Espaço Laser - LATAM Stocks Investment Analysis #17

Espaço Laser is the largest laser hair removal company in Latin America.

Dear LATAM Stocks Readers,

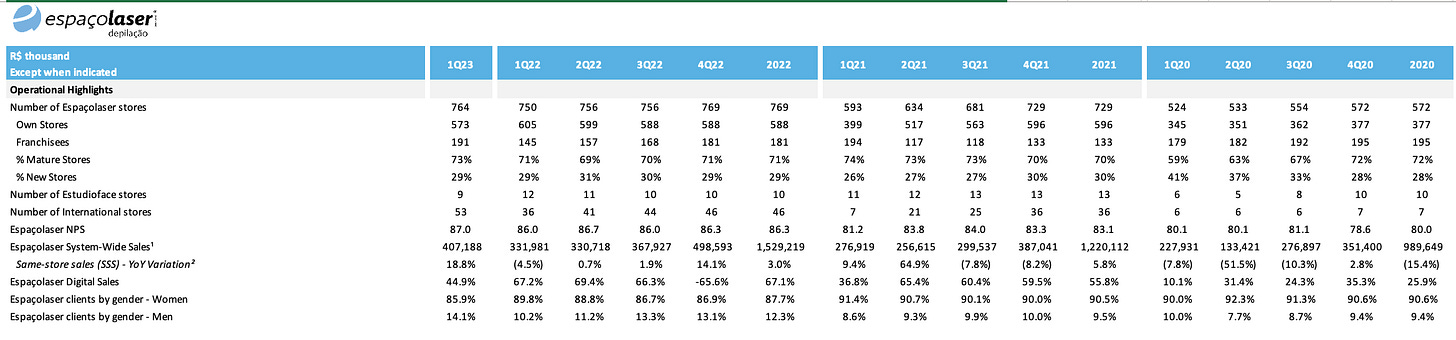

This edition will cover Espaço Laser, the largest laser hair removal company in Latin America. They have 764 stores in Brazil and are also present in Colombia, Argentina, Chile, and Paraguay.

The company has expanded extremely quickly, growing its store count organically and via acquisition from only 49 stores in 2014. This culminated in an IPO in 2021. But this growth is not without its growing pains, which now manifest as significant risk for equity holders.

Espaço Laser stock is one of the risker companies I have covered in this newsletter. The company is in a perilous financial situation. They have a huge debt cliff in 2024 and 2025 and I believe they will not be able to repay this debt from existing cash flows. Meaning dilution and/or bankruptcy are real possibilities.

That being said, there is a real turnaround effort underway. If management can resolve the company’s debt problem, Espaco Laser’s equity investors would be left with a solid operating business that is well positioned as the clear market leader in Latam’s cosmetic hair removal market.

So why am I covering a company that may very well go bankrupt?

First, the laser hair removal market is a huge market in Latin America, with significant growth potential. I think studying the clear cut market leader in a unique industry is worthwhile.

Second, I think Espaço Laser stock presents an asymmetric bet. The downside is very well defined, the stock price is already down over 90% from the IPO, and could go to zero. But if they can resolve their debt problem, I believe there is significant long term upside for equity investors.

Regardless of whether or not Espaço Laser survives, I think there are lessons to be learned here and the company is worth studying. I hope you find this write-up interesting. As always let me know what you think of the company in the comments section!

Common Stock: Espaço Laser (ESPA3)

Industry: Beauty and Healthcare

Current Market Price: R$ 1.85: $0.38 USD

Market Capitalization: R$ 668.6 Million: $136.5 Million USD

*All values in this article are expressed in Brazilian Reais (BRL) unless otherwise noted.

*A complete Disclaimer about LATAM Stocks Investment Overviews can be found by following this link.

Summary of the Company

Espaço Laser is the largest laser hair removal company in Brazil in terms of revenue, locations, and total customers served. Since its founding 19 years ago, Espaço Laser has served over 4.2 million clients.

The company aims to serve customers across the entire socio economic spectrum, and offers financing packages if needed.

Espaço Laser is the clear market leader in Brazil, accounting for 36% of all laser hair removal stores in the country.

In addition to their Brazilian operations, Espaço Laser is also present in:

Chile

Paraguay

Argentina

Colombia

As of March 31, 2023, Espaço Laser has:

764 laser hair removal stores in Brazil

573 Owned Stores

191 Franchised Stores

24 laser hair removal stores in Chile, under the brand Cela by Espaço laser

19 laser hair removal stores in Argentina, under the Definit brand. Their first store in Argentina was opened in 2018.

9 stores in Colombia. Their first store was opened in 2020.

1 store in Paraguay. This store was opened in 2022 and is part of a planned expansion into Paraguay.

9 Estudio Face stores, a brand that offers facial aesthetics services, such as Botox and Filler.

New CEO and Business Strategy Moving Forward

Moving forward the company has several core focuses that management expects will lead to positive value creation for shareholders.

Cost reduction – The company’s fast growth and numerous acquisitions have led to some runaway costs. Management is focused on reducing costs by closing poorly performing stores, optimizing headcounts (reorganizing the management hierarchy), and restructuring compensation policy to include more variable, performance based compensation.

Optimizing existing store performance – Management wants to consolidate their market leading position by improving many aspects related to the management and operation of individual stores. For example the company is undertaking initiatives to improve their digital advertising, scheduling procedures, and client relationship management.

International expansion - The company’s first store in Paraguay was opened in 2022. In total 17 new international stores opened between Q1 2022 and Q1 2023.

Acquisitions

Since their IPO Espaço Laser has been active making acquisitions. Several of these acquisitions involved acquiring their own franchised operations. In 2021 the company acquired over 100 franchisee stores.

“On July 1st, 21st, 26th and 27th, 2021, the Company acquired, through its subsidiary Corpóreos Serviços Terapêuticos S.A., 12 (twelve) stores of the “Espaçolaser” brand in the states of Amapá, Rio de Janeiro, Paraíba, São Paulo and Minas Gerais, upon payment of the total amount of R$36.9 million”

They also grew their international presence via acquisition. In 2021 Espaço Laser purchased 66% of Cela in Chile for $4.6 million USD. They now control and operate the company.

A Brief Market Overview

What is Laser Hair Removal?

Laser hair removal is one of the most common cosmetic procedures. It is a method for removing unwanted hair, and is an alternative to waxing, tweezing, or shaving with a razor.

The procedure involves beaming highly concentrated light into the hair follicles, where the pigment absorbs the light, thus destroying the hair. Although it is a simple procedure, it does require a trained technician to perform.

Laser Hair Removal Market in Brazil

In 2019 roughly 79% of Brazilian females between the ages of 12 and 65, and 9% of males, used some type of hair removal method. This is equates to approximately 69 million hair removal users in Brazil.

It is reasonable to assume that laser hair removal, being the newest method of hair removal, has room to grow as it further penetrates the hair removal market in Brazil.

Espaço Laser believes the growth of the laser hair removal market in Brazil will be dependent on 5 main factors.

Increased penetration and convergence towards more developed countries penetration levels. In 2019 laser hair removal had 4.9% market share in Brazil. This number was 20% in The United States and 50% in Spain.

Basic Demographics – Brazil’s population is increasing so its demographics remain favorable for consumer services like laser hair removal

Use of laser hair removal on more parts of the body – As laser hair removal becomes more common, the company expects clients to return for additional procedures on additional body parts.

Increase in male clients – this expectation is already showing up in Espaço Laser’s financials. Male clients went from 10% of the company’s clients in Q1 2022 to 14% in Q1 2023, a significant increase.

Many consumers believe Laser hair removal is more environmentally sustainable. These consumers are likely to choose laser instead of discardable razors or wax procedures.

Facial Aesthetics Market in Brazil

According to Espaço Laser data, the facial aesthetics market in Brazil grew 35% per year on average between 2015 and 2019. In the last 12 months, 12% of women in Brazil have had a facial aesthetics procedure such as botox or lip filler. That’s roughly 10 million women.

The estimated size of the facial aesthetics market in Brazil is R$ 3.8 billion.

The Financials 💰💰

Revenue and Cost Analysis

Net Revenue was R$ 931.5 million in 2022, up from R$ 714 million in 2021 and R$ 522 million in 2020.

Gross profit was R$ 330 million in 2022, representing a gross margin of 37%, down from 41% in 2021.

EBIT was R$ 104 million in 2022

EBITDA was R$ 182 million in 2022

Net loss of R$ 51.4 million in 2022, due in large part to a significant increase in financing expenses. The company was profitable in 2021 and 2020.

**Some of the financing expenses in both 2021 and 2022 are one-time expenses related to the IPO, secondary share offering, and debt issuance.

Balance Sheet Analysis

The company’s short term liquidity position is OK, with a current ratio over 1.5.

Their balance sheet is leveraged, with a debt to equity ratio of 2.6.

Debt Analysis

As of the end of Q1 2023, Espaço Laser has R$ 853 million in total debt outstanding.

The company faces a huge debt cliff in 2024 and 2025 when the majority of the debt is due.

It is highly unlikely the company will be able to make their 2024 and 2025 principal repayments based on current cash flows. Investors should analyze the company’s debt situation in detail before making an investment, as their current situation presents significant risks.

Valuation Metrics

Price to Book – 0.75x

Price to Net Revenue – 0.74x

Price to EBIT – 6.4x

Price to EBITDA – 3.6x

Price to Net Income -N/A

Share Dynamics and Capital Structure

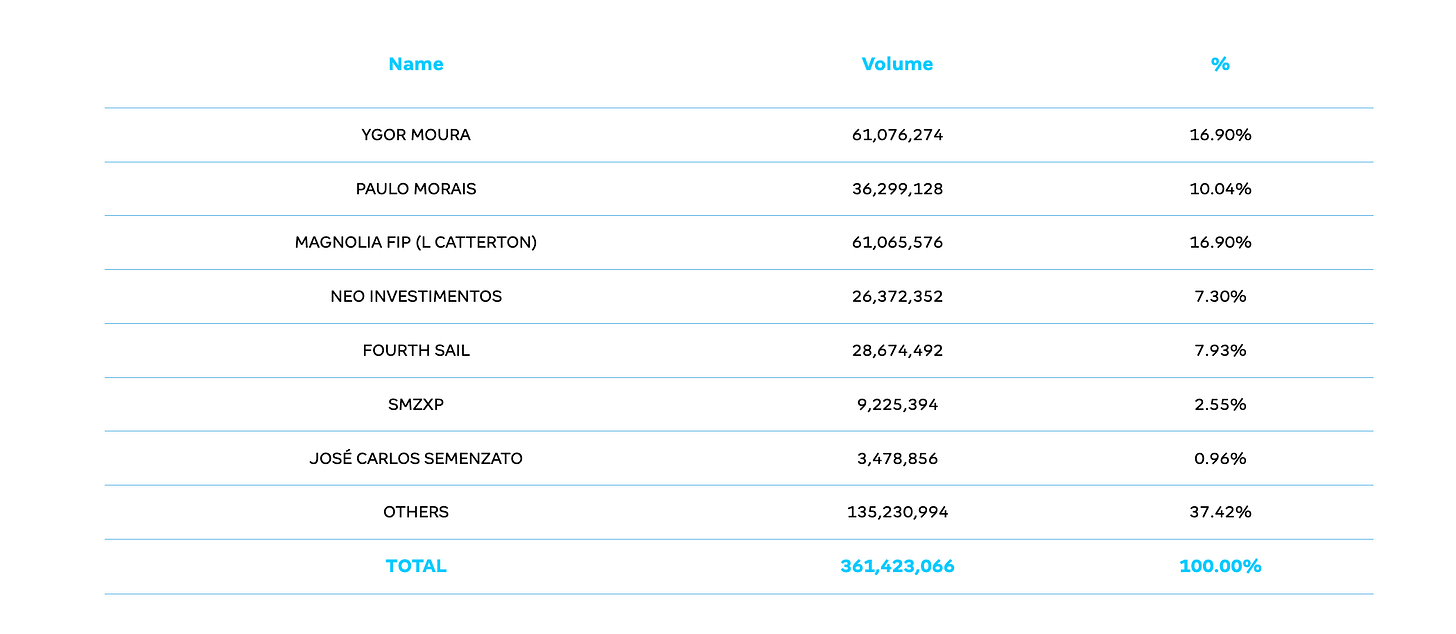

As of year-end 2022 the company has 361,423,066 common shares outstanding and no preferred shares.

In October of 2022 the company issued 117,187,500 new common shares at a price of R$1.92 per share, raising a total of R$ 225 million in new capital.

This capital raise was highly dilutive for existing shareholders, representing an increase in the number of share outstanding of 48%.

The founders still sit on the board and own a combined 27%. Several funds own a combined 36%. The remaining 37% is owned by smaller shareholders.

Dividends

Espaço Laser does not currently pay a dividend. In my opinion it is unlikely the company will pay any dividends for the foreseeable future.

They did pay one dividend of ~R$0.08 cents per share in 2021, shortly after their IPO. In hindsight, this looks very imprudent. But it is also worth noting this was a different management team.

Technical Analysis Notes

Espaço Laser’s share price has been in a constant down trend since the company’s IPO in February of 2021. Price is ~90% below its all-time high of ~R$ 20 per share.

Price is currently between the 50 and 200 daily moving averages. There is a potential technical bottoming pattern forming on the daily chart. But this bottom is unconfirmed on the weekly chart and price if below the 50 week moving average.

For now I would assume price will remain in a downtrend until there is clear technical confirmation of a reversal.

Investment Thesis, 3 Scenarios.

In my opinion Espaço Laser’s returns over the next 12-24 months are likely to be almost entirely dependent on one variable, their debt. Almost all of the company’s debt it due in 2024 and 2025 and I think it is highly unlikely they can repay based on the company’s current cash flows.

This implies 3 possible scenarios for equity investors:

1. The company is able to restructure and extend its debt to a point where it can cover its debt burden in the medium term with cash flows from its current operations. This is the bull case and would be the most positive outcome for equity investors.

2. The company cannot restructure its debt and must issue more shares in order to make its debt repayments on time. This dilution would likely lead to lower share prices in the short and medium term. But the bull case for the underlying business and industry would remain intact in the long term, assuming the new capital is used to resolve the debt problem.

3. The company cannot restructure its debt and cannot issue new shares, therefore they are forced to declare bankruptcy. The share price goes to zero. This is obviously the bear case for equity investors.

Summary and Conclusions

Positives

The hair removal market in Brazil is already huge. Laser hair removal still has significant growth potential as it further penetrates the Brazilian market.

Espaço Laser is the clear market leader.

LATAM expansion – the company already has a presence in several other Latam markets and has plenty of room for further growth.

Same stores sales started increasing again in 2022 after significant decreases in 2021 and 2020.

Negatives/Risks

Debt cliff – The company has large debt repayments due in 2024 and 2025 that it most likely cannot repay based on current cash flows

Dilution – The company has already had to issue additional shares since its IPO in 2021, diluting existing shareholders. With their impending debt cliff in 2024 and 2025, there is a significant possibility the company will need to further dilute existing shareholders.

Competition from cheaper alternatives - There is no guarantee laser hair removal will continue to gain market share. Customers can opt for cheaper options.

Conclusion

Espaço Laser is a high risk, high return investment opportunity. There is the clear and real possibility shares go to zero. But if the company can resolve its debt issues and new management can continue the turnaround, there will be smoother sailing ahead.

Equity investors that can weather the storm over the next 12-24 months, could potentially own a clear market leader, in a growth industry, that has favorable demographic tailwinds.

If you liked this write up, be sure to subscribe to LATAM Stocks.

You can also connect with me on LinkedIn or follow me on Twitter.

Would anyone know what model of laser they use? Would like to find out what the purchase and maintenance costs are of the lasers and how long it takes to depreciate and how often they need to update. I am assuming this is a major cost.

Interesting... I thought Korea had most of the aesthetic and plastic surgery stocks 😂