Viña Concha y Toro - LATAM Stocks Investment Analysis #22

Viña Concha y Toro is the largest wine producer in Latin America and one of the Largest in the world. They are Chile's largest wine exporter.

Dear LATAM Stocks Readers,

This edition will cover Chilean wine giant Viña Concha y Toro.

Viña Concha y Toro is the largest wine company in Latin America and one of the largest in the world. The company has vineyards in Chile, Argentina, and The United States. They sell their wine in over 130 countries.

There is no way to sugarcoat the current state of affairs in the wine industry.

The global wine industry is currently in a downturn and Concha y Toro is no exception. Revenues and volumes are down.

When I started this write up I was expecting to find an ugly situation. I wanted to cover the Chilean wine industry for readers because Chile is a huge, and largely unknown, wine market, as well as a globally relevant exporter.

I wasn’t expecting much in terms of stocks worth buying.

But the situation at Concha y Toro isn’t all doom and gloom. They are sound financially. Their balance sheet is healthy and they should have no problem weathering the current downturn in the wine industry.

If/when the wine industry picks back up, Concha y Toro should be well positioned.

You can make the case that their current valuation is reasonable given their scale. The stock trades at book value and 16.7x earnings.

Is 16.7x earnings the right price to pay to own 2.9% of the worlds vineyards? I don’t know. I’ll leave that up to you.

But Concha y Toro is an interesting company that provides tons of insights into Chile and the global wine industry!

I hope you enjoy this write up!

And who knows, maybe even a bottle of Chilean wine over the holidays!

Thank you all for reading and participating in the LATAM Stocks community this year. It has been a pleasure to meet and engage with so many of you!

Wishing you a happy holidays and new year.

See you in 2024!!

Best Wishes,

Patrick Flood

Subscribe to The LATAM Stocks Newsletter to receive all our investment write ups for free!

Common Stock: Viña Concha y Toro

Industry: Wine

Current Market Price: CLP 1,065: $1.24 USD

Market Capitalization: CLP 791 Billion: $917.6 million USD

*All values in this article are expressed in Chilean Pesos (CLP) unless otherwise noted.

**The USD/CLP exchange rate at the time of writing was 862-1 which was the conversion rate used for all USD conversions.

***A complete Disclaimer about LATAM Stocks Investment Overviews can be found by following this link.

Summary of the Company ##

Viña Concha y Toro is the largest wine company in Latin America and the 8th largest in the world in terms of vineyard area planted. They have over 12,000 hectares of vineyards in Chile, Argentina, and The United States. This means they are responsible for 2.9% of all the vineyard land in the world.

The company is vertically integrated owning the vineyards, wineries, packaging, and distribution.

They sell their wine in over 130 countries, with their main markets being The United

Kingdom, United States, Chile, Brazil, and Nordic countries.

Viña Concha y Toro is the largest Chilean wine exporter, responsible for 25% of the value of all Chilean wine exported in 2022.

The company was founded in 1883 and has over 3,500 employees.

Brands

Chile – The company has 56 vineyards and 13 wineries in Chile. This is by far their largest vineyard market, with over 10,000 hectares of land under vine. Their major Chilean wine brands include the flagship brand Concha y Toro, as well as Viña Don Melchor, Viña Mapio, Viña Como Sur, and Viña AlmaViva

Argentina – Concha y Toro has 10 vineyards and 3 cellars in Argentina. They have over 1,400 hectares under vine, all located in the Uco Valley (Mendoza). All of their Argentine wine is bottled and sold under one brand, Bodega Trivento.

The United States – The company owns 14 vineyards and 1 cellar in The U.S. This is their smallest market in terms of land under vine, with 448 hectares. All of their vineyards are located in Northern Sonoma Valley. All of Concha y Toro’s U.S. wine is bottles and sold under one brands, Bonterra Organic Estates.

Strategy

The company’s main strategy and its core focus for the past 5 years has been to increase the share of “premium brands” in its portfolio. Since Concha y Toro is already one of the largest wine companies in the world, growing unit volume has been difficult.

Management’s strategy of focusing on premium brands is a strategy of focusing on increasing gross margins. More expensive, premium wine, has higher margins.

Management has been reasonably successful with this strategy. Premium brand sales have increased from 36% of total sales in 2017 to 48.7% in 2022.

Concha y Toro also simplified their operations during this period. They significantly decreased the number of brands in their portfolio from 264 brands in 2017 to 144 in 2022. Again, focusing on premium, higher margin brands.

The Chilean Wine Industry

Chile is the 6th largest wine producer in the world in terms of volume.

Although wine is a popular in Chile, The Chilean population is only 19.5 million people, so 74% of all Chilean wine production was exported in 2022.

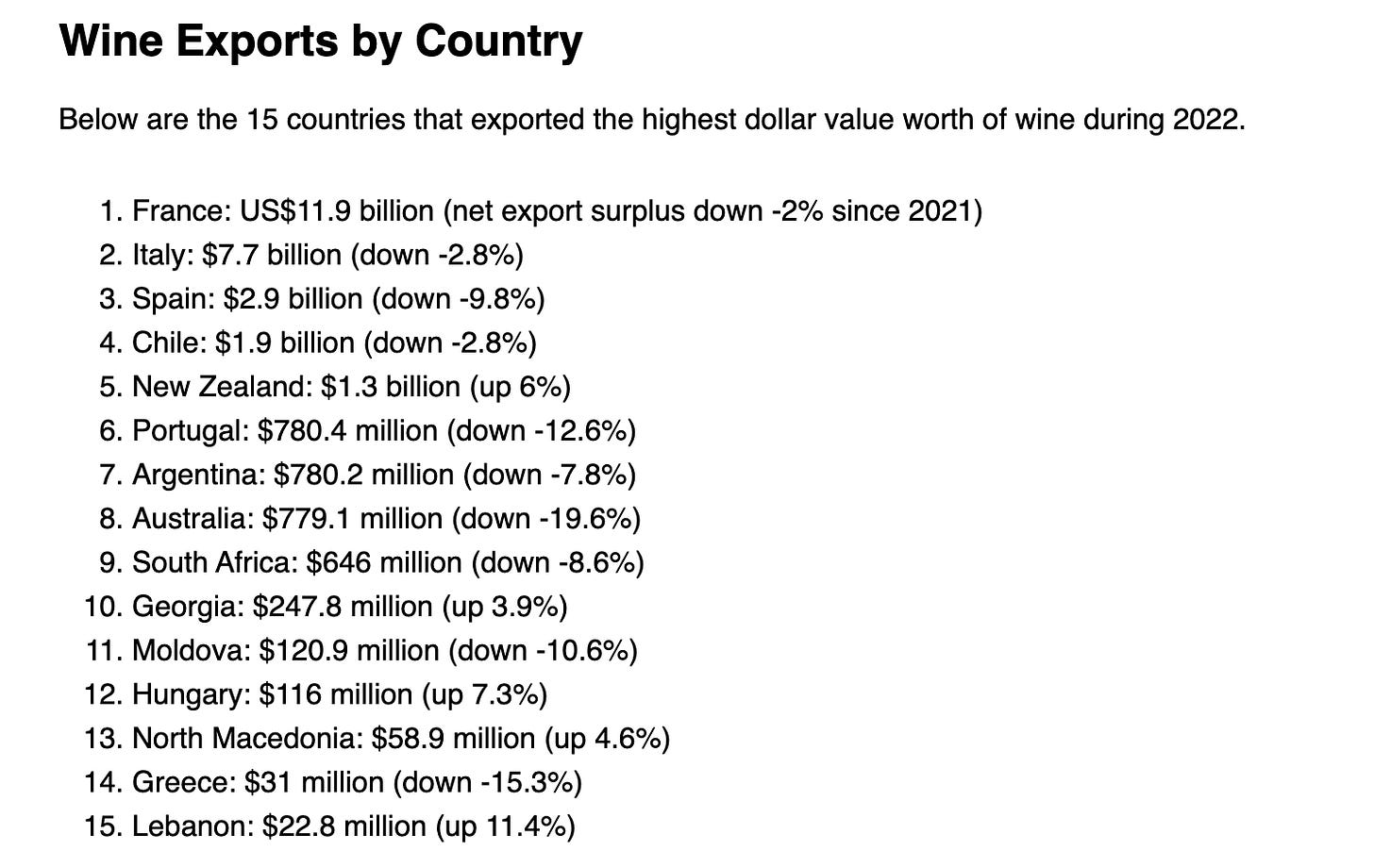

Chile was the 4th largest wine exporter in the world in terms of dollar value exported in 2022.

Wine accounts for ~2% of all Chilean exports.

Their geographic location makes China a key market for Chilean wine. Chile is the 2nd largest exporter of wine to China after France. Chile exports more wine to China than The U.S., Italy, and Spain combined.

Another interesting fact about Chile’s wine industry worth noting is related to water and irrigation. Most of Chile’s wine production is dependent on irrigation. Water rights in Chile are completely privatized and access to water is often talked about when discussing Chilean agriculture.

I’m not sure if this is good, bad, or irrelevant. But is certainly a market dynamic unique to Chile’s wine industry.

The Financials

Revenue and Cost Analysis

Concha y Toro revenue for the last 12 months (Q3 2023 – Q4 2022) was 824.5 Billion CLP ($956.5 million USD).

Gross Profit over the same period was 306.5 Billion CLP, representing a gross margin of 37.1%.

EBIT was 67.1 Billion CLP over the last 12 months ($77.8 million USD).

Net income was 47.4 billion CLP over the period, representing a profit margin of 5.7% ($55 million USD).

*Revenue and volumes have continued to decline in 2023. Quarter over quarter revenue was down 4.8% in Q3 2023 and volumes were down 3.8%.

Balance Sheet Analysis

Concha y Toro has a sound balance sheet. Their liquidity position is solid with a current ratio of 1.8.

The company uses moderate leverage, with a debt to equity ratio of 1.1 as of Q3 2023.

There were no other balance sheet items that drew my attention. Accounts payable, receivable, and inventory, all look reasonable.

Debt Analysis

As of Q3 2023 Concha y Toro has 517.2 Billion CLP in total debt outstanding ($600 million USD).

211.1 Billion CLP of this debt is current.

A significant portion of this debt is denominated in foreign currencies such as USD, BRL, and MXN. But given the company’s highly diversified revenue, I don’t think this is a cause for concern. They are not overly exposed to any carry trade.

Valuation Metrics

Price to Book – 1.03

Price to Sales – 0.96

Price to EBIT – 11.8x

Price to Net Income – 16.7x

*Sales, EBIT, and Net Income are all calculated using last 12 months (Q3 2023- Q4 2022). Book value was calculated as of the end of Q3 2023.

Share Dynamics and Capital Structure

As of year-end 2022 the company has 747 million common shares outstanding.

A controlling group owns 37.3% of Viña Concha y Toro. The 12 largest shareholders own a combined 61.4%.

Dividends

Over the last 12 months (Q3 2023- Q4 2022) Concha y Toro has paid total dividends of 47.2 CLP per share.

At the current market price this implies a dividend yield of 4.4%.

Technical Analysis Notes

Concha y Toro stock has been range bound for the past 15 years. Price has ranged between roughly 800 and 1,500 CLP per share since 2008.

Price is currently at the lower end of the range, trading at 1,065 per share.

Concha y Toro is clearly a cyclical stock. Other than being towards the lower end of a long term range, I don’t see much else that is interesting in the price chart.

Summary and Conclusions

Positives

The company is very diversified globally in 130 markets. No single currency was responsible for more than 28% of revenue in Q3 2023.

The stock is a clear cut industry bet. If you are bullish on Chilean and Argentine wine, particularly exports, then Viña Concha y Toro stock is an effective investment vehicle for this theme.

Their balance sheet is sound with reasonable liquidity and leverage.

Consistently pays a healthy dividend.

Valuation is reasonable. Not excessively cheap, but certainty not grossly overvalued. Could argue it’s a fair price for “quality”.

Negatives

The wine industry is struggling. Consumption and unit volumes are down globally. Concha y Toro’s financials have suffered. Revenue and volumes are both declining. It is not clear when the wine industry will turn around.

Gross margins are down slightly, despite management’s focus on “premium brands” and higher gross margins.

Conclusion

Concha y Toro merits study based on its globally relevant position as a wine exporter and its dominant position regionally in Latin America.

Their current situation is not great, but the global wine industry is in a downturn.

I think Concha y Toro is as well positioned as any wine company to weather an industry downturn. Despite declining revenues and volumes, their balance sheet remains healthy.

I’m not sure if the current valuation is cheap. But it is a cyclical stock trading at the lower end of its long term trading range.

I think longer term investors should take a hard look at the company to decide if they can wait out the wine industry downturn. Because if/when the wine industry does turnaround, Concha y Toro will be as well positioned as any company in the world. And you get paid a healthy dividend while you wait.

I hope you liked this analysis!! Let me know what you think of Concha y Toro in the comments.

And be sure to subscribe to receive all LATAM Stocks write ups!

Disclaimer

**A complete Disclaimer about LATAM Stocks Investment Overviews can be found by following this link.

I was long Concha y Toro back when it was listed in New York. The bull case here is they own a bunch of valuable real estate including some prime parcels around the Santiago urban area which would be worth way more than they are carrying at. Instead of sharing this wealth with shareholders, however, they delisted the company from New York and have done nothing else to market the stock.

I have reallocated my funds there to CCU, the Chilean monopoly (60% market share) brewer that also operates Gato Negro, the large mass market Chilean wine brand.