briefly explaining what the chemical is, what it’s used for, and exploring some of the unique opportunities available to Orbia due to its strategic position in this market.

What is Fluorspar?

Fluorspar is the commercial name for the naturally occurring mineral fluorite, composed of calcium and fluorine (CaF2). Fluorspar is the predominant commercial source for the chemical element fluorine. Fluorine is a non-metallic element and the lightest of the halogens and therefore largely irreplaceable in its use.

What is Fluorspar used for?

Fluorspar is an industrial mineral from which the element Fluorine is liberated, with two major downstream uses; the production of Hydrofluoric Acid (HF) which is used as a building block for Fluorine Chemicals, and the production of Aluminum Fluoride (AlF3) which is an important additive for the production of Aluminum by electrolysis. Fluorspar also finds application in various steel and aluminum products, glass and ceramic manufacturing and in the growing nitrogen trifluoride (NF3) sector. Examples of products containing Fluorine includes household and automotive air conditioners, Teflon products fluoxetine medicines, welding rods, glass and ceramics.

Since most of the fluorspar mined globally is “acid grade” it ends up being turned into hydrofluoric acid.

Why is Fluorspar important?

There is steady demand for Fluorspar from its use in refrigerants, aluminum, and medical propellants like inhalers. But according to research from Coherent Market Insights, the market for Fluorspar is expected to nearly double by 2030. In 2021 the market size was around 7,500 kilotons. They expect the market to be 14,500 kilotons in 2030, representing a CAGR of 7.8% annually.

Some of this growth is from the steady demand mentioned above. But there is the potential for significantly higher growth due to the chemical’s use in lithium ion batteries for electric vehicles. Fluorine comprises 10% of each electric vehicles lithium ion battery by mass.

Government Awards

Due to the company’s strategic competitive position in several of its markets, Orbia is regularly eligible for and competes for, government grants and other benefit programs.

One of the most notable awards was related to their Fluorspar business. Orbia won a $100 million grant from the US government in October 2022.

From the company’s press release.:

“In October 2022, Orbia’s Fluorinated Solutions business, Koura, received a $100 million award from the U.S. Department of Energy (DOE) as part of the first set of projects funded by the President’s Bipartisan Infrastructure Law to expand domestic manufacturing of batteries for electric vehicles (EVs) and the electrical grid and for materials and components currently imported from other countries. The grant will enable Koura to build the first U.S. manufacturing plant for lithium hexafluorophosphate (LiPF6) on the grounds of Koura’s existing fluorochemical production site in St. Gabriel, Louisiana. Once operational, the proposed plant will produce up to 10,000MT of LiPF6 per year, which is sufficient to support domestic production of more than one million full electric vehicles annually.”

The Financials💰💰

Revenue and Cost Analysis

$9.6 billion USD in total revenue in 2022, an increase from $8.8 billion in 2021.

Gross profit was $2.6 billion in 2022, representing a gross margin of 26.6%. Gross margin deteriorated year over year from 29.9% in 2021. The deterioration is due mostly to inflationary pressure causing higher raw material, labor, and shipping costs.

EBITDA was $1.9 billion in 2022, down slightly from $2 billion in 2021.

EBIT was $1.33 billion in 2022, down from $1.5 billion in 2021.

Net income was $666 million in 2022, representing a profit margin of 6.9%. Profit margins decreased year over year, from 8.8% in 2021.

**It is worth noting that the company had a $119 million write down expense for the “fair value of redeemable non-controlling interests”. Without this expense margins were more stable year over year.

Balance Sheet Analysis

Orbia’s liquidity position is fine, with a current ratio of ~1.5

Their balance sheet is leveraged, with a debt to equity ratio of ~2.5

Debt Analysis

As of year-end 2022 Orbia has $4.7 billion in total debt outstanding, $760 million of which is current. The average maturity of their debt is 14.8 years with an average interest rate of 4.1%.

Credit Ratings

Three of the major credit rating agencies consider the company’s debt to be investment grade, but on the lower end of investment grade.

Fitch – “BBB”

Moody’s – “Baa3”

S&P – “BBB-”

Valuation Metrics

Price to Book – 1.25x

Price to Sales – 0.5x

Price to EBITDA – 2.4x

Price to EBIT – 3.4x

Price to Net Income – 6.8x

Share Dynamics and Capital Structure

Weighted average shares outstanding during 2022 was 1,918,919,097. Orbia has a share repurchase program, so their shares outstanding has been decreasing slightly year over year.

Dividends

In 2022 Orbia paid out $240 million in dividends totaling $0.125 cents per share, paid in 4 quarterly payments.

The company will pay out the same amount, $240 million, in 2023.

At the current price, the trailing dividend yield is ~5.8%.

Technical Analysis Notes

Orbia’s price has been range bound between MXN 25 and MXN 52 per share for over 10 years.

The current trend is sideways, with price sitting near the 50 and 200, daily and weekly, moving averages. So they is no clear directional signal.

A break above or below the decade long range would be a clear technical signal in either direction.

Summary and Conclusions

Positives

The company is very well diversified both geographically and across their 5 business segments.

Proven competence in making and integrating acquisitions. Reasonable to assume the company could benefit for opportunistic M&A in the future.

Valuation is very reasonable, if not cheap, at 3.4x EBIT and 6.8x earnings.

Steady growth likely, with potential for significant growth is some businesses such as Fluorspar.

Negatives

The company operates in highly competitive, cyclical markets. Global commodity prices can significantly impact margins.

Balance sheet is leveraged increasing risk and potential losses to equity holders in a downturn.

Conclusion

Orbia is a very unique business. Their market leading position in several global markets provides a certain level of downside protection, with significant growth potential across their business units. I also find the embedded upside from the potential growth in the Fluorspar market interesting.

The company is currently financially healthy with solid margins. Their balance sheet is OK, but their leverage should be monitored closely. As far as I can tell the business is well run, effectively integrating acquisitions consistently. The company also pays a healthy dividend.

At the current valuation Orbia stock looks very reasonable. If price revisits long term support around MXN 25 per share, I think it will likely be a screaming buy. I don’t own it yet, but I find Orbia to be a fascinating business, and have it at the top of my watchlist.

I hope you liked this write up! As always, feel free to comment below. And if you want to receive future write ups, subscribe here.

You can also connect with me on LinkedIn or follow me on Twitter.

Sources:

Disclaimer:

*A complete Disclaimer about LATAM Stocks Investment Overviews can be found by following this link.

What is the difference between MXCHF and MXCHY ? They seem to have a recent price divergence.